AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Grab backer 500 Durians rebrands as 500 Southeast Asia

500 Durians, the Southeast Asia-focused fund of global venture capital firm 500 Startups, has rebranded to 500 Southeast Asia in a nod to the region’s growing status as a world-class innovation economy.

500 Southeast Asia, whose investment themes include fintech, healthcare, the creator economy, All-commerce ecosystem, human and machine productivity, rural digitisation, and sustainable cities, will continue its primary focus on Indonesia, Malaysia, and Singapore.

The firm said it may also invest in the broader Southeast Asia region. 500 Startups also operate 500 Vietnam and the Thailand-focused fund 500 Tuktuks.

“We began our investing practice here seven years ago with the audacious belief that Southeast Asia would birth some of the largest and most innovative startups. At the time, we chose the Durians name, because our funds had a distinctly local flavor,” said Vishal Harnal, Managing Partner at 500 Startups Southeast Asia.

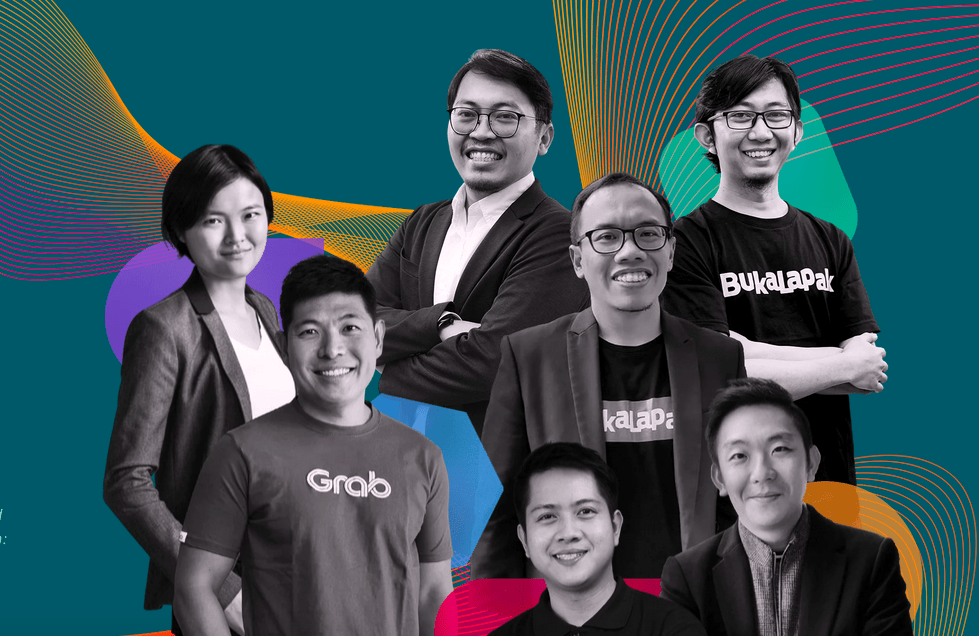

About half of the region’s $1 billion+ companies announcing plans to go public in 2021 and 20222 are 500 Southeast Asia portfolio companies. They include Grab, Bukalapak, Carsome, Prenetics, FinAccel, and Carousell, all part of the firm’s first generation of investments.

“Now we have multiple companies individually valued at more than $1 billion that have announced plans for listing on global stock exchanges. We’re incredibly proud of our founders and how far the region has come,” Harnal added.

500 Southeast Asia is nurturing its ‘next generation’ of portfolio companies, of which 15 have been reported to be worth more than $100 million each. Collectively, it has made investments in approximately 250 companies, which have gone on to raise a total of $20 billion.

The firm believes that startups in fast-growing economies like Southeast Asia play a role not only as innovators, but as future stewards of society. To support this, it has started incorporating environmental, social, and governance (ESG) considerations into its investment practices, guiding founders with their ESG journey.

“The relationships we have built with the broader ecosystem is the foundation for 500 Southeast Asia’s next phase of growth. There is a growing realization of societal interconnectedness and responsibility. We want our entrepreneurs to create returns on investment that drive returns to society. We’re in this together,” said Khailee Ng, Managing Partner at 500 Startups.