AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Investor Confidence Returns as SEA Tech Funding Hits $909M in Q1 2025 – Tracxn

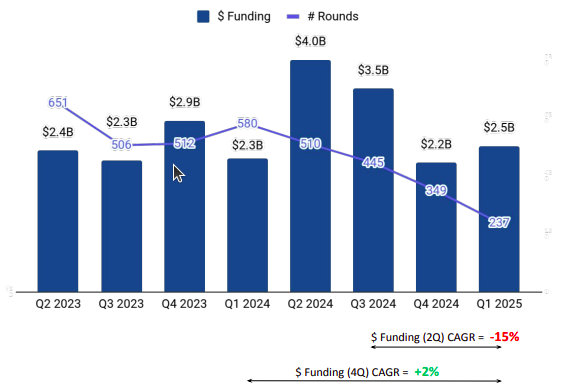

Southeast Asia’s tech startup ecosystem is showing signs of recovery, with total funding reaching $909 million in Q1 2025, according to a report by Tracxn. This marks a 30.79% increase from the $695 million raised in Q4 2024, signaling renewed investor confidence. However, funding remains 9.10% lower than the $1 billion secured in Q1 2024, reflecting ongoing macroeconomic challenges.

Late-stage funding sharply rose in Q1 2025, reaching $700 million—a 110.21% increase from the previous quarter’s $333 million and a 140.55% jump from $291 million in Q1 2024. Despite persistent global economic pressures, the report suggests that investor interest in mature startups is strengthening, driving a partial recovery in the region’s funding landscape.

However, early-stage investments declined significantly, with seed funding dropping to $44.8 million, marking a 43.07% decrease from Q4 2024 and a steep 76.67% fall compared to Q1 2024. Similarly, early-stage funding fell 42.05% quarter-over-quarter to $164 million, down 70.82% from last year.

The quarter saw only one funding round exceeding $100 million, compared to two in the previous quarter. Digital Edge emerged as the top-funded company, securing $640 million in a Series D round. Enterprise infrastructure was the highest-funded sector, attracting $640 million—an astonishing 3,182.05% surge from Q4 2024’s $19.5 million and a 5,665.77% rise from Q1 2024’s $11.1 million.

Meanwhile, fintech startups raised $171.6 million, reflecting a 37.40% decline from Q4 2024 and a 71.69% drop from Q1 2024. High-tech investments also slumped, with funding falling 44.36% year-over-year to $111.1 million.

Mergers and acquisitions activity showed mixed trends, with 13 deals completed in Q1 2025—a slight 8.33% increase from 12 in Q4 2024 but a 50% drop from 26 in Q1 2024. The largest acquisition of the quarter was NinjaOne’s $252 million purchase of Dropsuite. However, no SEA tech companies went public during the quarter, in contrast to one IPO in Q4 2024 and two in Q1 2024.

Singapore remained the dominant tech hub in the region, accounting for 95% of total funding. Startups based in the city-state secured $865 million, followed by Ho Chi Minh City’s Thu Duc, which raised $28 million, and Jakarta, with $6.2 million. The region saw the emergence of just one new unicorn, matching the count from Q1 2024.

Investor activity remained strong, with 500 Global, Wavemaker Partners, and East Ventures emerging as the most active overall. At the seed stage, Orbit Startups, Selini Capital, and AppWorks led investments, while Citi Ventures, Prosus, and JAFCO Asia were the top early-stage backers.

Tracxn noted that the rebound in late-stage funding and shifting sector trends indicate the resilience of Southeast Asia’s tech ecosystem. Despite ongoing economic challenges, the region remains attractive to investors, with funding levels expected to improve in the coming quarters.

Southeast Asia is strengthening its position as a key hub for technology and startups as innovation drives growth. The adaptability of the ecosystem and increasing investor confidence suggest long-term potential for sustained funding and expansion in the region.

Tracxn Technologies Ltd. is a data intelligence platform for private market research, tracking 4 million entities through 2900+ feeds categorized across industries, sub-sectors, geographies, and networks globally. It has become one of the leading providers of private company data and ranks among the top five players globally in terms of the number of companies and web domains profiled.