AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Indonesian fintech startup Ayoconnect raises $13m more in Series B funding

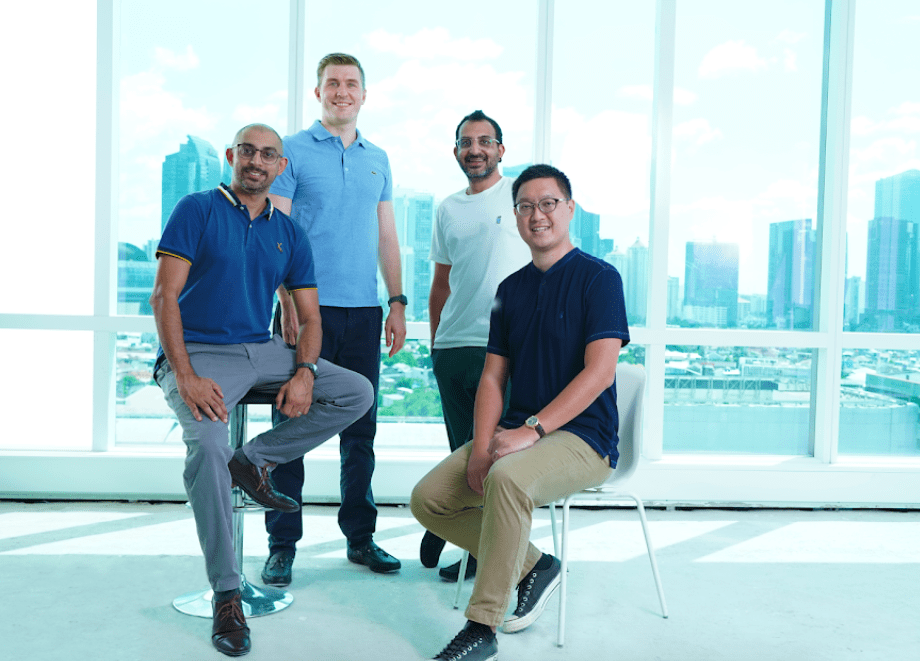

Indonesian open finance platform Ayoconnect has raised an additional $13 million in its Series B funding round, bringing the total amount it raised to date to $43 million.

The Series B extension financing round was anchored by SIG Venture Capital and backed by CE Innovation Capital and PayU, the payments and fintech business of Prosus.

In January 2022, Ayoconnect raised an oversubscribed Series B funding led by Tiger Global. In a statement, the startup said it the fresh capital will enable it to continue building out a leadership team and to invest in product and technology development.

The round will also facilitate the execution of Ayoconnect’s roadmap through both organic and external growth, which includes new solutions around payments, data and banking, and with new APIs planned for account opening and card issuing.

Founded in 2016, Ayoconnect is Southeast Asia’s largest Open Finance API platform. The company is building full stack solutions with the mission to power the leading companies of today and tech unicorns of tomorrow. The platform has over 200 clients, including leading financial institutions and tech companies such as Bank Mandiri, BRI, Dana, and Bukalapak.

Ayoconnect’s vision is to drive financial inclusion for Indonesian consumers and SMEs working in conjunction with regulators and incumbent banks to facilitate this.

As part of that strategy, the startup has recently been awarded a Bank of Indonesia (BI) Payment Service Provider (PSP) Category 1 license. The company is the only open finance player in the country to benefit from the credibility and reassurance of the central bank’s licensed regulation.

Ayoconnect has also just launched automated recurring direct debit with seven of Indonesia’s biggest banks (Mandiri, BRI, BNI, CIMB Niaga, Danamon, Bank Syariah Indonesia and Bank Neo Commerce).

The direct debit API, which can be integrated with minimum effort, is the first to provide Indonesian businesses with recurring capabilities that can instantly debit from customers’ saving accounts across multiple banks.

“We are delighted that previous and new investors have joined this B Extension round. That level of trust is a result of Ayoconnect’s rapidly growing traction in the Indonesian market, where we have successfully closed high profile partnerships, launched important new products, and increased even further the range of banks we work with,” said Ayoconnect CEO and co-founder Jakob Rost.