AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Vantage Completes US$1.6B APAC Investment and Secures 300MW+ Hyperscale Campus in Malaysia

Backed by GIC and ADIA, Vantage Data Centers locks in a 300MW+ Malaysia campus and 1GW APAC platform as demand for AI-ready infrastructure accelerates.

Vantage Data Centers, a global developer of hyperscale data center campuses, has finalized a US$1.6 billion equity investment to expand its Asia-Pacific platform. The funding was led by an affiliate of GIC alongside a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA), reflecting strong sovereign investor interest in the region’s rapidly growing digital infrastructure sector.

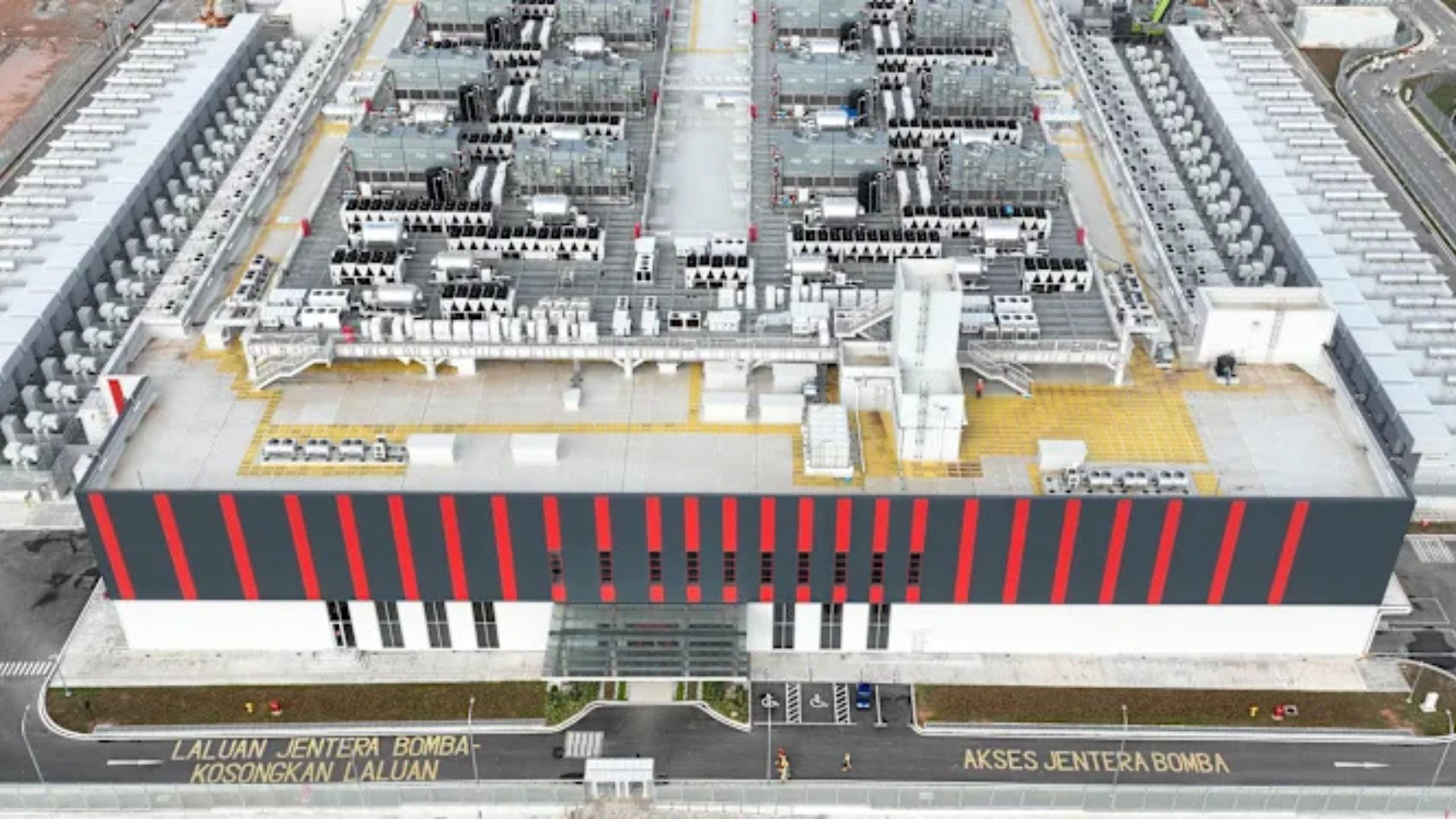

Part of the capital has been allocated to complete the acquisition of Yondr Group’s hyperscale data center campus in Sedenak Tech Park, Johor, Malaysia. The site is designed to deliver over 300 megawatts (MW) of IT capacity once fully developed. With the addition of this campus, Vantage’s planned and operational capacity in Asia-Pacific climbs to 1 gigawatt, covering markets such as Hong Kong, Japan, Australia, Taiwan and Malaysia.

