AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Southeast Asia’s Fintech Slowdown Is Real — and Tracxn Data Shows Singapore Winning the Long Game

As Southeast Asia’s fintech sector faces its sharpest funding slowdown in years, Singapore continues to dominate with 84% of total investments. Tracxn’s latest report reveals a market in transition — where capital is consolidating, early-stage startups are struggling, and late-stage leaders are holding firm.

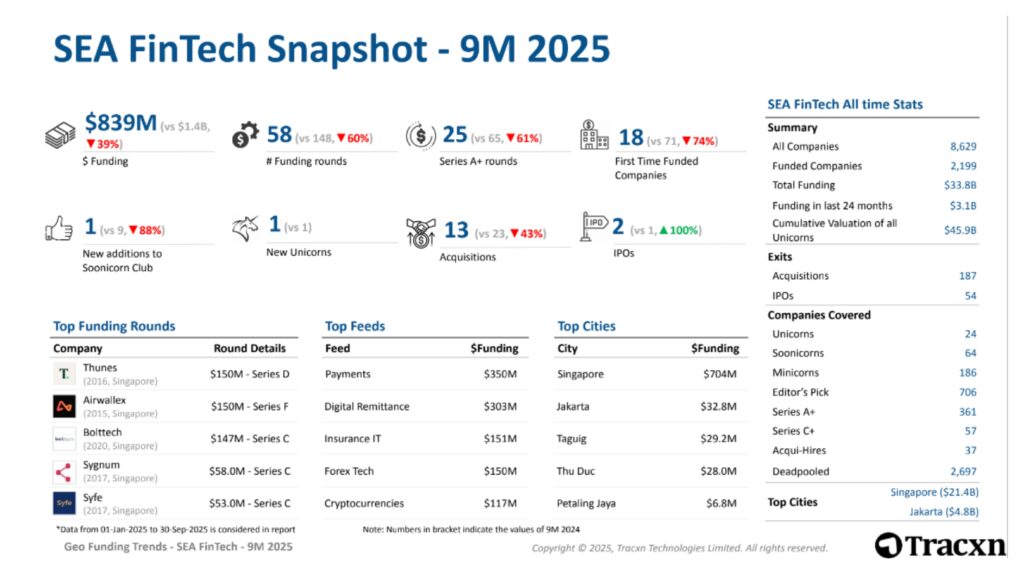

In the first nine months of 2025, fintech startups across Southeast Asia raised US$839 million, marking a 39% year-on-year decline and a 56% drop from 2023 levels. These figures, from Tracxn’s Southeast Asia FinTech Funding Report – 9M 2025, confirm what many investors and founders already sense: the region’s once-surging fintech funding cycle has entered a period of sustained correction.

But the slowdown tells two stories, not one. On one hand, early-stage and seed funding have sharply contracted which is a direct consequence of higher interest rates, investor caution, and maturing market expectations. On the other hand, late-stage players such as Airwallex, Thunes, and Bolttech have continued to attract substantial capital, cushioning the overall decline.

Most notably, Singapore accounted for 84% of all fintech funding in the region during this period, dwarfing its neighbors.

“The fintech ecosystem in Southeast Asia hasn’t collapsed — it’s maturing,” said a Singapore-based venture capitalist interviewed for this story. “Capital is being deployed more selectively, focusing on scalability and profitability rather than just market potential.”

This shift is reshaping the regional startup landscape. For early founders, it signals a tougher fundraising climate. For investors, it’s a reminder that the days of easy deals are over — and disciplined capital allocation is back in vogue.

