AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Chinese robotics startup Hai Robotics gathers $200m in funding

Hai Robotics, a Chinese warehouse robotics startup pioneering in autonomous case-handling robotics (ACR), announced that it raised about $200 million in total in two new continuous rounds of financing.

According to the announcement, the Series C funding round was led by 5Y Capital with participation from Sequoia Capital China, Source Code Capital, VMS, Walden International, and Scheme Capital.

The Series D funding round, the third capital infusion for the company in 2021, was led by Capital Today with some existing investors, including Sequoia Capital China, 5Y Capital, Source Code Capital, Legend Star, and 01VC.

Earlier in March, the company announced raising $15 million in its Series B+ funding round.

Hai Robotics said it will use the fresh funding to boost its robot fleet with technological upgrades, expand its global operations networks, optimize its supply chain management, and acquire more talent.

“Our major future orientation will center on expanding the overseas market and localize our service,” said Richie Chen, the company’s co-founder and CEO.

Chen said that the company will continue to pursue technological innovation as the primary driver for growth and continuously create values for customers.

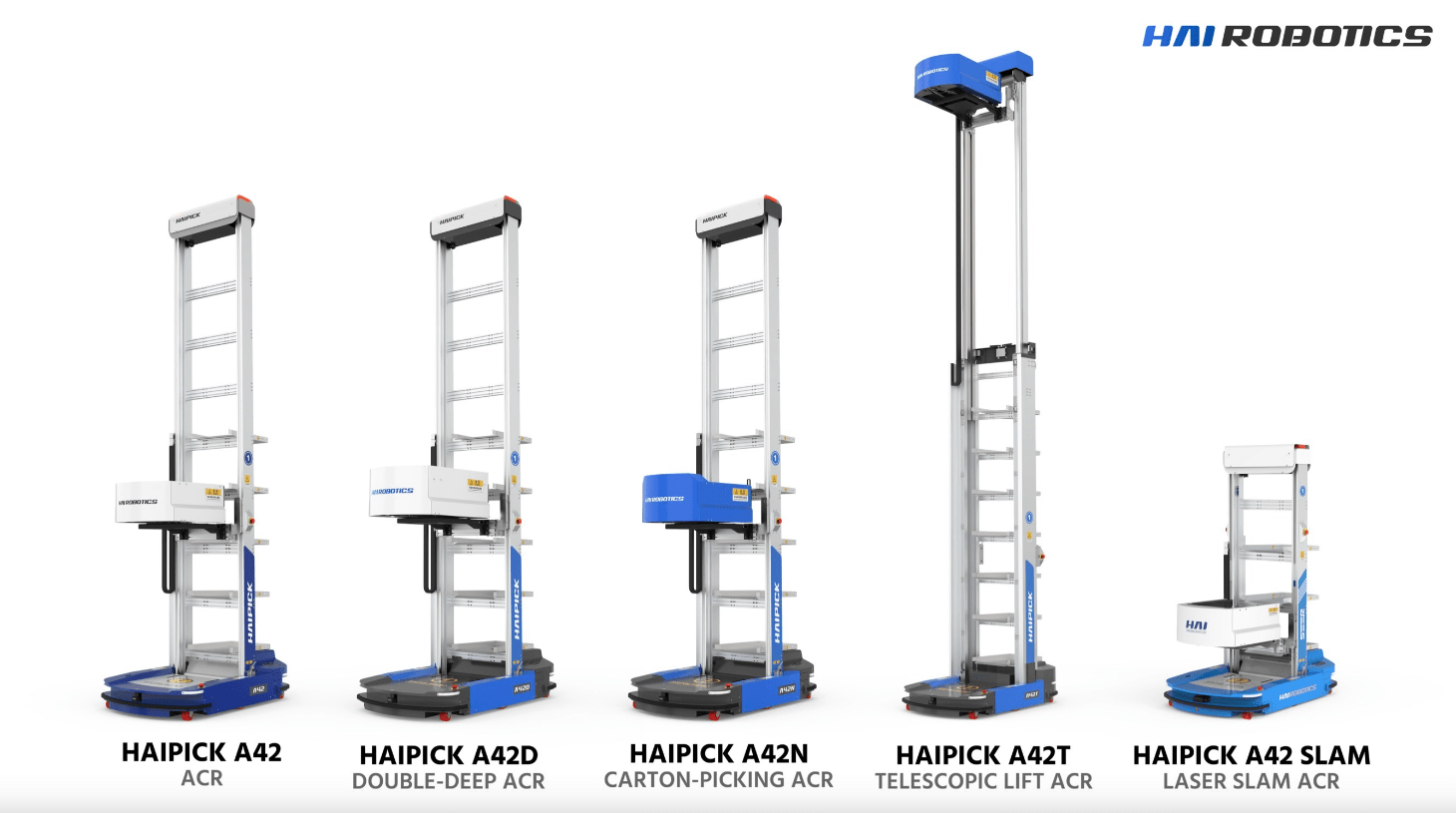

Hai Robotics launched the world’s first ACR system–HAIPICK™ in 2015. The HAIPICK™ robots can pick and place totes or cartons on storage shelves up to 5 to 7 meters high and are able to carry up to 8 loads to continuously feed goods-to-person picking stations.

Founded in 2016 with headquarters in Shenzhen, China, HAI ROBOTICS has set up five subsidiaries in Hong Kong SAR, Japan, Singapore, the US, and the Netherlands, serving customers from more than 30 countries and regions.

It now has over 1,000 staff, more than 50% of which are engineers. The company has acquired more than 400 global patents for core intellectual properties involving positioning, robot control, and warehouse management.

“The case-handling robot is riding on the market trend that shifts towards smaller workflows, such as from pallet-picking to totes-picking. We’re very pleased to see the company’s fast growth with good innovation,” said Guo Shanshan, a partner at Sequoia Capital China.