AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Botsync Extends Series A With SGInnovate Backing as Industrial Robotics Demand Accelerates

Singapore-based startup bets on orchestration software and regional scale to stand out in a crowded automation market

Singapore-based robotics startup Botsync has secured additional funding from SGInnovate as part of an extended Series A round, as the company looks to deepen product development and scale deployments across manufacturing and logistics markets.

The funding comes amid rising demand for automation across Asia-Pacific, where labour constraints, cost pressures, and supply chain volatility are pushing enterprises to adopt autonomous mobile robots (AMRs). While the company did not disclose the size of the investment, the backing from SGInnovate signals continued confidence in Botsync’s approach to robotics orchestration rather than single-vendor hardware.

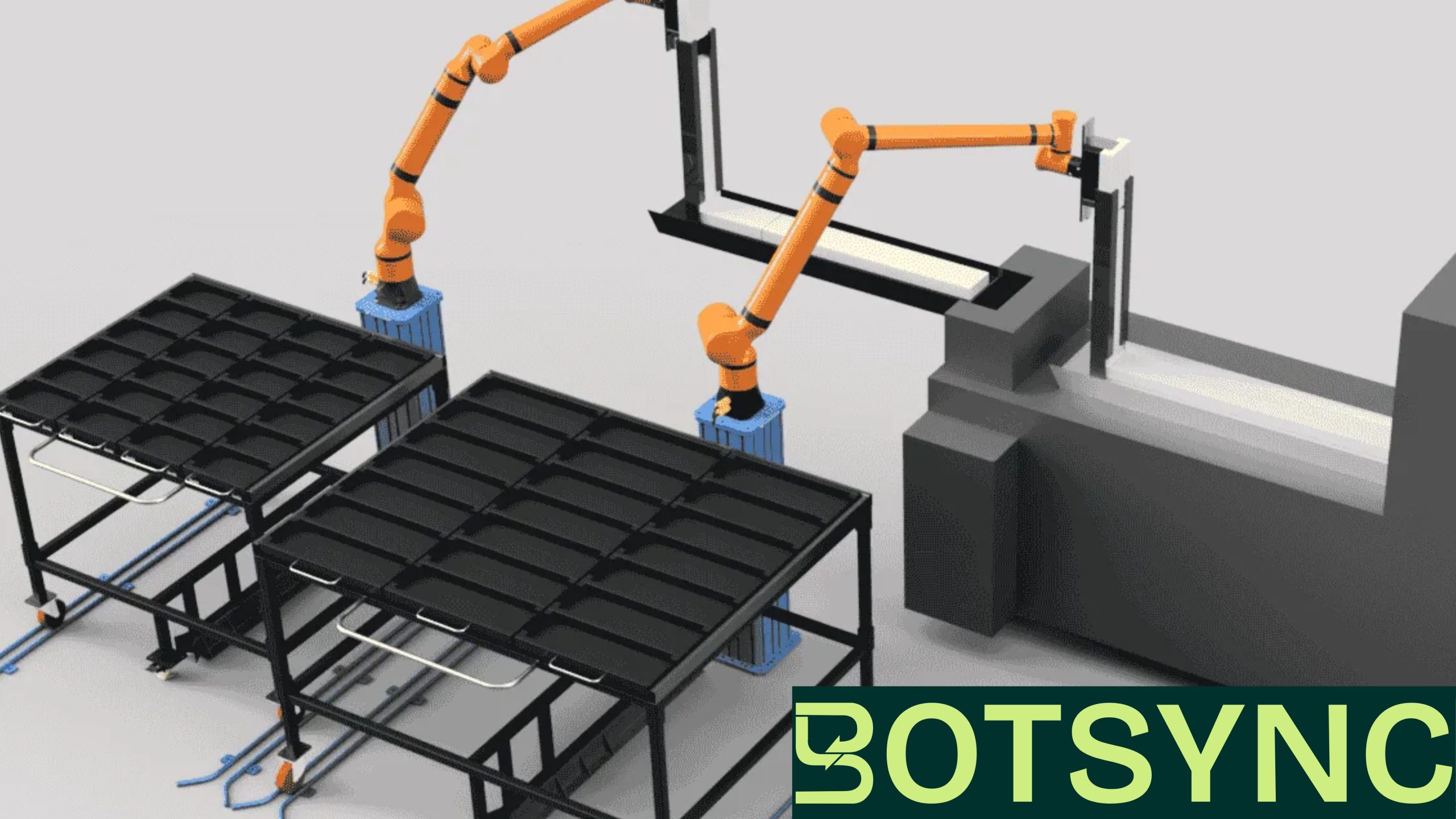

Founded in Singapore, Botsync operates at the intersection of robotics hardware and software, offering AMRs alongside a vendor-agnostic orchestration platform that allows enterprises to manage mixed fleets of robots. This positioning differentiates the company in a market crowded with hardware-focused robotics startups.

According to the company, demand has been particularly strong from fast-moving consumer goods, food and beverage, and automotive customers—industries under pressure to automate without locking themselves into proprietary systems. Over the past year, Botsync has expanded into Australia and South Africa through partnerships supporting existing customers, while also working with SK International as part of its U.S. market entry.

Growth Signals From Live Deployments

In industrial robotics, the hardest challenge is not winning pilot projects, but converting trials into systems that run reliably every day. Many automation startups struggle to move beyond small-scale testing because real factory and warehouse environments are unpredictable and costly to disrupt.

Botsync’s growth metrics suggest it has crossed that hurdle. The company reported a 240% increase in production trips, surpassing one million live runs in 2025—an indicator that its robots and orchestration software are being used continuously in operational settings, not just demonstrations. At the same time, revenue grew 230%, largely driven by existing customers expanding from initial deployments to larger rollouts.

This pattern matters. Expansion-led growth typically signals customer confidence, especially in sectors such as automotive, FMCG, and food and beverage, where downtime carries high operational risk. Deployments with global enterprises including Ford, Caterpillar, Nestlé, Coca-Cola, and Kimberly-Clark suggest Botsync’s systems are meeting reliability, safety, and integration standards required by large manufacturers.

For investors, sustained live usage at this scale points to a transition from experimentation to operational relevance—a critical inflection point for robotics startups. It indicates not only technical maturity, but also the ability to embed automation deeply into customer workflows, where switching costs are higher and long-term contracts are more likely.

Where the New Capital Will Go

With the extended Series A funding, Botsync plans to accelerate development of its SyncOS™ platform, positioning it as a central orchestration layer for industrial automation. The company said it will invest further in AI-driven analytics, optimisation, and the ability to coordinate a wider range of robots and software systems.

It also plans to improve the throughput and adaptability of its MAG AMRs, particularly for more complex, real-world factory and warehouse environments. On the market side, Botsync is preparing to deepen its footprint in Southeast Asia and India, while building partnerships to support expansion in ANZ and the U.S.

Botsync CEO and co-founder Rahul Nambiar said the company’s focus is shifting from building smarter individual robots to enabling systems that can coordinate many robots effectively.

“The next frontier of robotics won’t be just about making smarter robots, but about building intelligent systems that can orchestrate different robots together more effectively,” Nambiar said, adding that customer demand is increasingly moving from small deployments to large-scale rollouts.

This view aligns with broader industry trends, where enterprises want flexibility and interoperability as automation estates grow more complex.

For SGInnovate, the investment fits its mandate to support deep-tech companies with regional and global scaling potential. Hsien-Hui Tong, Executive Director of Investments at SGInnovate, said Botsync addresses practical industry needs and reflects how Singapore-based deep-tech firms can expand beyond the domestic market.

“Botsync exemplifies how home-grown deep tech companies can scale regionally to deliver meaningful impact,” Tong said.

State-backed participation may also help Botsync with partnerships, talent, and credibility as it competes against global robotics vendors.

What This Means for the Robotics Market

Botsync’s funding extension highlights a broader shift in industrial robotics: value is increasingly moving toward software platforms that manage complexity rather than hardware alone. As enterprises deploy multiple robot types across factories and warehouses, orchestration and optimisation are becoming strategic layers.

For startups and investors, the takeaway is clear. In industrial automation, scale is not just about shipping more robots—it’s about embedding deeply into customer operations. Botsync’s trajectory suggests that companies solving coordination and integration challenges may be better positioned as automation adoption moves from pilots to core infrastructure.

If successful, Botsync’s ambition to make SyncOS™ a default orchestration layer could place it at the centre of how industrial automation systems are built and managed across multiple markets—an outcome that would matter well beyond Singapore.

Quick Takeaways

- Series A extension signals confidence: SGInnovate’s additional backing suggests Botsync has shown enough traction to justify continued investment beyond its initial Series A.

- Scale beyond pilots: Growth in live production trips and expansion within existing customers indicate Botsync has moved past pilot deployments into day-to-day operations.

- Software-led differentiation: The company’s focus on vendor-agnostic orchestration highlights a shift in industrial robotics from hardware sales to platform-driven value.

- Enterprise validation: Deployments with global manufacturers point to strong reliability and integration capability in complex environments.

- Regional ambition: Botsync’s expansion across Asia-Pacific and beyond reflects increasing demand for scalable automation in cost- and labour-constrained industries.