AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Korean FinTech Startup CONCAT- Making Insurance Smarter!

The new accounting standards, diversification of sales channels, and constant deterioration of profitability have led to a fundamental transformation of the insurance industry. Keeping this in mind, CONCAT, a South Korean FinTech startup, is offering optimal financial services.

CONCAT was founded in 2018 by a core engineering team with capabilities in deep learning and data analytics technologies and has a talented and highly qualified team on board. Mr. Jaeyeop Kim, the CEO, has done a BS in Chemical and Biomolecular Engineering from Yonsei University. Mr. Taemin Kwak, a Frontend Developer, has done a BS in Computer Science and BA in Business also from Yonsei University.

The company believes that the recommendation of insurance products should be personalized, and services should assist the customer decision making based on competitive coverage, easy subscription and claim process, and reliable brands.

CONCAT- Providing World-Class Tech-Enabled Insurance Products

According to the company’s philosophy, there should be three criteria for consumer choice and judgment- competitiveness, reliability, and convenience. Basis the individual characteristics, the assurance should be designed to maximize the guaranteed effect at the same cost. They believe in developing a sustainable system that guides consumers through the main details of the guarantee effortlessly and helps subscription. However, the company also believes that planners still play an essential role as transaction executors since many customers are comfortable with professional help when buying insurance.

The company’s working model helps planners to analyze guarantees, design subscriptions, etc. This helps them to maximize their sales capabilities and remove the factors that delay subscription. The key products to make insurance smarter include-

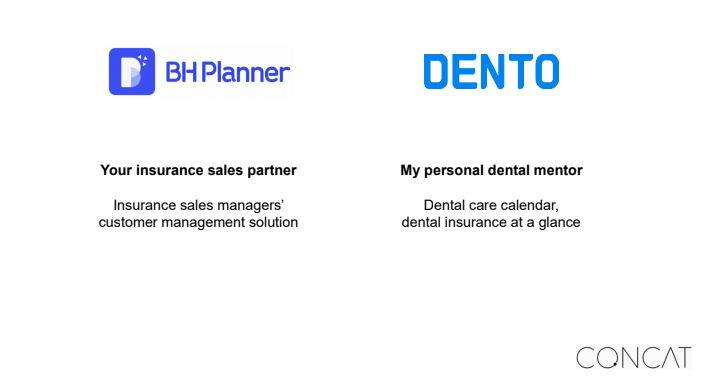

BH Planner

The insurance sales partner for agents so that they can manage customer service efficiently. The main features of this service include- personalized product recommendation, insurance guarantee analysis according to the subscription history, customer asset management services, and agent internal communication solution service.

Main Features

- Insurance guarantee analysis according to subscription history

- Personalized product recommendation based on guarantee analysis results

- Agent internal communication solution service

- Customer asset management services

Dento

This smart app provides consumers with a personal dental care calendar. It is a comprehensive solution that brings together dental practice management, dental insurance services, and dental diary along with personalized comparison and recommendation. This service helps consumers to take care of their teeth in a healthier and more rational manner.

Main Features

- Fill in brush habit calendar day by day

- Dental clinic record and diary function

- Dental insurance analysis report: personalized comparison and recommendation

CONCAT will be releasing both its innovative solution in the first quarter of 2020, which is February 2020. The startup’s revenue model will be based on service fees and commission from affiliated general agency partners. For BH Planner, the company intends to keep a subscription-based model and brokerage fee for new customer referrals.

The company also has an app- ‘bople’ that notifies the clients on the insurance coverage analysis and provides an easy and secure platform for insurance consulting. This app is available on Google Play and the App Store.

CONCAT- All Set For A Bright Future

CONCAT has seen steady growth in sales and continues to expand. The company has secured a high-quality database that is customer-centric with a service fee for insurance designers and a real demand for insurance. The company aims to achieve a high rate of subscriptions in 2020, with revenue reaching 950 KRV mm.