AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Byju’s Valuation Drastically Cut by Prosus: Now Under $3 Billion Only

India’s Edtech startup company Byju’s faces a sharp drop in its valuation. This massive plunge occurred after investment giant Prosus slashed Byju’s value to less than a sixth of its original valuation. This massive plunge reportedly happened due to the startup company’s ongoing challenges.

Investment Giant Prosus Drastically Reduce Valuation of Edtech Startup Company Byju’s

Prosus, a leading investment firm, recently announced a major cut in the valuation of Byju’s, a major startup company in the Edtech sector, bringing it down to less than $3 billion. This new valuation represents an 86% decrease from the impressive $22 billion mark that the Indian startup achieved last year.

Ervin Tu, the interim CEO of Prosus, shared this update during the November 29 earnings call. He acknowledged the various difficulties Byju’s is currently facing. Therefore, Prosus and other investors are actively working to help the Bengaluru-based company recover. This announcement came as Prosus reported its financial results for the past six months to September.

Since 2018, Prosus has invested $536 million in Byju’s, with another significant $153 million investment made in April 2021. Therefore, Prosus now holds a 9.6% stake in Think & Learn Pvt Ltd, the parent company of Byju’s.

Earlier in June, Prosus had already decreased the value of its stake in the Indian startup company to $493 million, which at that time placed its valuation at around $5 billion. Today, the Edtech startup company’s valuation continues plunging to under $3 billion.

Prosus Criticizes Byju’s Reckless Decision-Making Amid Ongoing Challenges, Leading to Valuation Decrease

The massive reduction of Byju’s valuation to less than $3 billion was caused by the numerous challenges happening in the Edtech startup company.

Headquartered in Bengaluru, the Indian Edtech startup is undergoing significant restructuring and cost-cutting efforts following substantial losses incurred after its rapid growth during the pandemic. Despite raising over $5 billion, the company’s recent developments represent a significant shift in its fortunes.

Byju’s has encountered several challenges, including a missing revenue target for the last financial year and a $1.2 billion debt.

Not only that, but the Indian Enforcement Directorate (ED) is also investigating the company for allegedly breaching forex laws, involving about $1.12 billion.

Amid these issues, Byju’s CFO, Ajay Goel, left the company following the earlier departures of auditor Deloitte and three key board members.

As of the end of March, Prosus valued Byju’s only at $5.1 billion. The investment giant then criticized Byju’s in July for not adequately evolving and neglecting investor advice.

All the Challenges and Violations Leading to the Plunging Valuation of the Indian Startup Company

The Foreign Exchange Management Act (FEMA) Adjudicating Authority recently issued notices to Byju’s and its founder, Byju Raveendran. This occurred based on a Directorate of Enforcement (ED) complaint. This issue is one of the initial issues causing Byju’s declining valuation.

According to the report, Byju’s allegedly made unauthorized foreign remittances and investments. The Edtech startup company has broken FEMA rules, causing revenue loss to the Indian government.

The ED’s investigation, which included searches at Byju’s offices and Raveendran’s residence, found several violations of FEMA regulations. These include unreported imports/exports, delayed foreign direct investment documents filing, and failure to allocate shares for received FDI.

“The investigation revealed that Think & Learn Private Limited and Byju Raveendran violated FEMA regulations. They did not provide documents for imports against advance payments made abroad and didn’t secure earnings from exports outside India.

Additionally, they were late in submitting paperwork related to Foreign Direct Investment (FDI) received by the company. They failed to submit necessary documents for remittances sent abroad by the company and did not issue shares for the FDI they had received.”

– Enforcement Directorate.

Over the past few years, Byju’s has also been on an acquisition spree. The Edtech startup company had spent $2.5 billion on companies like Aakash Educational Services, US-based Epic, kids’ coding platform Tynker, professional education firm Great Learning, and a platform for exam preparation, Toppr.

Then, Byju’s faced another setback when Deloitte Haskins & Sells, its statutory auditor, resigned over delays in financial reporting. Deloitte cited challenges in conducting audits due to these delays. Following this, Byju’s appointed BDO (MSKA & Associates) as its new auditor.

Besides Deloitte, investor board members from Prosus and Peak XV resigned from Byju’s as well. All these challenges were the start of Byju’s declining valuation.

Prosus Experiences Growth in Indian Investments Despite Significant Losses

Along with the plunging valuation of Edtech startup company startup Byju’s, Prosus also suffers losses from Pharmeasy. This Indian online pharmacy has also faced a 90% drop in valuation from 2021.

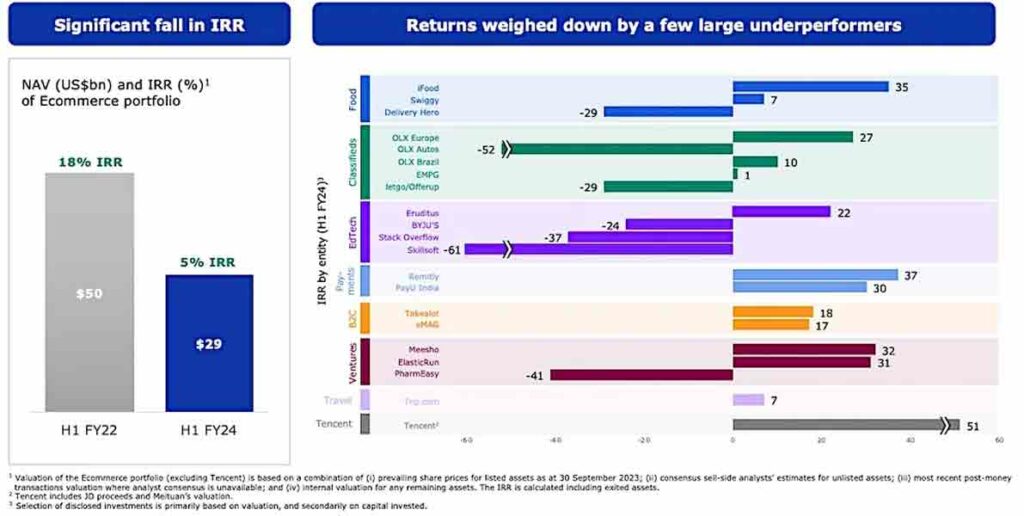

As a result, Prosus is now suffering massive losses from its e-commerce investments. The value of the company’s investments in fintech, Edtech, and food delivery stands at just $29 billion at the end of the first half of the 2024 financial year. And this is a massive decrease from Prosus’ investment value, which reached $50 billion two years ago.

Not only that but in the same timeframe, Prosus’ internal rate of return (IRR) also dropped to 5% from 18%.

Despite all this bad news, Prosus announced on November 29 that its payment business, PayU, is planning an initial public offering (IPO) in late 2024.

Along with PayU, the giant investment company experiences a powerful improvement from the leading food delivery startup, Swiggy.

Therefore, despite the plunging valuation of Byju’s, it is not all bad news for Prosus’ investments in India.