AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Indian FinTech unicorn CRED raises $251 million, valuation soars to $4.01 billion

India-based FinTech firm CRED bags US$251 million in a fresh funding round led by its existing backers Falcon Edge Capital and Tiger Global. Two new investors Steadfast and Marshall Wace also participated in the round along with its existing investors Insight Partners, DST Global, Sofina, Coatue, Dragoneer, and RTP.

With this new funding round, startup’s valuation has soared to $4.01 billion which is nearly double its valuation from $2.2 billion in April. Less than a year ago, CRED valued at $800 million. The company has raised more than $500 million from investors in the last twelve months.

CRED plans to use the fresh funding to expand its financial service offerings and grow its existing range of products for its users.

Diving Deeper

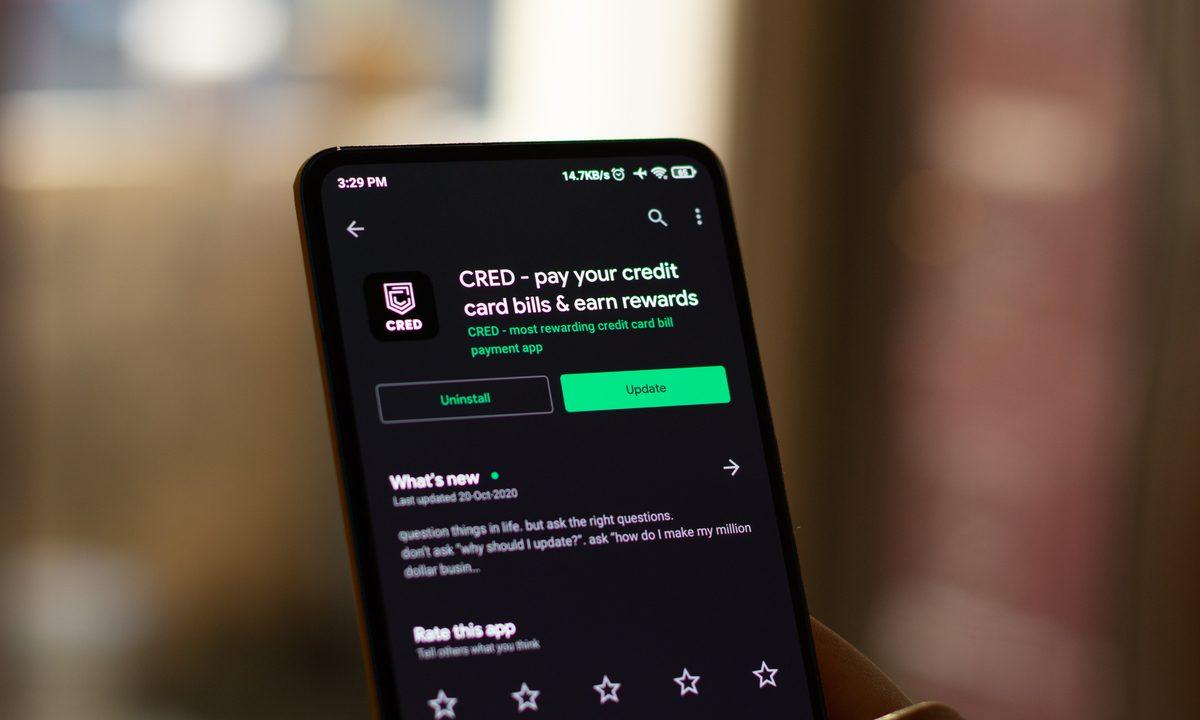

CRED, founded in 2018, allows its users to pay credit card bills through its online platform and rewards them with offers from various brands for paying the credit cards bills on time. When the user redeems a reward on the firm’s ecommerce platform Cred Store, the partner businesses then pay CRED and an agreed fee.

CRED also charges its bank partners a cut of the fee for improving the payment discipline of its credit card users.

In 2020, CRED launched its lending business in association with IDFC First Bank that had a loan book of about $20 billion as of August 2021. The startup also launched Cred Mint early this year which is its Peer-to-Peer lending platform.

According to Kunal Shah, founder of CRED, “About 25-30% of all credit card bill payments in India are happening through the platform.” He added, “The commerce business is doing well, and we have over 2,000 brands. Our payments piece, which is young, is also growing 60% month on month.”

CRED’s quirky storyline commercials have given the firm a decent following on social media platforms. The FinTech firm boasts of more than 7.5 million users and the members on its platform have access to vast range of premium brands.

Kunal Shah is one of the leading entrepreneurs in the country as well as an angel investor. He had earlier launched a company Freecharge which he sold to Snapdeal in 2015.