AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Korean Fintech Firm Rainist Raises US$37m in Series C

Seoul-based Rainist, a financial technology startup that operates mobile asset management service app Bank Salad, has raised W45 billion (US$37 million) in its Series C round of funding.

The latest funding round, which valued the startup at W300 billion (US$247 million, attracted 10 venture investors, including existing investors Base Investment, Murex Partners, Kiwoom Investment, KB Investment, Company K Partners, and Atinum Investment.

New investors that participated in the funding round include Intervest, Stonebridge Ventures, IMM Investment, and Gorilla Private Equity. Intervest is the biggest investor in the latest round.

[ihc-hide-content ihc_mb_type=”block” ihc_mb_who=”unreg” ihc_mb_template=”1″ ]

Established in Seoul, Korea in June 2012, Rainist has so far raised a total of W63.9 billion (US$52.5 million) over four rounds that started in 2015.

In a statement, Rainist said it will utilise the proceeds of the funding round to hire more staff and further strengthen its capabilities in financial technology, in addition to developing its services and system.

Rainist co-founder and CEO Kim Tae-hoon said the company will do its best to keep its stature as the leading service provider in Korea’s personal management market. The startup will also harness the power of data to further empower its customers.

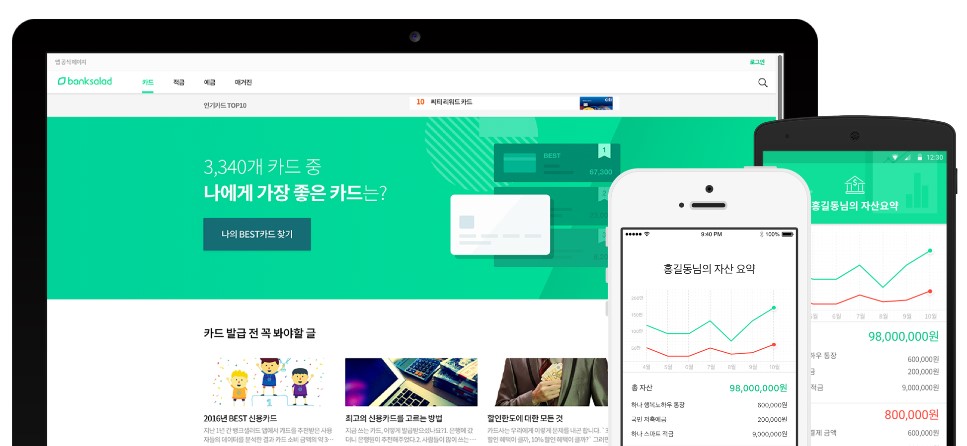

In 2014, the startup launched the web-version of Banksalad and then introduced a mobile app for the service in 2017. Banksalad is a financial management service that recommends credit cards and other financial products according to the financial status and spending habits of individuals.

With the fresh funding, Rainist said it will focus on “My Data” a full-fledged system that allows users to keep track of their own financial data to make sound and practical financial decisions.

The company is set to introduce its simple remittance service in the next few weeks, according to financial industry sources.

[/ihc-hide-content]