AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Chinese Humanoid Robot Maker Unitree Plans Fourth-Quarter IPO

Chinese robotics company Unitree Robotics said it plans to submit its initial public offering (IPO) application in the fourth quarter of 2025, with filings expected between October and December. The Hangzhou-based firm confirmed the move in a post on social media platform X, adding that relevant operating data will be disclosed at the time of submission.

Industry analysts say the listing could become one of the most closely watched IPOs in the global robotics sector, given Unitree’s position as one of China’s leading developers of humanoid robots. While the company has not yet specified the exchange, people familiar with the matter suggest it is preparing for an onshore listing in mainland China, likely in Shanghai, Beijing, or Shenzhen.

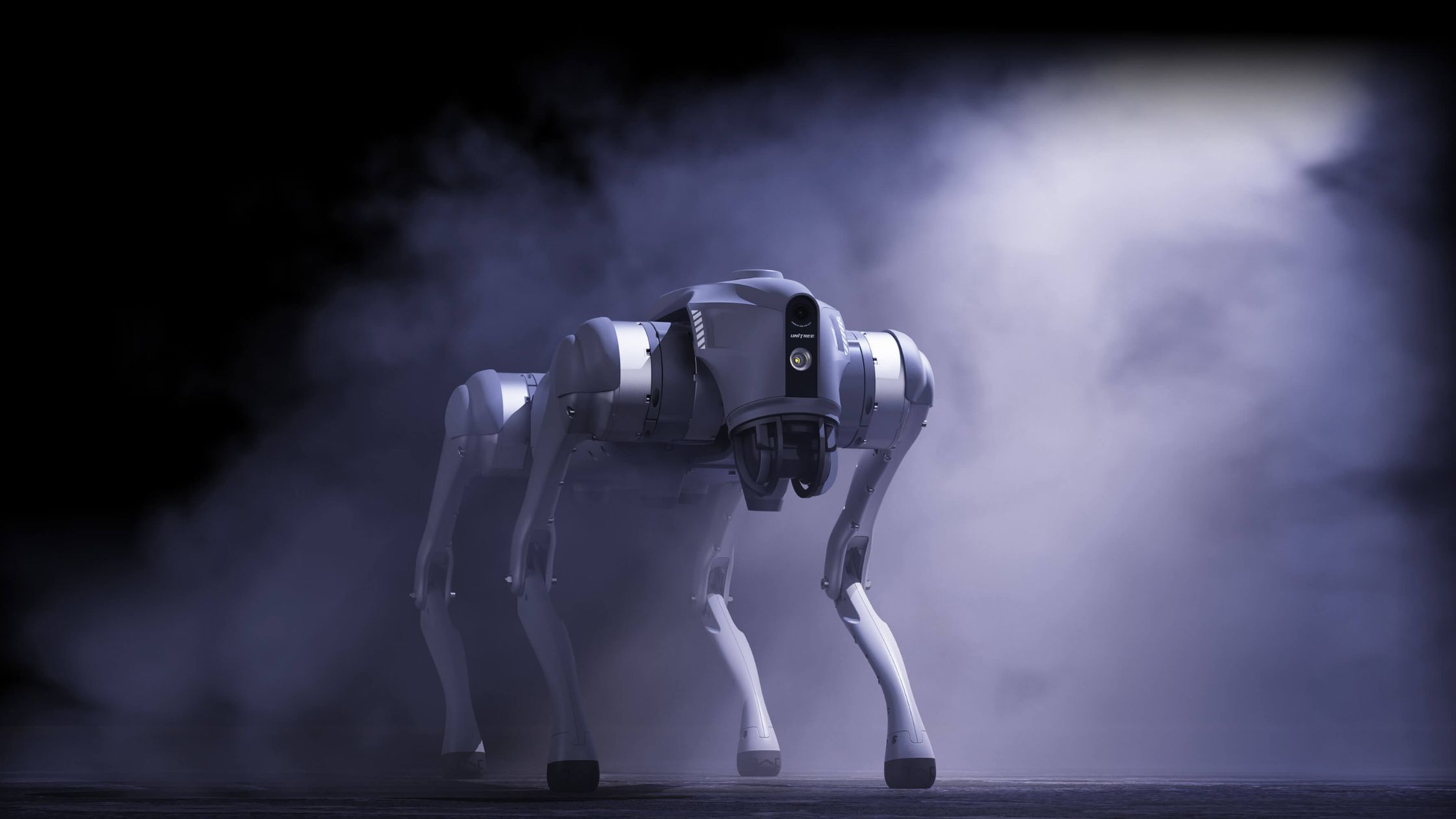

Unitree reported that quadruped robots accounted for about 65 percent of its revenue last year, while humanoid robots generated 30 percent and components made up the remaining 5 percent. The company noted that most of its robot dogs were purchased for consumer, research, and educational purposes, with the rest applied in industrial areas such as firefighting and inspection. All of its humanoid robots, meanwhile, were used exclusively in non-industrial domains.

The startup has appointed CITIC Securities as its advisor for the planned IPO, according to a filing with the China Securities Regulatory Commission in July. Sources familiar with the matter suggest Unitree is leaning toward an onshore listing on one of China’s major exchanges, with Shanghai’s STAR Market viewed as the most likely venue.

Founded in 2016 by entrepreneur Wang Xingxing, Unitree has grown into one of China’s most recognized robotics companies. Wang, who serves as both chief executive and legal representative, holds about 35 percent of the company through direct and indirect ownership. Unitree has a registered capital of CNY364 million (USD51 million).

Unitree is supported by some of China’s largest tech and investment players, including Alibaba Group, Tencent Holdings, Meituan, Matrix Partners China, HongShan Capital, Shenzhen Capital Group, and the Beijing Robot Industry Development Fund. The company’s valuation has recently crossed CNY10 billion (USD1.4 billion).

Unitree’s rising profile has also had a ripple effect on the stock market. Several listed firms with actual or rumored links to the company have seen their share prices surge this year. For example, Zhongji Innolight said a fund it invested in holds Unitree shares, and its stock has more than tripled in value in 2025.

Other companies have confirmed collaborations. Digital China Group has disclosed a partnership with Unitree to sell robotics products and scenario-based solutions across various industries, including energy, emergency fire services, petrochemicals, mining, and transportation. Its shares have risen 22 percent this year. Shenzhen Huaqiang Industry also confirmed a tie-up, though still at an early stage, and its stock has gained 24 percent year to date.

Despite the excitement, Unitree has stressed that it remains a civilian robotics company. The firm has repeatedly denied involvement in military projects, even after videos circulated online showing robot dogs equipped with weapons. In an August statement, Unitree said it has “always been committed” to civilian applications and set explicit restrictions in contracts and manuals to prevent unauthorized military use.

Image credits: Unitree