AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

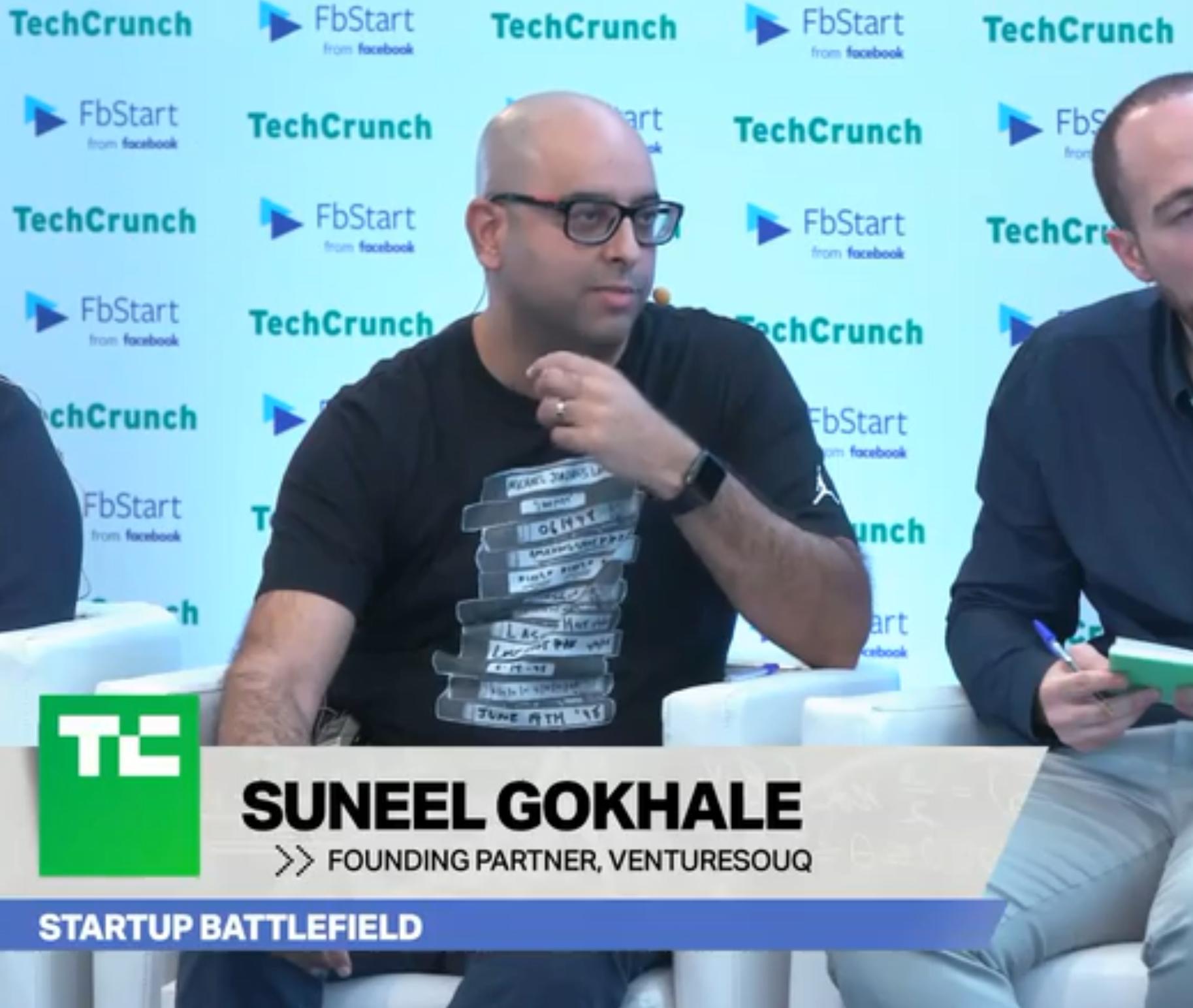

Suneel Gokhale, VentureSouq- Looking For Passion, Drive, And Experience

Suneel Gokhale is a lawyer turned venture capitalist and is a co-founder and managing partner at VentureSouq, an early stage venture capital firm based out of Dubai. The firm focusses on FinTech, enterprise software companies as well as EdTech, and HealthTech. The portfolio is quite diversified and the mindful investments have reaped fruits as per Suneel. Also, VentureSouq is looking to invest in approximately 20 companies as per Suneel. So, for all the budding entrepreneurs out there who are looking to secure funding, here is your opportunity.

Prior to VentureSouq, Suneel was a senior legal counsel to the investment arm of the Government of Abu Dhabi- Abu Dhabi Investment Council. Suneel advised on private equity transactions, venture capital, and mergers and acquisitions. Suneel has also held senior positions practicing business/corporate law at Allen & Overy and Blake, and Cassels & Graydon.

Read on to know more about Suneel Gokhale, his definition of success, and his investment plans for the near future.

What background and domain expertise do you have? What makes you turn into an investor?

