AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Singapore Cashback Firm ShopBack Acquires Ebates Korea

ShopBack, a Singapore-based rewards and discovery platform, announced its acquisition of Ebates Korea, the Rakuten-owned online cashback platform, for an undisclosed amount.

Ebates Korea has ceased operations as a result of the acquisition and its users will be directed to the ShopBack Korea beta platform. The platform is expected to be officially launched for mid-2020.

In a statement, ShopBack said the deal, which marks its expansion into South Korea, will help grow its user base and strengthen its roster of merchants offering cashback through its platform in the country.

ShopBack Korea will include major Korean brands such as Market, Wemakeprice, and 11Street.

South Korea is one of the biggest e-commerce markets worldwide, and ShopBack Korea will bring more choices, discovery, and savings to their fast-growth demographic of online shoppers, the firm said.

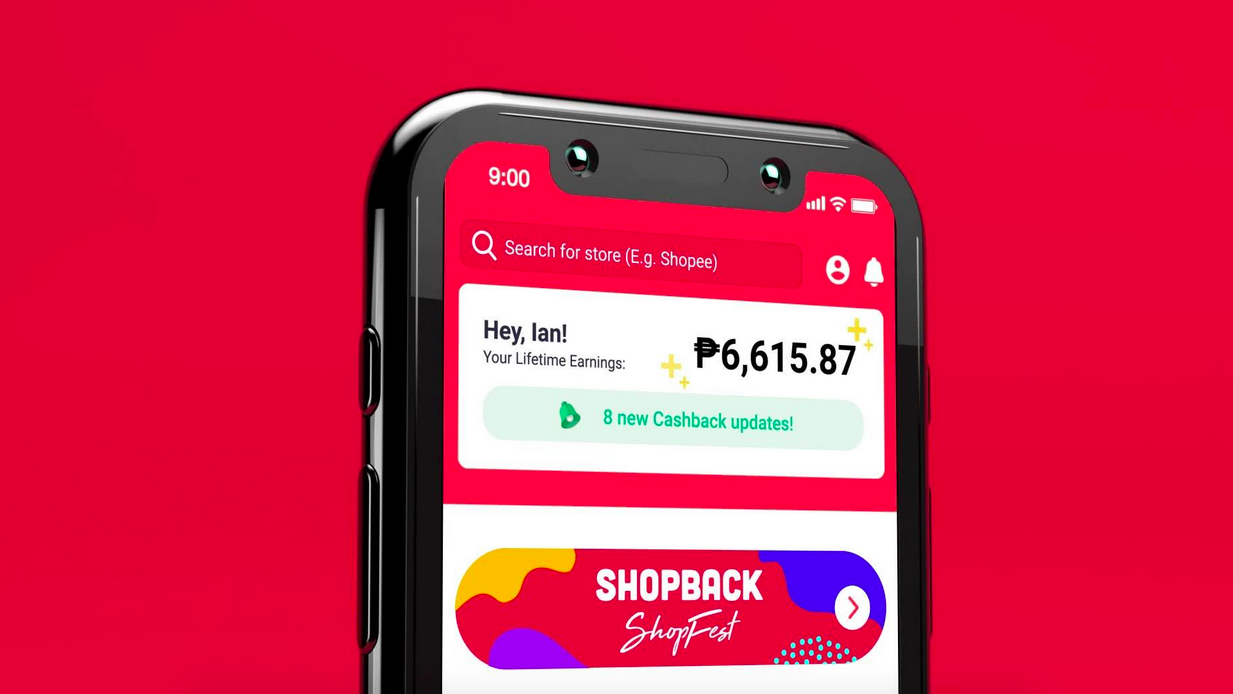

Through the platform, shoppers can make purchases and earn up to 15% cashback on their purchases in categories like fashion, beauty, and electronics.

“We constantly evaluate new opportunities to connect with and serve more consumers, and acquiring Ebates Korea presents a unique opportunity to enter the South Korean market from a position of strength,” said Henry Chan, CEO and Co-Founder, ShopBack.

First launched in Singapore in 2014, ShopBack has since expanded its reach to Malaysia, Indonesia, the Philippines, Thailand, Taiwan, and Australia.

It partners with leading e-commerce merchants to reward its users with cashback across a wide range of categories, including general merchandise, travel bookings, fashion, health and beauty, groceries, and food delivery.

“Launching ShopBack Korea will be a major step forward for us in fulfilling our mission to create a world of Smarter Shoppers. We look forward to bringing the high-quality ShopBack experience that our users know and love to even more shoppers,” added Chan.

The expansion into South Korea comes a month after ShopBack secured $75 million in an extended funding round led by Singapore’s state investor Temasek.