AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Top 10 Venture Capitalists In Asia

The period between 2012 and 2018 has seen almost 12 fold increase in venture capital funding in startups across Southeast Asia.

Growing investments in VC backed startups is leading to some major IPO exits (like Dianping and Pinduoduo in China) and Merger Acquisition exits (like Walmart’s Flipkart acquisition in India).

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”1,2,3″ ihc_mb_template=”1″ ]

Please Note – This is a list by CB Insights. Also, we have done our own research and this list has not been ranked in any specific order. Any feedback is welcome in the comments section or @[email protected]

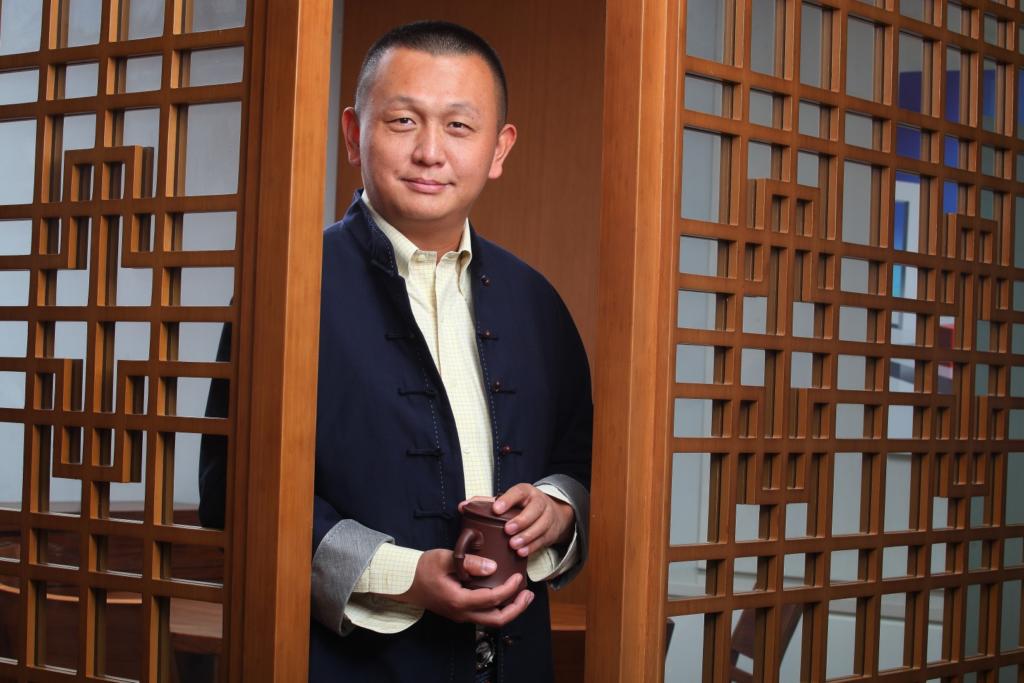

Neil Shen – Sequoia Capital China

As Founding Managing Partner and Director of Sequoia Capital China, Neil Shen has been associated with the investment banking industry for over 18 years, having worked with Deutsche Bank, Citibank and Lehman Brothers, post his Masters from Yale University.

Currently having a net worth of 1.6 Billion dollars, and with holdings in 16 partner investments, he topped the 2018 ‘Midas list’ of the world’s best venture capitalists after Ppdai Group’s IPO exit.

In the aftermath of the 2009 economic crash, Sequoia Capital chose to fund companies with high potential growth. Shen has successfully managed the IPO exits of many companies listed on the NYSE and HKEx. With a vast and diverse portfolio, Sequoia now is a group of 300 dynamic companies providing financial products and innovative business models across the globe.

Lee Fixel – Tiger Global Management

American Venture Capitalist Lee Fixel’s claim to fame was his striking $600 million deal when Tiger’s portfolio company, electronic cigarette makers Juul Labs merged with tobacco leaders Altria Group in 2018.

No looking back from there, Fixel’s Tiger Global went on to earn 3.5 billion dollars in profits from Walmart’s merger acquisition of Flipkart in India. Add to this further IPO exit revenues from Spotify, Eventbrite, Tencent Music, and SurveyMonkey, and it makes Tiger global a huge name in the venture capital arena.

This year Lee decided to venture out on his own by leaving Tiger Global and look out for investment prospects in Indian startups.

Allen Zhu – GSR Ventures

Managing director of GSR Ventures and positioned at # 25 on the Forbes list, Shanghai-based venture capitalist Allen Zhu has made his mark as one of the top tech investors in the world.

An economics major from Fudan University, Zhu’s first major funding deal was struck with the Chinese Uber counterpart DiDi Chuxing as he took over Uber’s China operations in 2016.

Ele.me, a food delivery app service and bike ride-sharing app Ofo which are valued in billions now were also funded by GSR Ventures in the same year.

JP Gan –Qiming Venture Partners

Majoring in business administration from the University of Chicago JP Gan’s climb to the top of the VC list can be owed to 3 of his major IPO exits. The first being BiliBili, an online video sharing service, the second an instant door to door delivery service Meituan-Dianping and the third, a social media-based fashion site Mogu.

Having started venture capital funding in the year 2000 with the Carlyle Group, Gan already had several exits in his kitty including selfie app Meitu, and Chinese travel website Ctrip.

Currently serving as Managing partner to Qiming Venture Partners, he ranks at number 5 on the Forbes Midas List of top tech investors 2019.

Richard Liu – Morningside Ventures

With a net worth of $12 billion, Richard Liu is the general partner and co-founder of Chinese venture fund company Morningside and leads its funding in the Internet, entertainment, and consumer sectors.

His most notable deal was with Smartphone manufacturers Xiaomi, which is now worth 45 billion dollars.

He has also made IPO exits with Chinese social media firm YY, Phoenix new Media, and smart app company UC web.

Shailendra Singh – Sequoia Capital India

With a venture fund that focuses on Indian startups, Shailendra Singh is presently Managing Director with Sequoia Capital, India.

His IPO exits include SCIO Health Analytics and online payment app Pine Labs. He also is serving as a board member to startups like Tokopedia and Zoomcar.

Ranked 70 in the Forbes Midas list, Singh has headed investments in online payment app Cred and gaming company MPL.

Yuri Milner – DST Global

Based out of Russia, Yuri Milner, partner at DST Global, was one of the first VCs to back social media moguls Facebook and Twitter. After selling off his shares, his company DST global funded Spotify and Airbnb.

DST has also invested big on online retailers like Alibaba, JD.com and Chinese smartphone company Xiaomi.

He features on the Forbes Midas List of top 100 tech investors.

Jenny Lee – GGV Capital

Armed with a master’s in business administration from Kellogg school of management, Jenny Lee is one of the most sought after names in the venture capital industry. As managing partner at GGV Capital, Lee has led a fund closure of $1.8 billion in 2018 which was the highest by any VC firm in that year.

She boasts of an impressive portfolio of IPOs including China’s first flying taxi service eHang184 and Lingochamp, the AI learning bot.

Chinese social media company YY has seen a 10 fold increase in its value after GGV capital-backed it in 2012.

Jixun Foo– GGV Capital

Based out of Singapore, Jixun Foo, Managing Director of GGV capital has an impressive portfolio totaling over 14 companies, more than $122 billion in net worth. These include truck loading company Manbang, app-based cab service Grab and grocery supplier startup Xpeng.

His USP is that he prefers to personally communicate with startup founders. Foo was responsible for Chinese Google counterpart Baidu’s multiple returns in 2000 after he led GGV to invest in them.

Xiaojun Li – IDG Capital

Partner at IDG capital and currently ranked 17 on Forbes Midas list, Xiaojun Li made a huge leap this year with his portfolio increasing by 7 major IPO exits. Pinduoduo was alone valued at 30 billion dollars, followed by entertainment firm Bilibili, scooter manufacturers Niu and fashion website Mogu.

His landmark investment in Xiaomi in 2010 paid off well as the smartphone company is now worth over $30 billion.

The future looks bright for this Wharton graduate as more than 13 million dollar companies await back up from IDG Capital.

The above top ten has been arrived at based on factors like the investor’s exits, investor connectivity, consistency, and liquidity of the portfolio.

Follow Asia Tech Daily for the latest news from the startup world.

Image Source – Official Websites and Press releases

[/ihc-hide-content]