AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

India’s Private Capital Flows Hit $5.3B in October — But Fewer Deals Reveal a Market in Transition

Mega-deals, PIPE dominance, and a sectoral shift toward financial services mark a new phase in India’s PE/VC cycle.

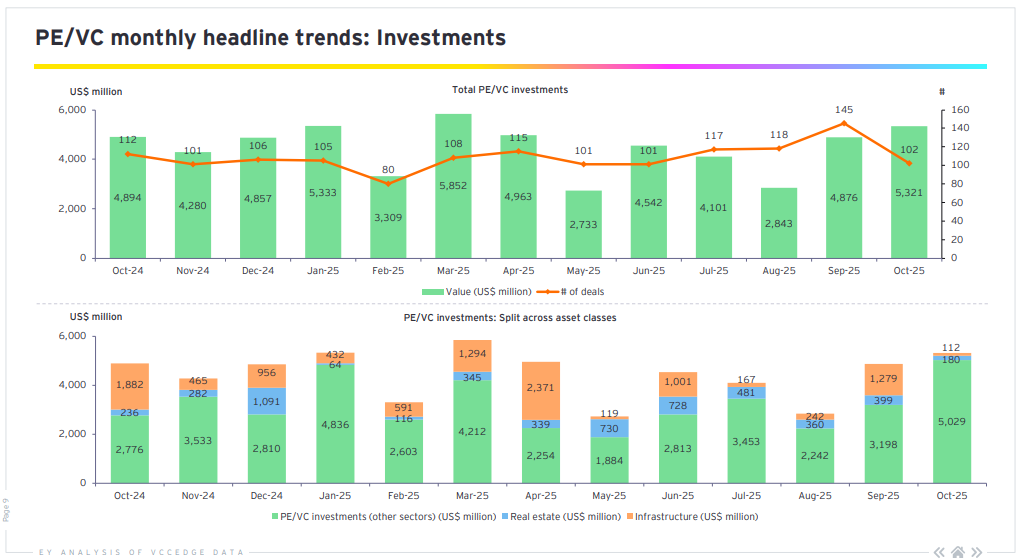

India’s private equity and venture capital (PE/VC) market posted a strong month in October 2025, attracting US$5.3 billion in investments — a 9% rise year-on-year and month-on-month, according to the latest EY–IVCA report. This renewed momentum signals that institutional capital remains bullish on India even as global markets navigate inflation, geopolitical risks, and tightening liquidity.

Yet deal volume told a different story. India recorded only 102 deals, down sharply from 145 in September and 112 in October last year. This divergence — rising capital deployment but falling deal counts — highlights a clear trend: investors are concentrating their money in fewer, high-conviction opportunities rather than spreading risk broadly across early-stage deals.

Mega-Deals Shape India’s October Investment Landscape

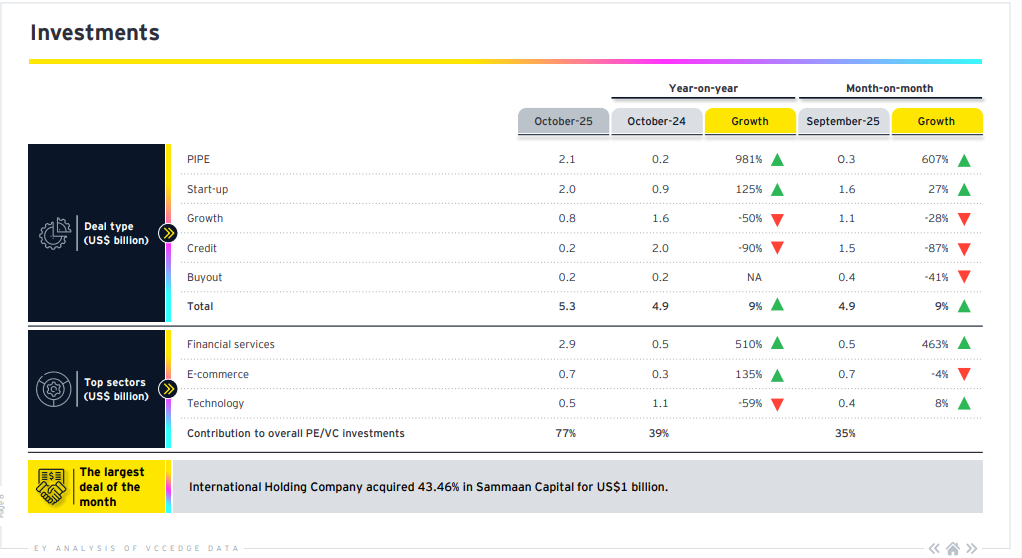

Large-ticket transactions defined October’s momentum. Nine deals alone contributed US$3.7 billion, representing 70% of the month’s total inflows — a pattern increasingly common in India’s PE/VC landscape.

The standout deal was International Holding Company’s US$1 billion purchase of a 43.46% stake in Sammaan Capital, which helped push financial services to the top of the sector charts. The return of mega-deals also reflects improving confidence in India’s mid-to-late stage companies, many of which are scaling despite market uncertainties.

