AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Singapore Startup Thunes – Smart Solutions For Digital Payments

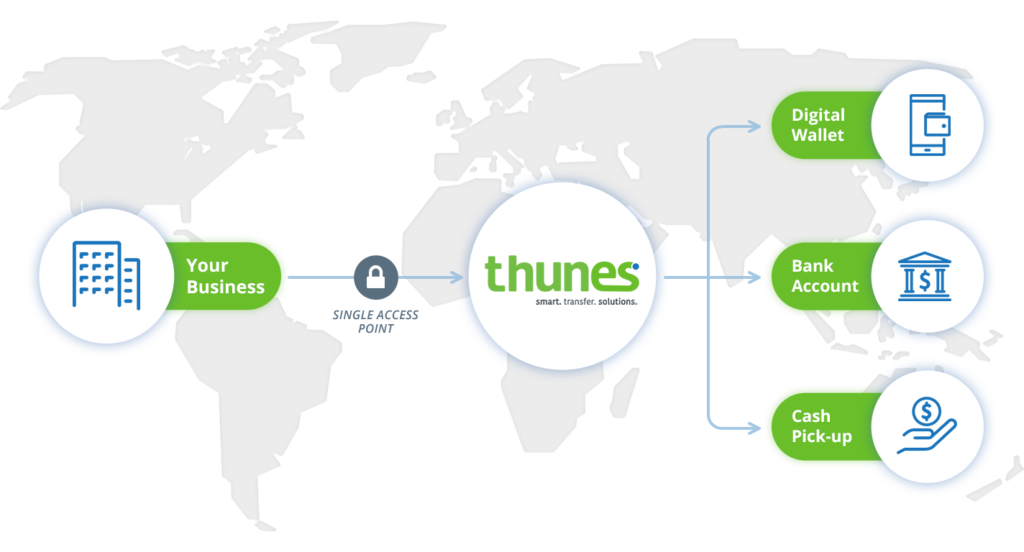

Singapore startup Thunes is a cross-border payment network startup that was established in the year 2015. Thunes interconnects diversified payment systems to facilitate the real-time movement of funds in and out of emerging economies. The Fintech startup incorporates digital wallets into its network to offer alternate payment solutions to unbanked consumers to ascertain that they aren’t denied access to the global economy. B2B payments, P2P remittance processing, digital payment solutions, and corporate mass payouts are the four key payment solutions offered by Thunes at the moment. With over 9000 interconnected payment partners, Singapore startup Thunes claims to have an international network that extends over 80 nations till date. Lastly, Thunes possesses the capacity to handle up to 3,00,000 transactions on an everyday basis.

Fintech Singapore Startup Thunes Raises $10M Series A Funding

Singapore-based payment network Thunes has announced that it has closed USD 10M Series A Funding in a round conducted by GGV Capital. The global venture capital firm has invested in Thunes because it sees a great deal of potential for growth in this business. This financial support from GGV Capital will allow Singapore startup Thunes to focus on expansion and improvement of its service offerings.

The cross-border Fintech startup stated that it would utilize the funds to boost growth in various parts of Asia, Latin America, and Africa. Nevertheless, Thunes is going to strengthen its base in Southeast Asian continents with this newly acquired capital. Keeping everything else at bay, the investment will also increase the accessibility of financial services in emerging markets in the near future.

What Are The Future Plans Of Singapore Startup Thunes?

The ultimate mission of Thunes is to make financial services available to everyone. The Fintech startup plans to enter into strategic partnerships so that it can deliver enhanced payment services to customers in emerging markets. Not just that, the company will also set up new workplaces in places such as Dubai, USA, and Paris for the facilitation improved interaction with customers concomitantly.

Not long ago, Singapore startup Thunes declared that it partnered with Western Union to increase payout potential to known mobile wallets. In addition to that, the payment network startup has collaborated with leading online money transfer platforms M-PESA and PayPal to provide its Kenyan customers with alternative payment services so that they can reap the benefits of global e-commerce. As of now, Thunes is looking forward to raising additional funding for undisrupted growth of the business.

Get in touch with the team today.

Keep an eye on this innovative startup and many more such startups.

Image Source- Google.