This is not just another capacity announcement—it is a signal of how capital-intensive and strategically important AI- and cloud-ready infrastructure has become in Asia-Pacific.

Why the Johor Campus Matters

The newly acquired Johor campus, JHB1, is Vantage’s third site in Malaysia and a key pillar of its regional strategy. Once fully developed, it will consist of three data centers and deliver over 300MW of IT capacity, placing it among the largest hyperscale campuses in Southeast Asia.

Its location is equally important. Situated within the Johor–Singapore Special Economic Zone, the campus benefits from:

- Proximity to Singapore, one of the world’s most important data and cloud hubs

- Access to dark fiber connectivity and regional network routes

- Reach into high-growth markets such as Indonesia and Thailand

For hyperscale cloud and AI customers, this setup offers a way to secure large-scale capacity just outside tightly constrained markets like Singapore, while still maintaining low-latency access.

AI and Cloud Are Reshaping Infrastructure Needs

Vantage’s move reflects a broader shift: AI training and inference workloads are changing what “hyperscale” means. Large language models, GPU clusters and high-density compute environments require:

- Far higher power density per rack

- Efficient cooling solutions

- Larger contiguous campuses with room to expand

According to Jeremy Deutsch, president of Vantage Data Centers, APAC, integrating one of Southeast Asia’s most advanced hyperscale campuses is a “key step” in the company’s growth strategy for the region. The Johor site strengthens the firm’s ability to deliver sustainable and scalable infrastructure tailored to AI and cloud customers that want both speed and scale.

The 1GW regional platform suggests Vantage is positioning itself as a long-term infrastructure partner for hyperscalers planning multi-year AI capacity roadmaps in APAC.

Sustainability as a Competitive Requirement

Vantage is not framing this expansion as purely a capacity play. The Johor campus was originally financed through a green loan and incorporates sustainability-focused technologies, including direct-to-chip liquid cooling, which is increasingly important for dense GPU deployments.

The site is also on track to achieve EDGE certification, aligning with growing expectations from regulators, customers and investors around energy efficiency and environmental performance. As data centers come under scrutiny for power use and emissions, such design choices are becoming a differentiator—especially for AI workloads that can be particularly energy intensive.

In this context, the campus is as much a sustainability story as it is a scale story.

Talent, Integration and Execution

As part of the acquisition, more than 30 Yondr APAC team members will join Vantage. For a company scaling across multiple markets, local execution capability is critical. Retaining on-the-ground expertise can smooth integration, accelerate project timelines and maintain continuity for customers already familiar with the site.

Vantage positions this as part of a broader push to build capacity in “locations that matter most” to its customers—namely major AI, cloud and digital platforms that need consistent, reliable infrastructure across regions rather than isolated sites.

The Role of Sovereign Capital: GIC and ADIA

The involvement of GIC and ADIA is another important signal. Both institutions have been steadily increasing their exposure to digital infrastructure as long-term, defensive growth assets. Their backing suggests confidence not only in Vantage’s execution track record, but also in:

- The durability of cloud and AI infrastructure demand

- The strategic importance of APAC as a growth region

- The ability of platforms like Vantage to aggregate, develop and operate large-scale campuses efficiently

For founders, operators and investors in the broader ecosystem, this highlights how infrastructure capital and technology demand are increasingly intertwined.

What This Means for APAC’s Digital Ecosystem

Vantage already operates infrastructure for global cloud and AI service providers across North America, Europe and APAC. The Johor acquisition and US$1.6 billion platform investment are likely to have broader knock-on effects:

- Regional hyperscale competition: As large operators race to secure land, power and network access, secondary locations like Johor gain strategic importance.

- Spillover opportunities: Local ecosystems—from construction firms to connectivity providers and edge-service startups—may benefit from the growth of large campuses.

- Policy and regulation: Governments in Southeast Asia may increasingly shape zones, incentives and energy frameworks to attract such investments, balancing growth with grid stability and sustainability.

For startups and investors, the move underscores how AI’s growth is now inseparable from physical infrastructure—and how Southeast Asia is becoming a critical theatre for that buildout.

Quick Takeaways

- Vantage Data Centers completed a US$1.6 billion equity investment into its APAC platform.

- The round was led by affiliates of GIC and ADIA, marking a major sovereign-backed push into digital infrastructure.

- Part of the investment funded the acquisition of Yondr’s 300MW+ hyperscale campus in Johor, Malaysia.

- With this acquisition, Vantage now reaches 1 gigawatt of operational and planned IT capacity in APAC.

- The Johor campus is positioned within the Johor–Singapore Special Economic Zone, enabling access to key regional markets.

- Sustainability is built into the design, including direct-to-chip liquid cooling and EDGE certification progression.

- Over 30 Yondr employees will join Vantage as part of the transition to support integration and expansion.