AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Indonesia and US Seal $38.4B in Deals: Trade Reset or Strategic Rebalancing?

Ahead of a formal trade pact, companies from both countries sign wide-ranging agreements across minerals, energy, semiconductors and agriculture — with tariffs and supply chains in focus.

Indonesian and U.S. companies signed agreements worth US$38.4 billion in Washington, DC, days before Indonesian President Prabowo Subianto is expected to formalise a comprehensive trade pact with U.S. President Donald Trump. The 11 memoranda of understanding (MoUs) were concluded during a business dinner hosted by the U.S. Chamber of Commerce and a roundtable organised by the US-ASEAN Business Council.

The deals span mining, energy, agribusiness, textiles, furniture and technology. President Prabowo said the agreements support Indonesia’s push to modernise and industrialise its economy. “We hope to find partners who are ready to join us in our ongoing efforts to modernise and industrialise,” he said, adding that the pacts could help reduce Indonesia’s trade surplus with the United States.

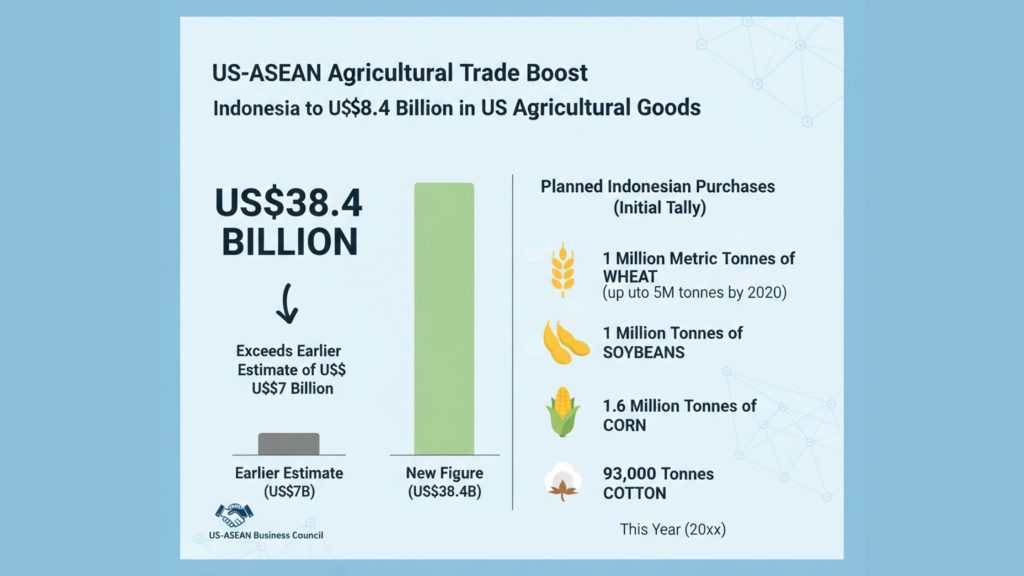

The US$38.4 billion figure exceeds an earlier estimate of just over US$7 billion cited by the US-ASEAN Business Council, which focused mainly on agricultural imports. That earlier tally included planned Indonesian purchases of: (1) 1 million metric tonnes of wheat this year (up to 5 million tonnes by 2030) (2) 1 million tonnes of soybeans (3) 1.6 million tonnes of corn (4) 93,000 tonnes of cotton

In recent years, Indonesia has imported roughly US$3 billion in U.S. agricultural goods annually, making it a significant market for American farm exports. The updated total suggests that beyond agriculture, larger industrial and technology-linked agreements are being counted.

However, not all MoUs disclosed financial values. Several represent frameworks for cooperation rather than immediate capital commitments, meaning the headline number may reflect long-term potential rather than near-term investment flows.

Minerals and Energy Agreements

Among the most strategically significant agreements is a critical minerals MoU between Freeport-McMoRan and Indonesia’s Ministry of Investment. Freeport chairman Richard Adkerson confirmed that discussions also include extending its mining permit beyond 2041 — a move that would secure long-term resource development.

