AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Tech Investing Trends and Tips: A Conversation with UpShot Venture’s Jessie Wu

Over the last decade, the landscape of venture investing in the U.S. has undergone transformations, and this evolution has not escaped the keen eyes of tech investors. Team Asia Daily spoke to one such venture capitalist Jessie Wu, an early-stage investor at Upshot Ventures, in an exclusive interview, shedding light upon her investment journey while paving the way for upcoming startup founders and venture capital investors.

Jessie Wu brings a thoughtful lens to early-stage investing. She’s not your typical venture capitalist, but that’s what makes her story so compelling. With a background in cross-border deal advisory, knitting together experiences covering Fortune 500 companies from a structured finance perspective to impact-driven direct investing and consultancy for early to growth-stage companies in emerging markets, she brings a unique financial perspective to the world of tech startups.

Despite shifting market interests, Jessie’s venture focus remains steadfast—assessing the compatibility between founders and markets, and ensuring early indicators of robust feedback loops built within company practices.

“We recently co-authored a piece in conjunction with Pitchbook Data,” Jessie reveals, “examining how seed stage investing has evolved over the last decade.”

Their findings shed light on some noteworthy trends: seed-stage companies today are older, the journey from seed to Series A funding rounds has lengthened, and investors are securing larger equity stakes during seed-stage investments.

“This,” Jessie emphasizes, “implies that seed-stage investing has become more institutionalized, with larger funds entering the market, all while highlighting the critical importance of achieving technical milestones by the priced round.”

She highlights their excitement over the recent surge of international startups tapping into the U.S. market. Jessie asserts, “It further strengthens our thesis of ‘global capital and resources, localized opportunities.'”

Starting her investment journey

As an investor at Upshot Ventures, she’s channeling her financial savviness into nurturing tech ideas.

Her journey into the world of venture investing began with Wall Street finance. Roles at major financial institutions, including MUFG and JPMorgan, marked her early career. She later worked at Impact Investment Exchange (IIX), a Singaporean-based impact investment fund built on the mission to connect the back streets of emerging economies to Wall Street.

Her path eventually led her to Upshot Ventures, a firm chosen for its global perspective and data-driven approach.

“After wrapping up my graduate program, I sought out venture opportunities in the U.S., ultimately landing in my current role (with the help of some amazing alums!),” she said.

“I chose Upshot for two reasons: the global lens it takes to venture investing (connecting capital and opportunities across borders), as well as taking a platform and data-driven approach to investing. The former has strong overlaps with my prior background, while the latter allows me to broadly access and assess high-quality opportunities in early-stage markets.”

Influence of Prior Experience

Her prior experiences significantly influenced Jessie to get into venture investing. “Early on, I was fortunate to have mentors who not only challenged me but also created a space for me to think outside the box, pioneer new solutions, and engage in creative structuring,” she said.

One milestone was her pivotal role in crafting an economic impact analysis that found its way to the Overseas Private Investment Corporation (OPIC), the U.S. government’s development finance institution. What followed was truly remarkable – within six months of joining that JPMorgan’s team, her analysis helped drive OPIC’s investment in an emerging market airline. It was a testament to her strategic thinking and the profound impact she could have in finance.

Experiences like these influence her approach to venture investing. Having witnessed the transformative power of strategic decisions and mentorship.

“When assessing opportunities, I consider both the innovation and broader impact of the technology. My background has taught me to ask critical questions about key stakeholders and their incentives, guiding my role as an Investor to contribute meaningfully to the growth of supported startups,” Jessie added.

The Art of Evaluating Startups

At Upshot Ventures, Jessie’s approach to evaluating potential startup investments is grounded in a steadfast commitment. Their mission? To unearth transformative technologies with the potential for global scalability. It’s a philosophy that sets the stage for their investment decisions, focusing on startups that can significantly impact a global scale.

Upon asking the same, Jessie said, “When it comes to early-stage investments, I place a strong focus on the founding team and spend a lot of time assessing their technical expertise, their ability to collaborate seamlessly, their openness to feedback, their hunger to grow and, above all, their unyielding drive to bring about the change they envision.”

“In my experience, the synergy between visionary technology and a resilient founding team is part of the DNA for success.”

A Peek into Investment Criteria

In our conversation with Jessie, we probed her perspective on essential factors for investment decisions, considering her extensive background.