PIPE and Startups Drive Capital Inflows

October saw a sharp divergence across investment categories:

- PIPE surged to US$2.1 billion, nearly 10 times the level seen a year ago.

This signals rising investor preference for publicly listed, higher-transparency vehicles during volatile cycles. - Startup investments hit US$2 billion, up 175% YoY.

Early-stage appetite is recovering, driven by renewed interest in deep tech, fintech, and enterprise SaaS. - Growth capital fell to US$810 million, half of October 2024’s level.

- Buyouts stayed flat at US$227 million, indicating stable interest in control transactions.

- Credit investments dropped 90% YoY to US$189 million, reflecting investors’ reduced risk appetite for leveraged structures.

Rather than a broad slowdown, these numbers show a market actively reallocating capital toward liquidity-friendly instruments (PIPE) and innovation-driven early-stage deals.

Where the Money Went: Financial Services Leads by a Large Margin

Financial services dominated October’s sectoral mix with US$2.9 billion, propelled by the Sammaan Capital mega-deal and continued investor interest in digital lending, NBFCs, and financial infrastructure. E-commerce and technology followed at US$715 million and US$455 million, respectively.

The data shows a clear shift: investors are doubling down on digital-first sectors with high scalability, regulatory clarity, and solid unit economics. Technology saw weaker year-on-year growth, but marginal month-on-month improvement suggests that the correction cycle may be stabilising.

These visuals underscore three key patterns:

- Investment value is rising despite a drop in deal count, showing market consolidation.

- PIPE and startup funding are disproportionately driving the uptick, even as credit and growth capital weaken.

- Sectoral concentration is intensifying, with financial services, e-commerce, and tech accounting for 77% of all inflows.

These charts visually reinforce a structural shift in how capital is being deployed and where investors are placing long-term bets.

Industrial Sector: A Long-Term Bright Spot

Beyond monthly fluctuations, India’s industrial sector continues to demonstrate structural strength. Since 2015, the sector has attracted US$10.4 billion across 256 deals, with over 70% of that coming in just the past five years.

The sector’s growth is supported by:

- A manufacturing push under Make in India

- Rising capex across power, electronics, defense, and automotive

- Strong demand for smart meters, packaging, and semiconductor components

- Increased interest in renewable energy and EV supply chains

Buyouts have been especially prominent, accounting for 54% of industrial-sector investment since 2020. Major acquisitions by GIC, PAG, and Blackstone highlight the sector’s attractiveness to long-term capital.

Exits Continue to Struggle Amid Tight Liquidity

October saw 14 exits worth US$640 million, sharply below October 2024’s US$1.1 billion and September 2025’s US$2.6 billion. Open-market exits dominated at US$234 million.

The month’s biggest exit was Advent’s US$186-million sale of a 2% stake in Aditya Birla Capital.

This slowdown is consistent with the broader global trend: exit windows remain narrow across IPOs, M&A, and secondary transactions due to investor caution and lower valuations.

Fundraising Rebounds as LP Confidence Improves

Fundraising picked up significantly, with US$1.8 billion raised — far above the US$209 million recorded a year earlier. The standout raise was HSBC’s US$1 billion vehicle, aimed at supporting working capital and term loans for growth-stage startups.

The rise in fresh capital commitments indicates that LPs remain confident in India’s long-term growth story, particularly in tech-forward sectors.

What This Means for India’s Private Capital Cycle

EY notes that India’s PE/VC cycle is shifting into a more active phase, backed by:

- Resilient corporate earnings in BFSI, IT, and FMCG

- Easing inflation and steady GST collections

- Growing domestic capex and infrastructure buildup

- Political stability after the Bihar elections

- Potential changes in US trade policy under a Trump administration

- Continued foreign interest in India as a China+1 market

The data suggests that India is entering a phase where capital is more selective, more concentrated, but still abundant for high-quality opportunities.

Conclusion: Bigger Bets, More Discipline, Clearer Signals

October’s numbers make one thing clear: India’s investment cycle is becoming deeper, not just larger. Capital is flowing toward sectors with scalable business models, stable regulatory environments, and long-term growth potential, while riskier categories such as credit and growth-stage investments are seeing pullbacks. The resurgence of PIPE deals reflects investors’ desire for liquidity and transparency—two attributes that become especially important during periods of macroeconomic uncertainty.

The next phase of growth will depend on how quickly exit channels reopen and whether domestic LP participation expands. With improving earnings across key sectors, rising capex, consistent GST collections, and supportive policy signals, India is well-positioned to attract sustained interest. The challenge now is ensuring that this capital supports innovation, strengthens local ecosystems, and creates durable value.

-Quick Takeaways–

- US$5.3B invested in October, up 9% YoY and MoM

- Deal count fell to 102, indicating selective deployment

- 70% of capital came from nine mega-deals

- PIPE and startup funding were the strongest categories

- Financial services led with US$2.9B, driven by a US$1B mega-transaction

- Exits dropped significantly, totaling US$640M

- Fundraising improved, with US$1.8B raised globally

- Overall trend: More capital, higher conviction, fewer deals