AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

ValleyNXT Launches Fund to Fix India’s Seed-to-Scale Gap

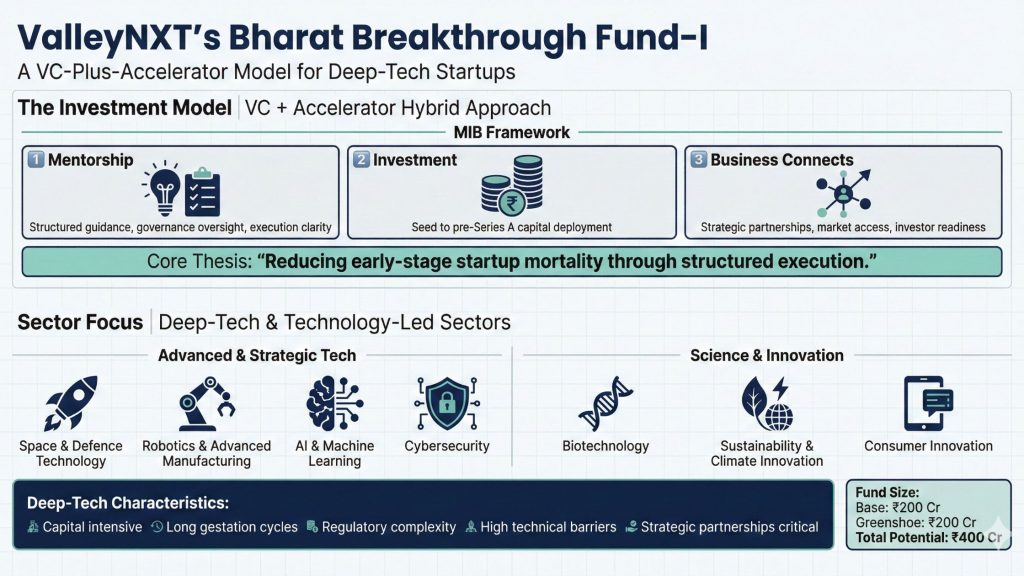

ValleyNXT Ventures launches a Rs 400 crore SEBI-registered fund to back seed to pre-Series A startups, betting that structured execution — not just capital — is the missing link.

ValleyNXT Ventures has introduced Bharat Breakthrough Fund–I, a SEBI-registered Category I venture capital vehicle targeting Rs 400 crore to back seed to pre-Series A startups. The fund comprises a base corpus of Rs 200 crore, along with a Rs 200 crore greenshoe option.

The firm says the fund is designed to address a persistent challenge in India’s startup ecosystem — the fragile phase between early validation and scalable growth. This stage, often referred to as the “Valley of Death,” is where many startups fail despite having promising products.

In recent years, India has seen a rise in seed capital availability, driven by angel networks, micro-VCs and accelerator programmes. However, survival rates between seed and Series A remain uneven.

ValleyNXT argues that failure at this stage is not only due to funding shortages. According to the firm, startups often struggle because of:

- Fragmented advice from multiple stakeholders

- Pressure to scale before achieving product-market fit

- Lack of execution clarity and governance discipline

Bharat Breakthrough Fund–I is positioned as a response to this structural gap rather than simply another pool of capital.

A VC-Plus-Accelerator Approach

Unlike traditional funds that focus purely on capital deployment, the new vehicle will operate through what ValleyNXT calls a VC-plus-accelerator model. The approach is built around its MIB framework — Mentorship, Investment, and Business Connects.

Nikhil Agarwal, Founder and Advisor at ValleyNXT Ventures, described the philosophy behind the fund as “Vision C.”

“Venture alpha is often most concentrated at the seed and pre-Series A stages, when companies remain highly shapeable and structured guidance can materially influence long-term outcomes,” Agarwal said.

The firm plans to combine capital with structured mentoring, governance oversight, business network access, and investor readiness preparation — aiming to compress growth cycles while reducing early missteps.