A Market in Retreat: Understanding the Numbers

The numbers tell a story of correction, not collapse. According to Tracxn, fintech startups in Southeast Asia raised US$839 million in the first nine months of 2025, compared to US$1.4 billion in 2024 and US$1.9 billion in 2023. The decline underscores two key trends — the global pullback in venture activity and the region’s maturing fintech ecosystem.

| Stage | 9M 2023 | 9M 2024 | 9M 2025 | % Change (2024→2025) |

| Seed | US$173M | US$168M | US$62.3M | –63% |

| Early (Series A–B) | US$724M | US$642M | US$219M | –66% |

| Late (Series C+) | US$1.0B | US$558M | US$558M | 0% |

Source: Tracxn SEA FinTech Funding Report – 9M 2025

The sharp fall in seed and early-stage rounds is especially concerning. These stages traditionally fuel innovation — small startups testing new digital banking, lending, or insurtech models. The decline suggests that investors are tightening their risk thresholds, favoring proven business models over untested ideas.

Several macro factors are contributing to this chill:

- Higher cost of capital: Global interest rates remain elevated, prompting limited partners (LPs) and venture funds to adopt a more conservative posture.

- Exit bottlenecks: With fewer IPOs and acquisitions, investors face longer holding periods before realizing returns.

- Overheating hangover: Many fintechs raised aggressively in 2021–22 and are now focused on achieving profitability, not raising again.

In short, capital hasn’t vanished — it’s simply become more cautious and concentrated.

Singapore: The Unchallenged FinTech Capital of Southeast Asia

Of all the findings in Tracxn’s report, one stands out clearly: Singapore captured 84% of total fintech funding in the region during 9M 2025. Jakarta followed at a distant 4%, while other Southeast Asian cities combined accounted for the remaining share.

Singapore’s dominance is not new, but the gap has widened significantly this year. The city-state benefits from a combination of structural and strategic advantages that continue to attract both founders and investors.

First, regulatory stability and clarity have been a long-term draw. The Monetary Authority of Singapore (MAS) has cultivated a forward-looking fintech environment, balancing innovation with prudence through initiatives such as the FinTech Regulatory Sandbox, Project Guardian, and digital banking licenses. These frameworks give startups the confidence to experiment and investors the assurance of oversight.

Second, capital proximity plays a role. Global venture firms such as Sequoia’s Peak XV Partners, DST Global Partners, and 500 Global have offices or significant operations in Singapore. This means funding conversations, due diligence, and deal execution all happen within a tight ecosystem.

Finally, Singapore’s fintech ecosystem is inherently networked — with regional headquarters of major players, talent pools, and a robust financial infrastructure that supports cross-border payments, digital lending, and insurtech platforms.

“Singapore is no longer just a hub — it’s the operating system for fintech in Southeast Asia,” said a partner at a regional investment firm. “If you want to scale regionally, being plugged into Singapore is no longer optional.”

The concentration, however, raises important questions about inclusivity. Emerging ecosystems like Vietnam and the Philippines are showing potential but still struggle to attract substantial institutional funding. Unless investors consciously diversify, the innovation gap between Singapore and the rest of the region could widen further.

The Resilience of Late-Stage Funding

While early-stage startups are finding it difficult to raise capital, late-stage fintechs have largely held steady. Tracxn reports that late-stage funding in 9M 2025 remained flat at US$558 million, the same level as in 2024. This stability was driven by a handful of mega-rounds, each exceeding US$100 million.

The Big Three:

- Thunes ($150M, Series D) – The Singapore-based cross-border payments network attracted significant investor interest as it expands in Africa and Latin America. The round reaffirmed the global appeal of fintechs solving infrastructure-level challenges.

- Airwallex ($150M, Series F) – A global payments platform serving SMEs and enterprises, Airwallex’s latest raise valued it at over US$5 billion. Its consistent growth illustrates investor preference for companies with proven revenue streams.

- Bolttech ($147M, Series C) – The insurtech firm continues to scale its embedded insurance solutions, backed by investors including Tokio Marine. Its success highlights resilience in the insurtech vertical despite market turbulence.

These three companies alone accounted for over half of all fintech capital raised in Southeast Asia this year — a clear sign of concentration.

