AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Singapore’s S$1B Startup Push: Can Budget 2026 Fix the Growth Capital Gap?

With a major top-up to Startup SG Equity, a larger Anchor Fund, and a new AI council, Singapore is trying to solve a long-standing problem — helping startups scale, list, and stay anchored at home.

In Budget 2026, Singapore unveiled one of its most significant startup-focused measures in recent years. Prime Minister and Finance Minister Lawrence Wong announced a S$1 billion (US$792 million) injection into the Startup SG Equity scheme, expanding it beyond early-stage funding to support growth-stage companies.

At the same time, the government committed a second S$1.5 billion tranche to the Anchor Fund — first launched in 2021 — and said it would convene a new workgroup led by Minister Chee Hong Tat to strengthen Singapore’s growth capital ecosystem. Singapore does not see its startup challenge at the seed stage anymore. The pressure point is scale.

During his Budget speech in Parliament, Wong acknowledged that while early-stage capital has become more accessible over the past decade, many firms still struggle to secure funding at later stages.

“But many firms continue to face challenges at the growth stage,” he said.

“This is not unique to Singapore. Globally, growth-stage capital has tightened. As a result, many firms, especially those in deep tech, find it harder to raise the larger and longer-term funding needed to scale.”

The Growth-Stage Bottleneck

It is a broader global shift. Venture funding has cooled in recent years, particularly for late-stage rounds. Investors are more cautious, valuations have reset, and capital is flowing more selectively. For deep-tech companies which require patient capital and longer development cycles, the squeeze is sharper!

By expanding Startup SG Equity to growth-stage firms, the government is attempting to crowd in private investors for larger rounds, rather than merely seeding new startups.

Under the scheme, the state co-invests alongside private investors in Singapore-based technology companies with intellectual property and global ambitions. The S$1 billion enhancement signals that the government is willing to share more risk in scaling companies, not just starting them.

From Startup to IPO: A Full Lifecycle Strategy

The S$1 billion injection is only one part of a broader capital-market strategy. The government will also launch a second S$1.5 billion tranche of the Anchor Fund, co-invested with Temasek. The fund was first introduced in 2021 to attract and anchor high-quality listings in Singapore.

Wong noted that there have been “encouraging signs of renewed listing activity” on the Singapore Exchange since the fund’s launch.

“When enterprises are ready to list, we want to see Singapore as their listing venue of choice,” he said.

In parallel, the Monetary Authority of Singapore (MAS) will expand its Equity Market Development Programme, which has already allocated close to S$4 billion to asset managers to deepen investor participation in local equities. A further S$1.5 billion top-up was announced, alongside plans to streamline listing rules for high-growth firms.

Taken together, the measures attempt to address both ends of the capital equation:

- Funding supply: More co-investment capital at growth stage

- Exit pathways: Stronger IPO support and deeper equity markets

This signals a shift from piecemeal startup support to a more integrated “lab-to-listing” model.

Why This Budget Feels Different

Singapore has long invested heavily in research, innovation and early-stage enterprise support. Previous Budgets focused on R&D spending, startup grants, accelerators, and seed co-investment schemes. These efforts helped build a strong pipeline of new ventures and strengthened the early-stage funding environment.

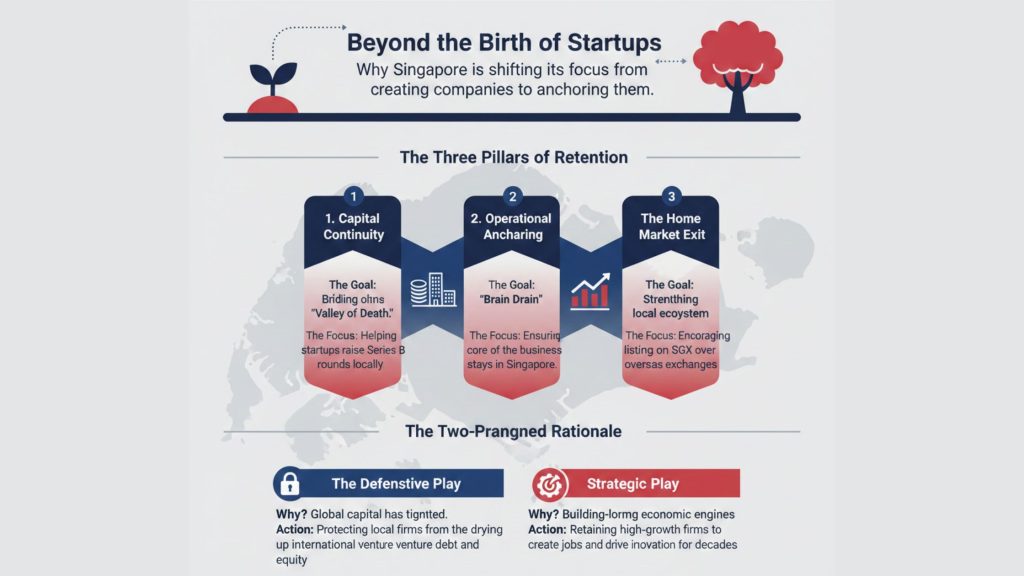

Budget 2026 shifts attention to what happens after that initial phase. Instead of concentrating on startup formation, the government is targeting the scale-up gap — the stage where companies need larger Series B and C rounds, deeper pools of private capital, and credible exit pathways. The S$1 billion expansion of Startup SG Equity to include growth-stage firms reflects this shift. It acknowledges that early capital is more accessible today than a decade ago, but later-stage funding remains constrained, particularly in a tighter global environment.

