AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Akseleran- a step forward in the P2P lending platform

The peer-to-peer lending platforms have seen a growth in recent years. In fact, it is being considered as an innovative way to invest surplus money. An Indonesia based P2P startup, Akseleran has been connecting borrowers and investors successful since its inception. They have made the whole process easy and simple by enabling users to connect online.

How Akseleran’s lending platform work?

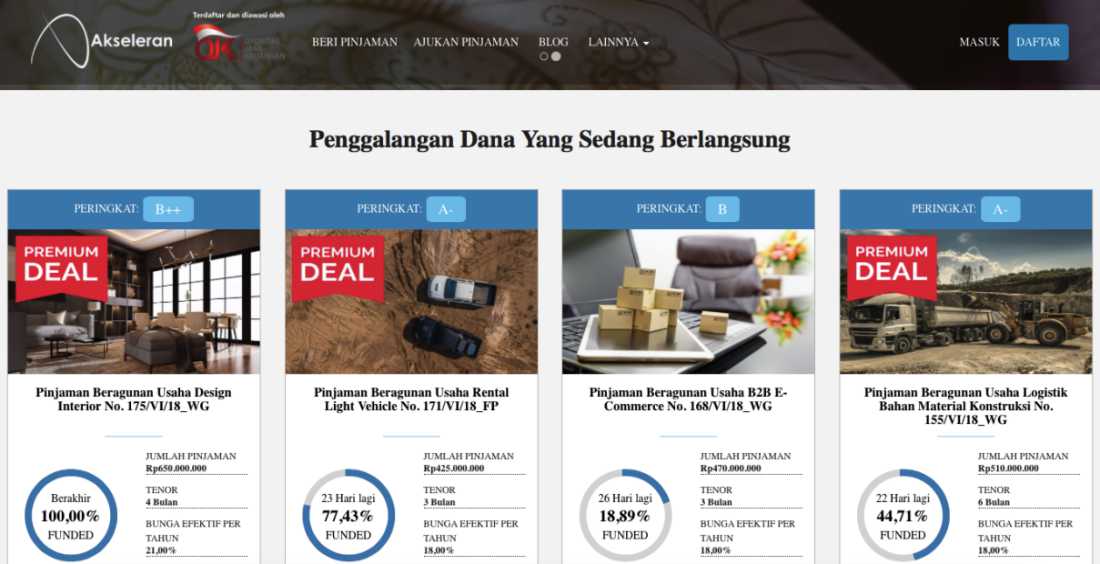

Akseleran connects SME’s that need loans to develop their businesses with a group of people who have more funds and can easily lend as a loan. The company provides access to business capital at competitive interest rates, flexible loan tenors, collateral participation, and payment models. This alternative lending opportunity to the people of Indonesia has enabled them to get attractive returns and proportionate with the risks involved.

Safe investment and higher returns with Akseleran’s

Akseleran was founded by Ivan Tambunan, CEO and Mikhail Tambunan, CFO. Both the founders having professional experience in the world of finance had the vision of “Inclusive Finance Becoming Reality” with the hope of development of SME’s in the country.

The SME’s can apply for loans according to the unique needs of their businesses and the loan size, loan tenor, payment schedules, and collaterals all can be customized accordingly. The loan can be availed from anywhere anytime and the loan amount can start from IDR 100,000 without any additional fees. On the other hand, the investors can get a yield of 18%-21% per year which in fact is a bigger and better return than most of the other financial products.

The transactions are safe and secured since the company uses collateral in more than 98% of the value of the loan portfolio. Moreover, the loan application is scrutinized and selected by experienced professionals.

Lenders save time and get optimal results

The Akseleran’s auto lending set up facilitates the lenders as they don’t have to spend time searching for lending opportunities matching their preferences. Moreover, it is a great investment opportunity for them if they are looking for diversification.

The Road Map

Akseleran has recently announced that it has raised USD 2.5 million funding from undisclosed banks as well as foreign and local venture capital firms. The company plans to use these funds in developing technology especially UX/UI, acquire new talents, and is also looking to expand in Celebs and Bali. In fact, Akseleran is planning to launch a number of new products as well.

The company has also started working with e-commerce giants Bukalapak and Tokopedia and expects to add the number of loan recipient to its existing tally of 450.

To learn more about the company, get in touch with the team today.