This “barbell effect” — strong activity at the top (mature players) and weakness at the bottom (seed stage) — suggests that venture money is increasingly flowing to known quantities rather than fresh entrants. For investors, this strategy reduces risk. For startups, it raises the bar for differentiation.

The implication is profound: innovation in fintech is narrowing, with capital favoring scale and incumbency over experimentation. Unless early-stage funding rebounds, the pipeline of new fintech ideas may slow in the years ahead.

M&A and IPO Activity: A Cautious Market for Exits

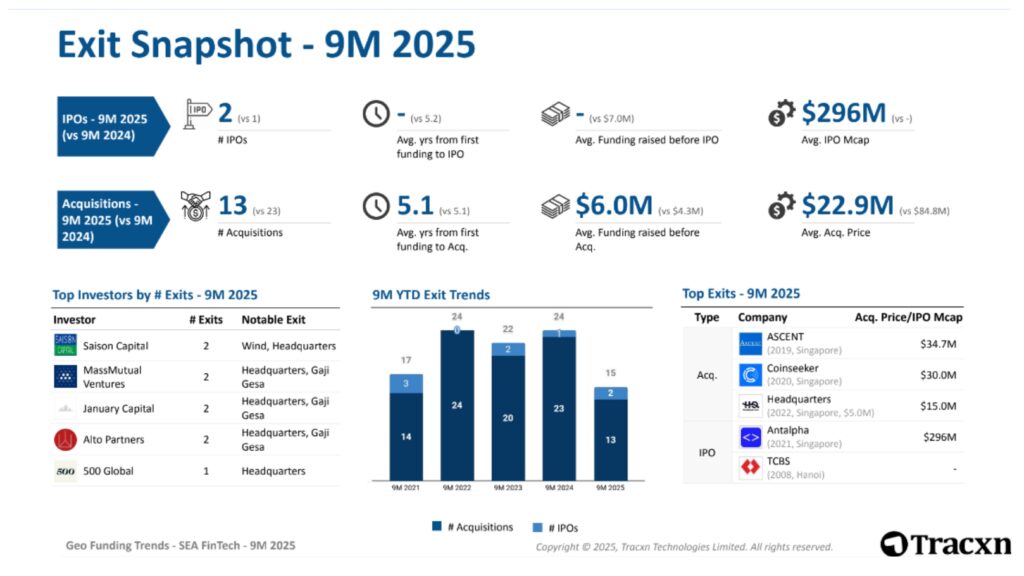

Funding trends are inseparable from exit dynamics — and here, too, Southeast Asia’s fintech sector shows signs of caution. According to Tracxn, the region saw two IPOs in the first nine months of 2025 — Antalpha and TCBS — compared with one in 2024.

Although modest, the increase reflects a selective reawakening of public-market interest in fintech, especially among companies with tangible profitability metrics.

At the same time, the report recorded 13 acquisition deals, down from 23 in 2024 and 20 in 2023. The slowdown underscores limited liquidity in the private markets. However, the deals that did occur were strategic rather than opportunistic.

For instance, KFin Technologies acquired ASCENT for approximately US$34.7 million — one of the highest-valued acquisitions in the period. Meanwhile, Titanlab’s acquisition of Coinseeker for US$30 million points to consolidation in digital asset management.

These acquisitions show that while overall M&A volume has fallen, larger incumbents are using downturns to buy technology, teams, or licenses that fit their long-term strategies.

For founders, this means acquisition remains a viable exit path, but valuations are more conservative. For investors, it reinforces the need for longer horizons and active portfolio management to navigate limited exit liquidity.

Investor Behaviour: From Spray-and-Pray to Precision Capital

One of the most interesting sections of Tracxn’s report covers investor activity. Despite the downturn, participation remained relatively broad across funding stages — just more measured.

At the seed stage, active backers included Iterative, 500 Global, and 1337 Ventures, each maintaining their focus on early innovation, particularly in embedded finance and lending automation.