Indonesia holds some of the world’s largest reserves of nickel and other battery-linked minerals. For the U.S., access to diversified mineral supply chains has become a strategic priority amid global competition in electric vehicles and clean energy technologies.

Another agreement pairs Indonesia’s state oil producer Pertamina with Halliburton for oilfield recovery projects. The focus on boosting output from existing fields reflects ongoing energy security concerns across Asia.

Semiconductors and Industrial Upgrading

Technology cooperation also featured prominently. Two semiconductor-related joint ventures were announced, including a US$4.89 billion agreement between Essence Global Group and an Indonesian partner, alongside another venture involving Tynergy Technology Group.

For Indonesia, semiconductor and downstream manufacturing investments align with a broader strategy: move beyond raw commodity exports and build higher-value industrial capabilities. Jakarta has been positioning itself as a regional manufacturing hub, leveraging its domestic market and mineral base to attract foreign capital.

For U.S. firms, partnerships in Indonesia offer supply chain diversification at a time when companies are rethinking exposure to geopolitical risk.

Trade Diplomacy and Tariff Context

The timing of the signings — ahead of a formal trade pact between the two presidents — underscores how corporate agreements are often linked to trade diplomacy.

In recent years, large commercial commitments have accompanied tariff negotiations. Agricultural import pledges featured prominently in U.S.-China trade discussions, while similar patterns have emerged in U.S.-India tariff adjustments. Indonesia is reportedly seeking a modest reduction in U.S. tariffs to 18 per cent from 19 per cent agreed last year.

Deputy U.S. Trade Representative Rick Switzer said the reciprocal trade agreement “will mean more trade — bilateral trade. It will mean more investment.” While the final tariff rate has not been confirmed, the scale of the announced deals strengthens the political optics of economic alignment.

For Asia’s startup and investment ecosystem, the agreements signal three broader shifts:

- Supply Chain Realignment: Critical minerals and semiconductor partnerships reflect growing emphasis on regional production resilience.

- Industrial Policy Convergence: Indonesia is actively courting capital to accelerate industrialisation, while U.S. firms seek new growth markets.

- Trade Diplomacy Through Deals: Large corporate commitments are increasingly tied to tariff negotiations and geopolitical alignment.

The presence of technology and semiconductor ventures within the deal package also highlights Indonesia’s ambition to participate more deeply in global manufacturing and digital supply chains.

A Trade Reset in Motion

The US$38.4 billion headline underscores expanding economic ties between Southeast Asia’s largest economy and the United States. Yet the real impact will depend on implementation — how many MoUs convert into operating projects, capital expenditure and sustained industrial capacity.

For Indonesia, the agreements support its push to move up the value chain. For U.S. firms, they offer access to resources and growth markets. For the broader region, they reflect a more strategic phase of trade diplomacy, where investment commitments, supply chains and tariff policy are increasingly intertwined.

Whether this marks a lasting reset in U.S.-Indonesia trade relations will become clearer once the final pact is signed and commercial terms begin to materialise.

Quick Takeaways

- US$38.4 billion in MoUs signed ahead of a formal U.S.–Indonesia trade pact, covering mining, energy, agriculture, furniture and technology.

- Critical minerals and semiconductors featured prominently, aligning with global supply chain diversification efforts and Indonesia’s downstream industrial strategy.

- Agricultural imports remain central, with wheat, soybeans and cotton purchases forming a significant part of the commitments.

- Some agreements lack disclosed values, and several represent cooperation frameworks rather than immediate capital deployment.

- Tariff negotiations form the backdrop, with Jakarta seeking a modest reduction in U.S. tariffs as part of the broader trade discussions.

- Execution will determine impact, particularly in technology sectors where Indonesia is still developing advanced manufacturing capabilities.