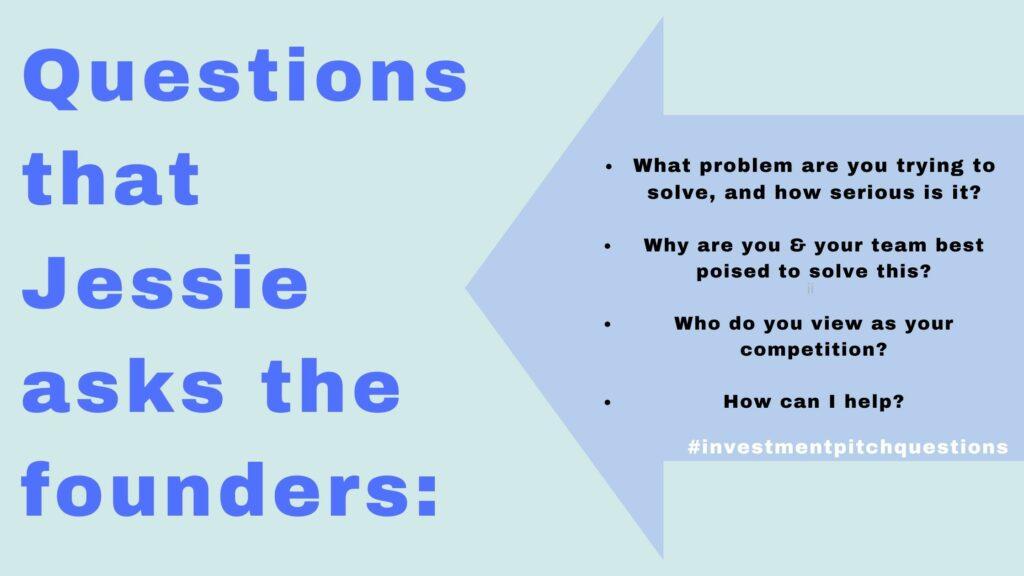

The first three questions are relatively standard questions in most founder-investor interactions. To elaborate more on the last question, this question serves two purposes: i) whether the Founder is strategic with their outreach efforts (a founder’s time is money!); ii) what kind of relationship the Founder is hoping to build for in the long run.

Starting Strong: Key Takeaways from Jessie for New Investors

Practice humility. Most people enter the startup landscape having had a run or multiple runs as an operator or are experts in some finance/consulting/academic/other field. All is to say, we often come very attached to our egos. However, new technologies and trends are always emerging, and the profile of founders and investors alike are gradually shifting between generations. There is always something to be learned at the table.

Define and stay postured for growth. One of the challenges I experienced moving from a more structured industry into venture (and being a part of lean fund) is that there are oftentimes opaque benchmarks for growth i.e. no – within 6mo, you should have done X; within 1 year, you should be doing Y. This is understandable as investing is personal and your journey is as much one of personal growth as it is alongside the fund and the companies you support. Therefore, make sure to re-strategize quarterly and note things you’ve accomplished, as well as learnings from interactions you can improve upon.

3 Key Tips for Early-Stage Founders by Jessie Wu:

Find investors that share your vision. You want investors that are as excited about your product as you are. They should be willing (and have the patience) to stay in it for the long haul. Furthermore, if an investor tells you that your company is not within their thesis; no hurt feelings and move on.

Be receptive to feedback, but don’t over-index on all the advice you receive. More often than not, we probably don’t know your company better than you. If you talk to (too many) investors, you may be pulled in way too many different directions. That said, if you are looking to build a relationship with a particular investor, I do really appreciate it when Founders I work with close the loop on our discussion items (even if it means coming back with a thoughtful response on why a particular approach doesn’t work).

Build and iterate. Enough said.

In Jessie’s world, change is not just a constant; it’s a guiding principle. Her early experiences transitioning from the Western world to the East and back again instilled in her invaluable qualities: resilience, empathy, and a remarkable ability to thrive in unfamiliar environments.

These traits have shaped her career in finance and venture capital, where adaptability and a global perspective are key. They’ve also fueled her passion for connecting capital and opportunities across borders, a mission she continues to pursue at Upshot Ventures.

Beyond her professional endeavors, She finds joy in life’s simple pleasures. She’s an enthusiastic host of dinner parties, a dedicated boxer, and an avid reader of novels in both English and Mandarin. It’s evident in her well-rounded approach to life, balancing the complexities of the financial world with the joys of personal interests.

Also Read:

- The Reddit-Inspired Startup Transforming the Way We Discover Content – An Interview with Lee Sung-gyu, CEO of Snippod

- From Vision to Reality: Unveiling Event Management Platform in Korea, EventUs

- How Wai Mun, CEO And Founder Of Doctor Anywhere Raised US$27M To Bring Convenient Healthcare Experience To Millions?

- Gem is using GenAI to create Tik-Tok-styled news feeds