AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Boost, RHB consortium receives Malaysia digital bank license

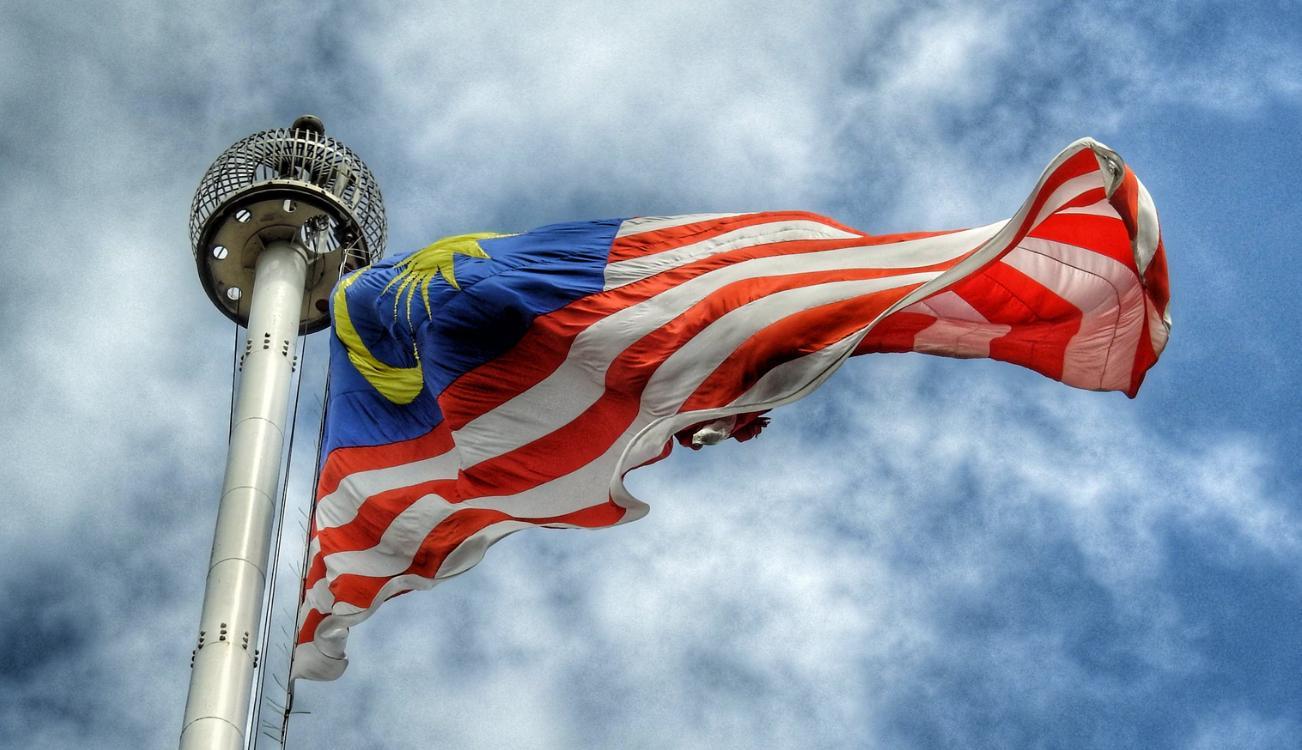

Boost, the fintech arm of Axiata Group Berhad (Axiata) and RHB Banking Group (RHB) achieved a significant milestone having secured the highly anticipated digital bank licence (DBL) issued by Bank Negara Malaysia (BNM).

In June last year, the partnership between Boost and RHB to form a Digital Bank consortium was announced, with Boost owning a majority stake of 60%, and RHB owning the remaining 40% in the Digital Bank to drive innovation, increase competitiveness and fast-track the country’s digital transformation ambition.

To deliver on the key criteria established by BNM, both parties will combine their deep expertise in specific areas – Boost’s extensive fintech experience and RHB’s intimate knowledge in banking services and risk management, to build a comprehensive suite of affordable and accessible digital banking and financial solutions. The aim will be to create greater access for financial inclusion digitally amongst the underserved and unserved segments.

“This is a significant milestone for Axiata’s fintech business and a validation of the strong value proposition we bring to the table with our partners RHB Banking Group. The digital banking business aligns with our collective aspirations to support Malaysia’s digital transformation, as well as the advancement of Axiata’s digital inclusion drive across the region,” Dato’ Izzaddin Idris, President & Group CEO of Axiata who is also the Chairman of Boost said

“Securing this license in our home ground delivers multi-pronged opportunities to address ongoing digitalisation shifts across our businesses. On one hand, we can now deliver financial inclusion to underserved and unserved segments such as the Micro and Small and Medium Enterprise community as they scale for growth to support the nation’s economic recovery,” he added.

Sheyantha Abeykoon, Group CEO of Boost said, “At Boost, we are extremely excited and thrilled with the announcement by BNM today. The Digital Bank will be a catalyst for greater financial inclusion and aligns with our core mission to financially empower and support users and merchants. The award of the digital banking licence now fulfils our vision of becoming a full spectrum fintech player in the region to better serve the underserved and as one of the pioneers in the industry, we look forward to this very exciting journey in creating an inclusive digital and financial ecosystem for all Malaysians together with RHB via the digital bank.”

With the announcement of five digital banking licenses, Malaysia is now poised to unlock the benefits of a fresh digital banking journey. It echoes a growing international confidence in digital banking solutions, with almost 250 digital banks established globally by the end of 2020, of which 50 of the digital banks are based in the Asia Pacific region. Acceptance of digital banking solutions has grown rapidly in recent years.