AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Why DMart’s Radhakishan Damani Is Betting ₹90 Crore on Lenskart Before Its IPO

The retail billionaire’s pre-IPO investment has shown confidence in Lenskart’s profitability and making it India’s next major consumer-tech listing.

Billionaire investor Radhakishan Damani, the founder of Avenue Supermarts (DMart), has invested nearly ₹90 crore in Lenskart Solutions in a notable pre-IPO transaction. The move, coming just before the eyewear retailer’s planned public listing, underscores investor confidence in Lenskart’s strong financial performance and sustainable growth model — a distinction among India’s new-generation consumer-tech firms preparing to go public.

Led by Peyush Bansal, Lenskart is set to launch its maiden IPO next week, aiming to raise ₹2,150 crore through fresh shares and an offer-for-sale by existing investors. The company is targeting a valuation of nearly ₹70,000 crore ($7.97 billion) at the upper end of its price band, making it one of the most valuable tech-driven consumer listings in India this year.

Breaking Down the IPO

According to its Draft Red Herring Prospectus (DRHP), Lenskart plans to raise ₹2,150 crore through new shares while promoters and existing investors will offload 13.22 crore shares via an offer-for-sale (OFS).

Those selling include:

- Founders: Amit Chaudhary, Sumeet Kapahi, Neha Bansal, and Peyush Bansal

- Key investors such as SoftBank’s SVF II Lightbulb (Cayman), Temasek’s Macritchie Investments, Kedaara Capital, Alpha Wave Ventures, and Schroders Capital Private Equity Asia

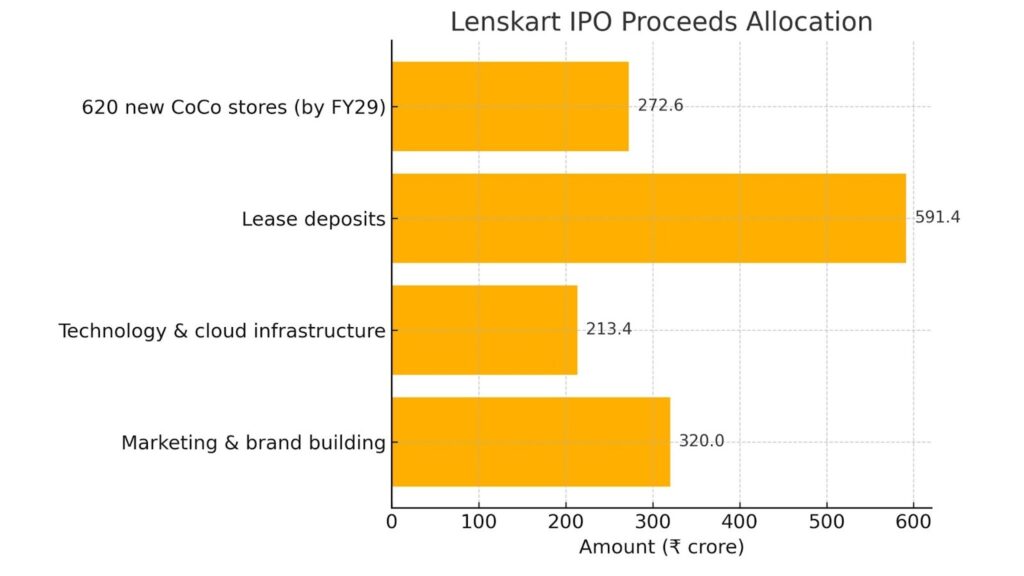

The proceeds from the IPO will fund store expansion, technology infrastructure, lease obligations, brand marketing, and potential acquisitions. Specifically

This structured allocation shows a clear strategy: expand, digitize, and strengthen brand recall—all while maintaining operational profitability.

Profitability in a Sector That Burned Cash

Unlike several internet-led consumer businesses that struggle with margins, Lenskart has turned profitable and stayed that way. The company reported a net profit of ₹297.3 crore in FY25, a significant turnaround from a ₹10.2 crore loss in FY24.

Revenue rose by 23% year-on-year to ₹6,652.5 crore in FY25, while gross margins improved by more than 500 basis points to about 69%. Over the past two years, the business has grown at a 33% compound annual growth rate (CAGR), indicating a transition from high-growth to more sustainable expansion.

This financial discipline likely appealed to Damani—a value investor known for backing profitable, fundamentals-driven businesses. His investment suggests that he views Lenskart less as a flashy consumer-tech play and more as a retail fundamentals story with a digital backbone.

About Lenskart: From Online Retailer to Omni-Channel Powerhouse

Founded in 2008, Lenskart began as an online eyewear retailer before opening its first store in 2013. It has since become India’s largest omni-channel eyewear brand, combining digital convenience with physical reach.

As of March, Lenskart operates 2,723 stores, including 2,067 in India and 656 abroad—largely driven by acquisitions in Japan and Europe. Roughly 60% of its revenue now comes from India, with the remaining 40% from Southeast Asia and the Middle East.

Its hybrid model—combining online reach, offline presence, and end-to-end control of manufacturing and supply chain—has given it a unique cost advantage. Robotic lens labs, centralized logistics, and AI-led fulfillment now enable next-day delivery in 40 Indian cities, setting a high operational benchmark in consumer retail.

The Market Context: Can Lenskart Ride the IPO Wave?

Lenskart’s IPO will be a major test for India’s consumer-tech listings, which are seeing renewed optimism after Urban Company’s strong market debut earlier this month.

With a projected post-money valuation near ₹70,000 crore, Lenskart joins the league of Indian consumer unicorns evolving into public market players. Sources suggest the issue will open between October 31 and November 4, with the anchor book on October 30, and a total issue size estimated at ₹7,250–₹7,350 crore, factoring in pre-IPO rounds.

Why Damani’s Bet Matters

Radhakishan Damani’s investment carries symbolic weight. Known for his disciplined investing style, Damani rarely bets on startups or pre-IPO tech plays. His move indicates a belief that Lenskart’s fundamentals—steady profits, scalable infrastructure, and customer stickiness—make it a long-term consumer brand rather than a speculative tech venture.

The investment also adds validation ahead of the IPO, providing a signal of stability to both retail and institutional investors. As one market observer noted, Damani’s entry “reinforces Lenskart’s credibility in public markets, especially at a time when profitability and governance have become central to investors’ evaluations of new-age firms.”

Conclusion: More Than Just Another Listing

Lenskart’s story reflects the maturity of India’s startup ecosystem—where tech-first companies are evolving into profitable, globally relevant businesses. The company’s upcoming IPO is not merely about raising capital; it’s a stress test for investor confidence in the next wave of Indian consumer-tech giants.

Damani’s ₹90 crore investment amplifies that narrative. It signals that institutional and veteran investors see potential beyond the hype—in sustainable business models that marry technology with tangible consumer value.

If successful, Lenskart’s public debut could become a playbook for other profitable startups preparing to enter the markets—where growth, efficiency, and fundamentals finally converge.

Quick Takeaways

- Investor: Radhakishan Damani (DMart founder) invests ₹90 crore in Lenskart pre-IPO.

- IPO size: ₹2,150 crore fresh issue + 13.22 crore shares in OFS.

- Use of funds: Expansion, tech upgrades, marketing, and acquisitions.

- Financials: FY25 profit ₹297.3 crore vs loss ₹10.2 crore in FY24.

- Valuation target: ₹70,000 crore ($7.97 billion).

- Store footprint: 2,723 stores across India, Southeast Asia, and Europe.