The second S$1.5 billion tranche of the Anchor Fund strengthens this lifecycle approach. While the first tranche in 2021 aimed to attract high-quality listings, the latest commitment suggests that Singapore wants to anchor more scaling companies on the Singapore Exchange rather than see them list overseas.

Taken together, the measures move beyond startup creation to focus on retention and liquidity. The policy direction is both defensive and forward-looking. Defensive, because global growth capital has slowed and valuations have corrected. Strategic, because Singapore wants high-growth firms to scale, list, and build long-term economic value locally.

The difference this year is not the size of the headline numbers alone — it is the clearer recognition that a mature startup ecosystem depends as much on scale and exits as it does on early experimentation.

AI as a Strategic Lever

Beyond funding measures, the Budget also announced the formation of a National AI Council, chaired by Wong, to guide Singapore’s artificial intelligence strategy. A new “Champions of AI” programme will offer customised workforce training.

“Singapore will not be passive in the face of rapid changes around us,” Wong said.

“We will adapt. We will compete. We will continue to move forward with confidence.”

The AI initiatives complement the capital measures. Deep-tech and AI firms are among those most affected by growth-stage funding constraints. By pairing capital support with sectoral strategy and workforce development, the government is aligning financial policy with technological ambition.

Is Singapore’s Infrastructure Ready for AI at Scale?

While much of Budget 2026 focuses on capital flows from growth-stage funding to IPO support where the government’s parallel push on artificial intelligence highlights another critical dimension: execution readiness.

The establishment of a National AI Council and the expansion of AI-related support schemes show that Singapore is serious about embedding AI across industries. However, industry players argue that scaling AI is not simply about funding models or deploying applications. It requires foundational upgrades in enterprise infrastructure.

Adeline Liew, Country Business Leader, Singapore at Alcatel-Lucent Enterprise, said Budget 2026 reflects a move from ambition to implementation.

“While much of the public discourse focuses on AI models and applications, a more immediate challenge for enterprises lies beneath the surface: infrastructure readiness. Budget 2026’s enhancements to the Productivity Solutions Grant (PSG) for AI-enabled solutions and the introduction of the Champions of AI programme recognize that digital transformation is not solely about deploying intelligent software.

It requires organizations to re-architect data flows, redesign workflows, and modernize the foundational systems that connect people, processes, and technology,” she noted.

According to Liew, AI systems across manufacturing, healthcare, logistics and services rely on resilient, secure and high-performance networks. Without modernised connectivity and secure data flows, AI investments may not fully translate into productivity gains.

Her remarks align with the government’s enhancements to the Productivity Solutions Grant for AI-enabled tools and the introduction of the Champions of AI programme. Together, these measures recognise that workforce capability and system architecture must evolve alongside capital deployment.

What Could Be Challenging

While the measures are comprehensive, several questions remain.

First, co-investment schemes must be carefully structured to crowd in, not crowd out private capital. The effectiveness of Startup SG Equity’s expansion will depend on how deals are selected and whether experienced private investors continue to lead rounds.

Second, strengthening IPO pipelines requires sustained investor depth and liquidity. While the Anchor Fund and MAS programmes aim to boost market participation, global listing competition remains intense.

Third, scaling deep-tech companies requires more than capital. Talent access, international market expansion, and regulatory agility will be equally important.

The new workgroup led by Chee Hong Tat is expected to address some of these structural issues. Its recommendations could shape the next phase of Singapore’s capital market evolution.

A Bigger State Role in Venture Markets

Beyond the headline figures, Budget 2026 marks a deeper shift: the Singapore government is taking a more active role in shaping later-stage capital markets.

Early-stage intervention has long been part of Singapore’s startup strategy. But stepping more decisively into growth-stage financing and IPO anchoring moves the state further into territory traditionally led by private institutional investors.

This raises important questions. Can public co-investment accelerate market confidence without distorting pricing signals? Will private capital follow the government into larger rounds, or become more cautious if the state is seen as setting terms? And can Singapore’s equity markets generate sustained liquidity, rather than short-term listing momentum?

The answers will determine whether this package strengthens market depth or simply cushions funding cycles. There is also a broader economic consideration. Singapore is positioning itself as a regional growth-capital hub at a time when global venture markets remain uneven. That ambition depends not just on domestic policy, but on regional capital flows, cross-border investor appetite, and the competitiveness of SGX against US and regional exchanges.

Budget 2026 does not guarantee outcomes. What it does is signal that Singapore is prepared to intervene more assertively to secure its position in the next phase of technology financing. Whether that intervention evolves into a durable market advantage — or remains a stabilising measure during a funding downturn — will become clearer in the coming years.

Quick Takeaways

- S$1B Targets the Scale-Up Gap: Singapore is expanding the Startup SG Equity scheme beyond early-stage funding to address growth-stage capital constraints, particularly for deep-tech firms.

- IPO Pipeline Reinforced: A second S$1.5B tranche of the Anchor Fund — co-invested with Temasek — aims to anchor high-quality listings on the Singapore Exchange and deepen local liquidity.

- Lifecycle Strategy Emerging: The measures link growth funding, market development, and listing reform — moving from startup creation to retention and exit readiness.

- AI Positioned as Strategic Infrastructure: The new National AI Council and workforce initiatives signal that AI adoption is central to economic competitiveness, not just innovation policy.

- Execution Will Determine Impact: Success depends on whether public capital crowds in private investors, whether SGX sustains listing momentum, and whether infrastructure and talent gaps are addressed.

- State Role Expanding: Budget 2026 marks a more assertive government presence in growth-stage venture markets — raising both opportunity and market-distortion questions.