AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Unicorn India Ventures leads $4m Series A funding in retail tech startup Daalchini

Indian retail tech startup Daalchini has raised $4 million in a Series A funding round, the largest in this round in the smart vending segment, led by Unicorn India Ventures.

The funding round was also backed by existing investors such as Artha Venture Fund, former Dominos India CEO Ajay Kaul, and VSS Investco.

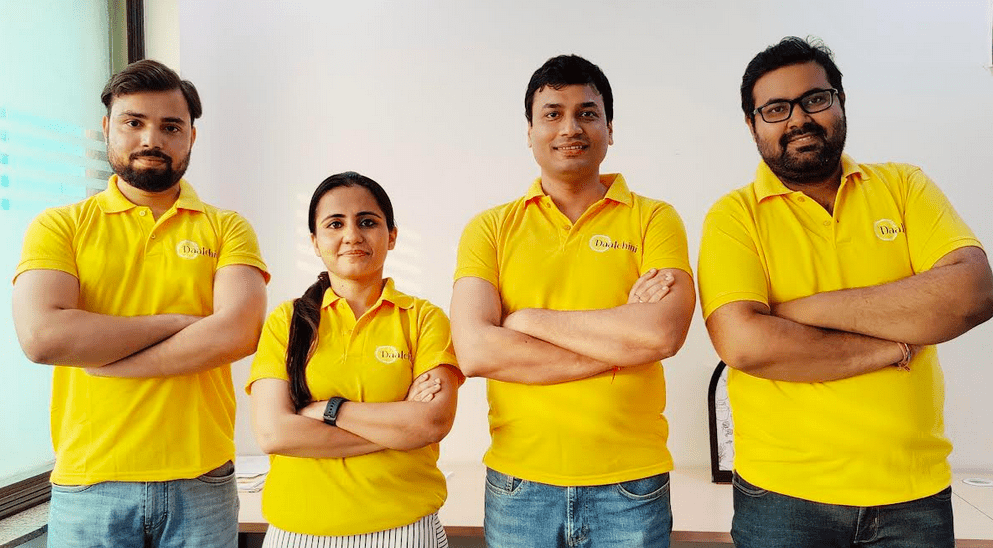

Founded in 2017 by ex-Paytm colleagues Prerna Kalra and Vidya Bhushan, Daalchini takes affordable snacks and home-style meals to its customers through technology-efficient models like automated kiosks, mobility retails, and smart vending machines.

In a statement, Daalchini said a large part of this funding will be deployed to expand its industry footprint and further its tech capabilities. The startup also wants to make its solutions asset-efficient and accessible to 10 million retail points in India and 450+ F&B D2C brands.

“Daalchini aims to establish its footprints at every 200 meters of habitable area with its autonomous smart stores and vending machines. Today, our country has just a few thousand vending machines, while the US or Japan has more than one autonomous store for every 200 people. We are far from the true potential of this kind of retail,” said Daalchini co-founder and CEO Prerna Kalra.

Currently, the Daalchini app has more than 200,000 monthly active users. It is present in more than 20 cities in India and has at least 200 franchise partners and 160 brands selling on its platform.

The startup said it has collaborated with more than 160 brands like Sleepy Owl, The Whole Truth Foods, Open Secret, Yoga Bar, Slurrp Farm, BRB, Cremica Opera, Cravova, Millet Bowl, Yogapulp as well as industry giants like Dabur, Nestle, Mars.

“The RetailTech segment in India is going through a massive transition from its traditional physical store form to a digital one, the speed of which has been intensified by the pandemic. In this phase, Daalchini represents the best of both worlds with a ubiquitous physical presence backed by a strong technological framework that prioritizes its customers’ needs and convenience,” said Ruchi Pincha, investment associate at Unicorn India Ventures, the lead investor in the funding round.