Suneel Gokhale: I am a lawyer by profession and prior to co-founding VentureSouq, I was senior investment legal counsel for Abu Dhabi Investment Council, one of the largest sovereign wealth funds in the world. At ADIC, I advised on numerous investments into the top VC funds in the world and direct investments into global technology companies. I had previously made some angel investments, but my exposure to the world of venture capital and some of the key players in the industry while at ADIC really sparked my interest in becoming a full-time venture capital investor and so with my partners, we started VentureSouq.

Right after being an investor like in early days, there must be some tough times in building up the first fund along with building up a second fund or giving back the good returns to those LPs, If there is any similar tough time like this, please tell me more about it and how you (or your team) overcome the difficult times.

Suneel Gokhale: VentureSouq is not a typical VC fund but rather we have developed an investment platform that allows family offices, HNWIs, and institutional investors to invest in global early-stage tech deals on an opportunistic basis. With that said, raising capital for first funds or initial deals can be very challenging especially with a limited track record. We were lucky because our first few deals turned out to be pretty strong (at least as it stands now) which gave us a track record but more importantly the confidence to know that if we stick to our thesis and process, we think we can do well in choosing enough winners.

As an investor, what kind of startups have you invested in? and how did you find those startups to invest in?

Suneel Gokhale: At VentureSouq, we are pretty opportunistic but within that broad investment mandate we in particular from a sector standpoint like FinTech and FinTech-adjacent opportunities and enterprise software. We also like EdTech, HealthTech, and mobility/logistics and in general companies that not only have a product or solution that is superior to whatever else already exists but also companies that understand distribution. In terms of geography, our focus is on the US, Asia (South and South-East Asia), Africa and MENA but we have also invested in companies in other markets.

What would be the core factors that you decide “Not” to invest in certain companies?

Suneel Gokhale: Weak founding team. As an early-stage investor, we look at a lot of criteria/data points when making a decision to invest in a particular company but a founding team that isn’t top-tier is a deal-breaker for me. No matter how big the market or the potential of the technology, we are not very likely to invest in a company with a founding team that does not rate extremely high.

What would be the KPI that you usually check about the startups’ growth? It may diverse in each industry like LTV, CAC, MoM, etc. but would be helpful to understand more about your additional investment factors.

Suneel Gokhale: Depends on the sector and stage but generally, we are interested in how quickly a company can grow its top-line revenue once its product is ready which allows us to confirm that the company is making something people want and ideally something they need. We also pay very close attention to gross margin (and typically want to invest in businesses with gross margins of close to / over 50% and CAC / LTV as we want to know how expensive it will be to acquire customers as we don’t want to invest in companies that require substantial burn to acquire customers.

What is the investment range and In a typical year, how many startups do you invest in? And overseas headquartered startups have a chance to get investment from you or should be headquartered in certain countries?

Suneel Gokhale: We will aim to invest in at least 20 companies this year and investment amounts will vary depending on the stage. We are generally agnostic when it comes to where businesses are based – if a company meets all of our requirements then we don’t really care where the company is based as there are lots of opportunities in globally.

What are the main factors that startups fail as per your experience “after” getting investment and how can they prevent mistakes in advance from your personal perspective?

Suneel Gokhale: Early-stage companies that close a nice-sized round of financing can often times go off on different tangents and lose focus from their core product/market, which can cause a company to lose focus and control over their cash flow. This can result in execution issues which is a huge issue.

What’s your advice to entrepreneurs who have a chance to meet investors like you? What are the top 3 questions that you always ask the founders?

Suneel Gokhale: My advice to entrepreneurs is to clearly communicate the problem they are trying to solve and how they have the team and product roadmap to solve that problem. A related point is that we like founders who amongst other things know their market very very well and spend time with customers trying to ensure they have product-market fit. My top three questions to founders are

- 1. What’s the problem you are trying to solve?

- 2. Is that problem big enough to make your company a billion-dollar company if you solve it?

- What’s your big vision?

What’s your general thought about the term “Global” and what are the important factors (criteria) for local startups to consider for international expansion?

Suneel Gokhale: The world has definitely become a smaller place and most companies no matter how big their initial market may need to think about international expansion. When assessing start-ups we spend a lot of time thinking about how easy it is for a company to sell into other markets which is why we have a preference for B2B / enterprise companies where this is easier.

As you know, our company name is “beSUCCESS”, what’s your definition of the term “success” as an investor or as an individual human being?

Suneel Gokhale: I think the definition for me is the same for both: success whether as an investor or for life is being able to do what you love and doing it well while along the way trying to make a positive impact on people’s lives. I would have loved to be an NBA basketball player but investing in early-stage companies and working closely with smart and driven founders is pretty good as well.

What are the one or two things that you would do differently if you could go back to 10 years ago?

Suneel Gokhale: Learn how to code and learn more languages.

When you travel internationally, what kind of entrepreneurs and startups (or industries) you want to meet?

Suneel Gokhale: I want to meet founders/companies that have a clear vision of what they are trying to achieve/solve and have the passion, drive, and experience to accomplish their goals.

You can follow Sunil Gokhale here.

Are you looking to secure investment for your startup or a keen startup enthusiast, keep an eye on our interview section.

Follow Asia Tech Daily to know about the innovative startups and how they are revolutionizing the ecosystem.