AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Why South-East Asia’s Tech ecosystem drawing the attention of investors from across the globe?

South-East Asia’s thriving tech ecosystem has drawn attention from investors around the world.

With increasing internet and smartphone penetration, about 400 million internet users, and fundraising unimpeded by the pandemic, the startups are doubling down on the region.

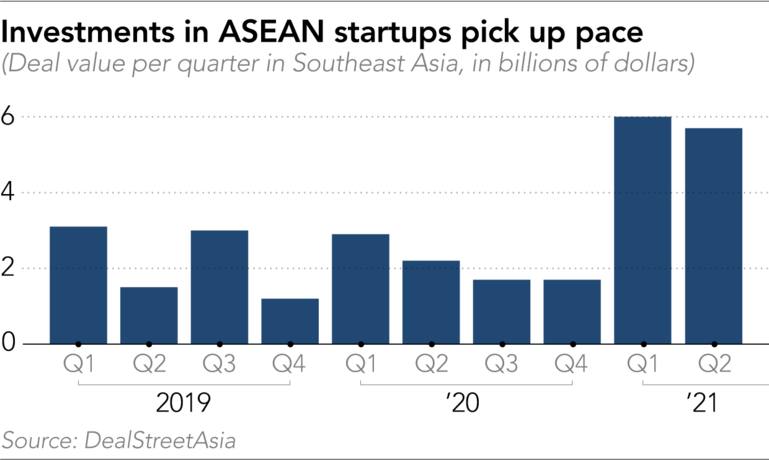

The startups in the region raised more than $8.2 billion in the year 2020 which was about 4x than what they did in 2015 and the trend continues in 2021. The first three quarters of 2021 witnessed venture-backed firms raising over US$17.2 billion. This surge in investments was mostly driven by FinTech and ecommerce companies.

In a study done by Bain, a business consultancy firm, the rise in venture capital coincided with the increase of unicorns in South East Asia from 2014 to 2017; particularly the tech companies that attracted more VC firms to the region. For instance; Singapore’s Lazada, Grab, and SEA along with Traveloka, Tokopedia, and Gojek of Indonesia and a few other companies in the region raised their Series A rounds during this period. This resulted in a doubling of total private equity in the region.

With boundless opportunities for gains in South-East Asia’s tech offerings, the VCs could no longer justify looking away from the region’s digital economy.

South-East Asia’s Big Tech Boom

Until the pandemic, digital adoption in region was still at a nascent stage, however, last year saw a surge in services such as online shopping and e-wallets. Besides that, the MedTech and EdTech boom in the last couple of years served as a perfect bridge for venture capitalists to tap on the capital available in the South East Asian market.

According to industry experts, with ever growing internet and smartphone usage, the new tech ventures are poised to achieve a decent growth. One of the leading VCs in the region, Jungle Ventures reveals that maximum internet and smartphone users in the region are young and tech-savvy- so the opportunities are immense.

Moreover, the region has become an attractive market for Chinese and US tech giants. Chinese tech giants Alibaba and Tencent have invested heavily in regions ecommerce growth and since then they are expanding their footprint into other internet verticals. Similarly, the US digital economy leaders such as Google, Facebook, Visa, and Tencent are also participating in the region’s tech scene.

Furthermore, the nature of these technology ventures in the region also proved alluring to the investors. Most of the new ventures are focused at offering access to goods and services that were once ‘out-of-reach’ for the common man.

Last but not the least, the regulatory landscape has evolved considerably to accommodate the growth of the region’s digital economy.

Expect continued strong investment interest and momentum in the S.E region

With 200 deals in 2020 alone, it is clear that the pandemic has not stopped VCs interest in the region. The growing demographics, favourable geopolitical climate, and the governments welcoming tech companies through incentives for the digital economy; the region is poised to increase its global presence.