Sector Focus: Deep-Tech and Technology-Led Ventures

Bharat Breakthrough Fund–I will invest primarily in deep-tech and technology-first startups across sectors such as space and defence technology, robotics and advanced manufacturing, artificial intelligence and machine learning, cybersecurity, biotechnology, sustainability and climate innovation, and consumer innovation.

These sectors share common characteristics. They are research-intensive, capital-heavy, and often require long development cycles before revenue visibility. Unlike asset-light digital startups, companies in space tech, biotech or advanced manufacturing must navigate regulatory approvals, hardware prototyping, pilot deployments, and enterprise validation. The path to scale is typically slower and more execution-dependent.

By concentrating on such areas, the fund is positioning itself in segments where early-stage guidance can materially influence outcomes. In deep-tech, mistakes in regulatory planning, IP strategy, or market selection can delay growth by years. Structured mentorship, governance discipline, and industry partnerships therefore become as important as capital itself.

The strategy also reflects a broader shift in India’s venture landscape. As the ecosystem matures, investor interest is expanding beyond consumer internet toward sectors aligned with national priorities such as defence, space, climate resilience, and advanced technologies. These domains may not deliver quick exits, but they offer the potential for long-term value creation and defensible competitive advantages.

In this context, the fund’s sectoral focus suggests a longer investment horizon and a thesis built around durability rather than rapid valuation spikes.

Institutionalising an Angel-Led Model

ValleyNXT said it has evaluated over 5,000 startup proposals and invested in more than 10 ventures through its angel network and accelerator-driven model. The launch of Bharat Breakthrough Fund–I formalises that approach under a regulated venture capital structure.

The leadership team includes Nikhil Agarwal, Madhu Vasepalli, Anand Saklecha and Suresh Goyal, bringing experience in venture investing, governance, acceleration and deep-tech ecosystems.

By institutionalising its model, the firm appears to be shifting from opportunistic early-stage investing to a more structured, portfolio-driven strategy.

Market Context: A Tougher Early-Stage Environment

The launch comes at a time when founders face tighter funding conditions and greater scrutiny on business fundamentals. While late-stage valuations have reset in recent years, early-stage capital has also become more selective.

Investors are increasingly prioritising:

- Capital efficiency

- Governance standards

- Clear product-market fit

- Realistic scaling plans

In this environment, funds that offer structured support beyond capital may gain traction — provided they can demonstrate measurable portfolio outcomes.

India’s startup ecosystem has matured significantly over the past decade. Yet the gap between seed funding and Series A readiness remains one of its recurring weak points.

Bharat Breakthrough Fund–I reflects an emerging belief among investors that early-stage mortality is often a function of execution gaps rather than capital alone. Whether a VC-plus-accelerator model can consistently improve conversion rates from seed to scale will depend on portfolio performance over the next few years.

The fund’s success will ultimately be judged not by its corpus size, but by how many of its portfolio companies secure follow-on funding, achieve sustainable growth, and build defensible positions in competitive sectors.

For now, ValleyNXT Ventures is betting that structured intervention at the most fragile stage of venture building can create long-term value — in a market where discipline increasingly outweighs speed.

Quick Takeaways

- Rs 400 Cr Target Corpus: ValleyNXT Ventures has introduced Bharat Breakthrough Fund–I with a base of Rs 200 crore and a Rs 200 crore greenshoe option.

- Seed to Pre-Series A Focus: The fund targets the high-risk validation-to-scale stage where many startups fail.

- VC-Plus-Accelerator Model: Instead of capital alone, the fund combines mentorship, governance, and business connects under its MIB framework.

- Execution Over Hype: The strategy is built on the belief that early-stage mortality stems from unclear direction and premature scaling — not just funding gaps.

- Real Test Ahead: Success will depend on follow-on funding, Series A conversion rates, and long-term portfolio outcomes.