At the early stage, Peak XV Partners, OSK Ventures, and Citi Ventures were among the most active, focusing on fintechs that had already demonstrated revenue traction.

At the late stage, DST Global Partners and Unbound stood out as key players, channeling capital into companies positioned for regional or global expansion.

This pattern reveals a fundamental shift in mindset. Investors are moving from the “spray-and-pray” approach that characterized the 2020–21 boom years toward precision capital deployment. Due diligence cycles are longer, governance standards are tighter, and follow-on funding is increasingly tied to tangible performance metrics.

A partner at one Southeast Asian fund summed it up succinctly:

“The age of valuations built on user growth alone is over. Today, we care about margins, regulatory alignment, and cash efficiency.”

This more disciplined environment, though challenging for founders, could prove healthy for the ecosystem in the long run. It weeds out weak models and forces startups to grow sustainably — a necessary evolution after years of exuberant spending.

The Global Context: SEA’s Slowdown Mirrors a Wider Shift

Southeast Asia’s funding contraction does not exist in isolation. Globally, fintech has faced a retrenchment since its pandemic-era peak. Giants like Stripe, Klarna, and Revolut have seen valuations correct, while new IPOs in Western markets remain sparse.

What distinguishes Southeast Asia, however, is that the region’s fintech market was still in its growth phase when global capital tightened. That means the slowdown hit earlier-stage ventures disproportionately, as many were still proving market fit.

The silver lining is that structural demand for digital financial services remains strong. Southeast Asia’s unbanked and underbanked populations still exceed 60% in some markets. Digital payments, embedded finance, and insurtech penetration are rising steadily.

In other words, the opportunity hasn’t shrunk — only the funding window has narrowed temporarily.

The current funding winter might therefore act as a reset, allowing the ecosystem to recalibrate around profitability, governance, and efficiency — qualities investors have been demanding globally.

What Comes Next: A 2026 Outlook

Looking ahead, several trends may shape the fintech funding landscape in Southeast Asia through 2026.

Interest rate normalization will be a key variable. If global central banks begin to ease monetary policy, liquidity could return to venture markets, particularly in Asia where growth remains robust.

Regulatory evolution will also matter. New digital bank licenses in Indonesia and Malaysia, open finance APIs in Singapore, and credit bureau reforms across the Philippines and Vietnam are gradually lowering barriers for innovation.

We are also likely to see consolidation and specialization. Fintechs that survive this phase will double down on niche domains such as:

- RegTech – compliance automation for cross-border transactions.

- B2B FinTech – infrastructure for SME lending and payments.

- Green FinTech – sustainability-linked finance platforms.

Finally, M&A activity could rebound as corporates with strong balance sheets look to acquire undervalued startups to expand capabilities. This will provide partial liquidity relief to early investors while reshaping the competitive map.

Conclusion: A Market Reset, Not a Meltdown

Tracxn’s SEA FinTech Funding Report – 9M 2025 captures a pivotal moment for the region’s fintech ecosystem. The sharp decline in early-stage funding and the dominance of Singapore highlight a market transitioning from exuberance to discipline.

For founders, the path forward will require more than a good idea — it will demand operational excellence, strong compliance foundations, and a clear path to profitability. For investors, the opportunity lies in backing resilient business models that thrive in leaner conditions.

The correction, while painful, is part of the ecosystem’s evolution. It is replacing easy capital with smart capital, and untested ideas with sustainable innovation.

“This isn’t a fintech winter,” said an industry observer. “It’s a necessary pruning season — one that will leave behind a stronger, more balanced forest.”

Singapore will likely continue to serve as the nucleus of this transformation, anchoring regional capital and policy alignment. But for Southeast Asia’s emerging markets, the coming year presents both a challenge and an opening — to build distinctive fintech stories that can attract capital not through hype, but through proof.

In essence, 2025 marks not the end of the fintech boom, but the beginning of fintech’s next, more sustainable chapter.

Sources: