AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Finest International Banking Experience For Migrants – Fintech Startup Rewire Making An Impact!

Fintech startup Rewire was founded in Amsterdam. It was started to help migrants transfer money quickly and securely. The platform has a partnership with several banks and promises to provide comprehensive banking features and services to its users.

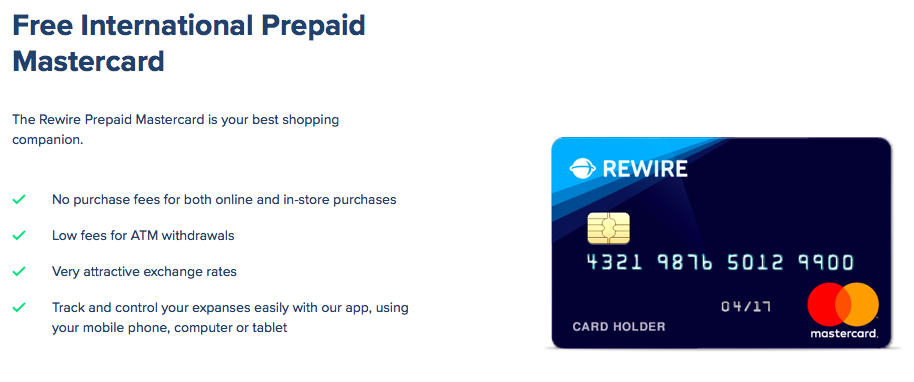

The firm allows workers to transfer their money to be deposited into their account to either use it locally or transfer the money to the country of their origin. For this, the users are provided with a free master card that lets them use it for their essential needs locally. Rewire focusses on providing services to people from Thai, Nigeria, Nepali, Sri Lankans, Filipinos, and other country migrants. Fintech startup Rewire elevates financial inclusion and benefits the migrant community as a whole.

How did it all start?

Fintech startup Rewire was started in the year 2015 with a motive to provide easy banking facilities for migrants intentionally. It started off as a low-cost banking facility with enhanced digitalization to support clients to send money easily to their family back home. Since then the growth curve has seen an upward trend with a present-day count of 1000+ deposit points across the country. The founders of Rewire include Adi Ben Dayan, Guy Kashtan, Or Benoz, and Saar Yahalom.

The banking solution has generated 2 rounds of funding. The firm has raised USD12M Series A round. The company is presently funded by Viola Fintech, BNP Paribas, OurCrowd, Moneta, Professor Yair Tauman, Yaron Lemelbaum, Leon Vaidman, and Rewire’s strategic partner Standard Bank of South Africa.

The funds will mostly be used to fuel expansion plans in additional geographies and further penetrate the European markets. Fintech startup Rewire also plans to strengthen the partnership with banks in the origin countries of migrant workers.

Benefits Of having an exclusive account

Fintech startup Rewire offers you a free euro account to secure and manage your financial activity as an international resident. It is one of the best financial solutions for most of the Filipinos, Nigerians, and Indians who live away from home in Europe.

Favors a quicker and efficient way of transferring money to your loved ones. Moreover, Rewire supports a functionally robust app which helps you to control and monitor your expenses from your connected devices like phone and computer.

A trusted choice for money transfer, Fintech startup Rewire offers a personalized IBAN which helps you to transfer and receive money across borders safely and securely.

The best part of the account is that every member is provided with an exclusive master card to enhance the shopping experience, use it across ATM’s to withdraw money and pay bills across various platforms.

The Verdict – Fintech Startup Rewire Making A Difference

The company aims to create an effectual, transparent, and reasonable solution for migrants in terms of banking and fund transfer across boundaries.

The future looks bright for this innovative Fintech startup. Keep an eye!

Image Source – Google