AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Singapore’s Singtel sells partial stake in Airtel Africa for $110m

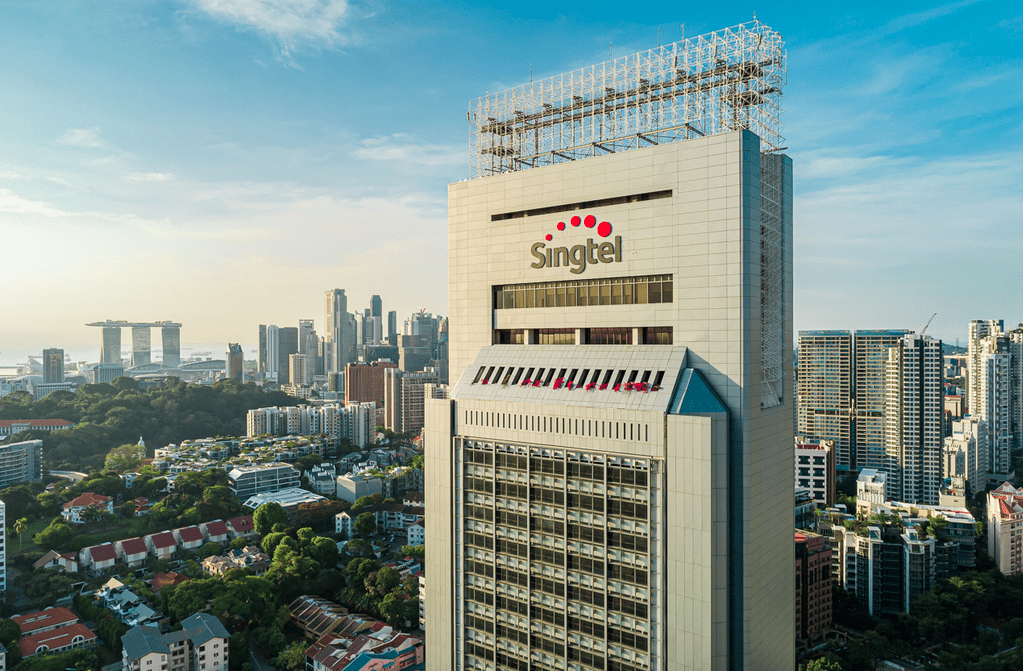

Singtel’s wholly-owned subsidiary Singapore Telecom International has monetised a 1.6% stake in Airtel Africa through a market placement, as part of its capital recycling strategy.

It raised net proceeds of approximately S$150 million from the placement which was well oversubscribed.

“We are pleased with the strong interest in the placement. This monetisation underscores our approach to actively pursue asset recycling opportunities and crystallise value from our assets to fund our new growth engines. It will also enhance the liquidity of Airtel Africa shares in the market and allow for more broad-based institutional investor participation,” said Arthur Lang, Singtel’s Group Chief Financial Officer.

Airtel Africa, Africa’s second largest telecom operator, with a combined mobile customer base of more than 125 million across 14 countries, offers an integrated suite of telecommunications solutions, including mobile voice, data and mobile money services. It has been delivering strong broad-based revenue growth and good returns to shareholders.

The realised gain on divestment of approximately S$34 million will be recorded in the Group’s retained earnings in the balance sheet. Following this transaction, Singtel will continue to hold a 21.7% effective stake in Airtel Africa, comprising a 17.8% indirect stake through its regional associate Airtel and a 3.9% direct stake.

“We remain positive and committed to Africa in the long run. Airtel Africa serves a young demographic in a fast-growing market and is well positioned to benefit from rapid smartphone and mobile money adoption with the rise of the continent’s digital economy,” Lang added.

Singtel was earlier recognised as one of the World’s Most Ethical Companies by Ethisphere, a global leader in defining and advancing the standards of ethical business practices. We are the only Singaporean and Southeast Asian company to receive this honour.

This year, 136 companies that stood out for their exceptional leadership and commitment to business integrity through best-in-class ethics, compliance, and governance practices were given this distinction. Ethisphere assessed companies on culture, environmental and social practices, ethics and compliance activities, governance, diversity, and initiatives to support a strong value chain.