AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

The Indian Unicorn Club – Latest 2021 Entrants – BharatPe – Enabling Payment Acceptance Absolutely FREE For All Businesses

BharatPe has become the latest addition to the list of Indian startups that become a part of the Unicorn Club, after its latest round of funding. The FinTech startup recently attained a valuation of $2.85 billion.

BharatPe -About The Company

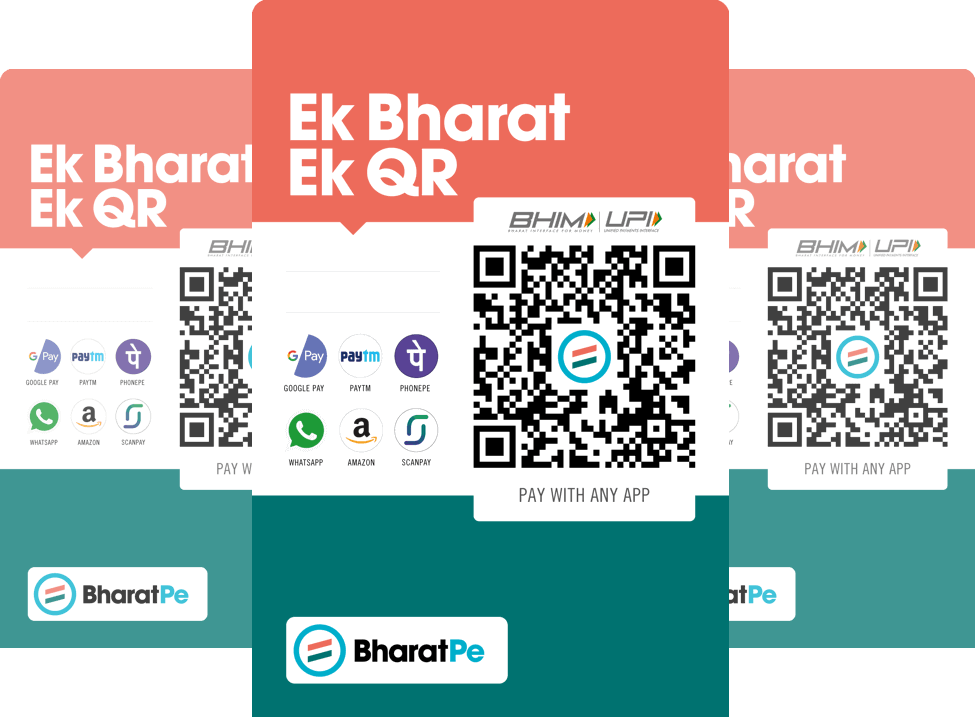

BharatPe was founded in 2018 by Ashneer Grover and Shashvat Nakrani and is based out of New Delhi, India. The company is one of many to pop up following demonetization and the subsequent digital payment revolution in India, but with a unique focus. The company allows merchants to accept digital transactions free of charge, providing QR codes for UPI payments, Point of Sale Machines for Card and NFC payments, and even loans and lines of credit for small businesses.

The Uniqueness

BharatPe has various things going for it that makes it unique when compared to other digital payment services. Its focus, Indianness and business model sets it apart from competitors, placing them in a unique spot.

The company is unique in its focus on the merchants’ side of the transaction. While UPI apps such as GPay, PhonePe and PayTM provides incentives for users and private customers to sign up, BharatPe helps the other side of the business. They assist businesses with the digitization of payments, and even directly aids their business with loans. Their QR codes allow businesses to accept payments from the vast network of India’s UPI apps, with a single interoperable sticker.

The company is also ‘Uniquely Indian’, founded by Indian entrepreneurs and running in the newly digitized Indian market. It is one of the companies that was established post demonetization, aiding the digital transformation of the Indian Economy.

Business Model

BharatPe is unique in its focus group targeting merchants, and offer them a way to prevent any loss of margins while conducting UPI transactions. While most payment portals take 1.5% or more as commission, BharatPe leverages UPI to remove all such charges that burden merchants. Furthermore, they also utilize interoperable QR codes(as mandated by RBI) to ensure compatibility with all UPI apps.

They also have BharatSwipe, India’s first zero-fee POS machine that only requires an upfront payment. They have also rolled out their lending product Distributor-to-Retailer finance, to provide instant liquidity to businesses. Their zero-fee transactions and focus on businesses have attracted many merchants to the platform as their digital money solution.

Growth And Investments

BharatPe has grown into a major player in the digital economy within just 3 years. The platform’s unique business-oriented approach and interoperability have garnered the trust and the usage of over 5 million Indian Merchants.

Their innovative business has also attracted the attention of prominent investors. In the 9 funding rounds that they have conducted since their inception, over $680 million has been raised. Their latest round of Series E investments conducted in August 2021 gathered a total of $370 million. This has tripled their valuation, pushing them into Unicorn status as a FinTech firm worth $2.85 billion. Their prominent investors are Tiger Global, Sequoia Capital India, Coatue, Steadview and others.

The Verdict

BharatPe maintains a unique perspective that will help India digitize its economy faster. By focusing on the merchant’s side of transactions, they help to push digitization and simultaneously invest in the SMEs in a mutually beneficial relationship.