AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Digital securities exchange ADDX launches private market services for wealth managers

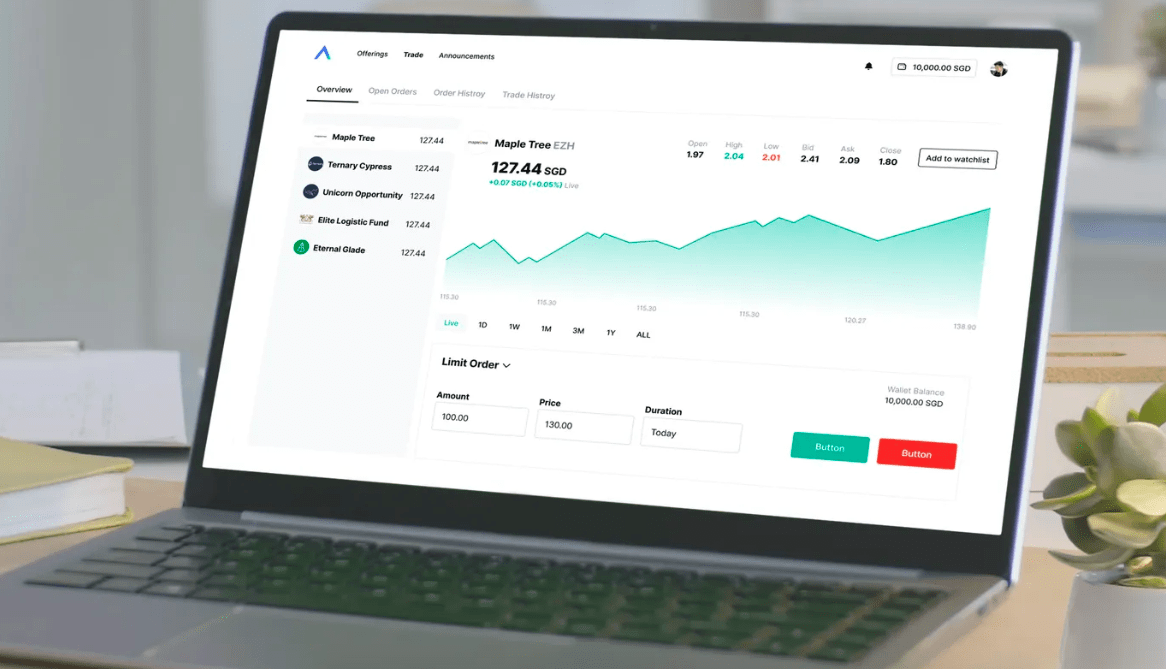

Wealth managers can now introduce more of their end-investors to the world of private investments through a newly-launched institutional service on digital securities exchange ADDX.

Corporate treasuries and family offices can also take part in the space via a corporate service to diversify their portfolios through private market products. Both services fall under a new product line for businesses, called ADDX Advantage.

Among some of the first institutions to come on board as partners include StashAway, Southeast Asia’s fastest growing digital wealth manager, and CGS-CIMB, a leading securities brokerage in Asia.

Wealth managers utilising this institutional service can offer their clients fractional access to private market products, which better enhances portfolio diversification away from public markets exposure.

This service is designed for brokerages, private banks, external asset managers and multi-family offices. Through a B2B2C 1 model, the service ultimately benefits the wealth manager’s end-clients, who may be individual accredited investors 2 or corporate investors.

Currently, wealth managers looking to offer private market products to their end-clients have to negotiate deals with each issuer separately – a time-consuming process. Being on ADDX means an instant plug-in to a full suite of deals across multiple asset types.

The use of blockchain and smart contracts on ADDX also enables the fractionalisation of opportunities down to a minimum of US$10,000, from the US$250,000 to US$5 million typically required when going direct to private market issuers. The lower barrier to entry makes it possible for end-clients to manage risk by spreading their capital across a variety of products.

Depending on the regulatory licenses the wealth managers hold, they can choose between two types of institutional services. They can either execute trades and perform fund transfers on behalf of end-investors, or create sub-accounts in their end-clients’ names and allow the clients to take control of their own activity on ADDX.