AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

AsiaStartupExpo Q4 2025 Wraps Up Its First Year With a Strong Founder–Investor Dialogue

DeepTech insights, investor discipline, and diverse early-stage innovation defined the final edition of the 2025 series.

AsiaStartupExpo Q4 2025 concluded on December 4, marking the end of the expo’s first full-year cycle and reinforcing its role as a focused meeting ground for early-stage founders and active investors across Asia. Organized by AsiaTechDaily, beSUCCESS, KoreaTechDesk, and IndiaTechDesk, the Q4 edition continued the series’ mission of bringing sharp, impact-driven startup pitches directly to VCs, angel networks, and ecosystem partners.

Held virtually, the event followed the established AsiaStartupExpo format — 4-minute pitches followed by 4–5 minutes of investor discussion — allowing founders and investors to engage in high-signal conversations centered on clarity, traction, and market timing.

Opening Remarks: A Year of Learning and Momentum

James Jung, CEO of beSUCCESS Media Group, opened the event by reflecting on the evolution of the expo throughout 2025. What began as a quarterly experiment has expanded into a pipeline-driven platform connecting founders with capital, media visibility, and cross-border support.

Jung highlighted how each edition — Q1 through Q4 — shaped the expo’s understanding of what early-stage founders need most: sharper articulation, investor preparedness, and structured pathways to fundraising. His opening note set a collaborative tone for the final session of the year.

Keynote by Nidhi Mathur: DeepTech Is Rising — But Requires Discipline

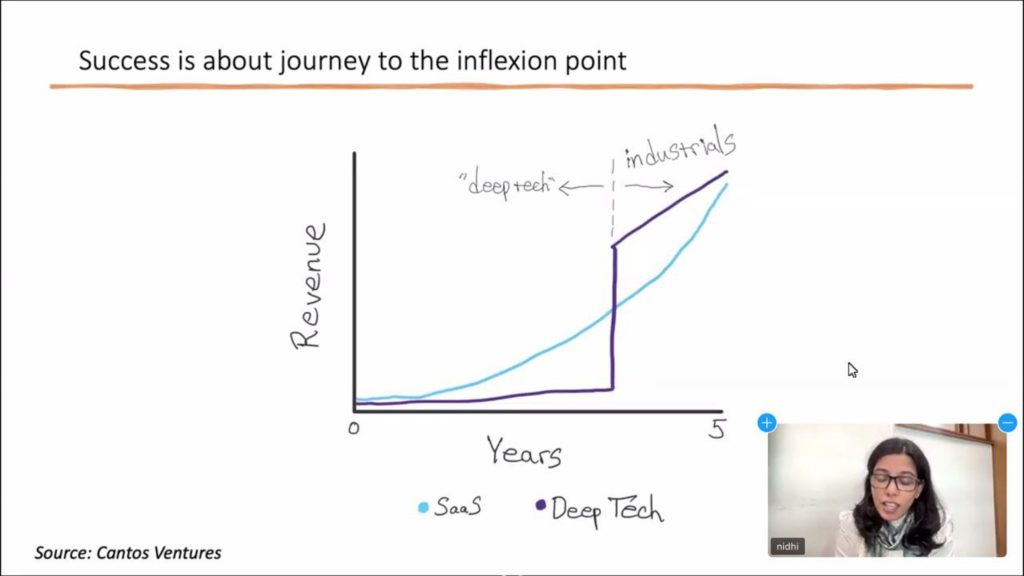

The keynote address was delivered by Nidhi Mathur, Venture Partner at XLR8 Ventures and a seasoned DeepTech founder. Drawing from her journey building AI-driven healthcare technology before moving into venture building, she presented a grounded playbook for DeepTech entrepreneurs navigating long development cycles.

She stressed that DeepTech success demands both scientific rigor and market discipline. Her ten scaling principles emphasized:

- Staying close to early adopters

- Keeping user experience simple even when the technology is complex

- Solving chicken-and-egg barriers early

- Protecting meaningful IP

- Ensuring a domain expert is part of the founding team

- Understanding risks beyond technology — especially market adoption

- Building long-term defensibility

- Thinking in terms of “inflection points”

One line resonated strongly with founders:

“It’s about determining the inflection point where your startup truly takes off. It may take four or five years to get there, but once you do, what will make your idea the industry standard? That’s where the step-function returns come from.”

She explained why she chose venture building over founding again — her strength lies in the “zero-to-one” stage where many DeepTech projects face their toughest hurdles and where structured support is most needed.

Her talk added strategic depth to the session while remaining applicable to founders across sectors.

Investor Panel: A Cross-Section of Asia’s Early-Stage Capital

The Q4 investor panel brought together a diverse mix of VC funds, corporate venture arms, and angel networks where early-stage capital is flowing in Asia.

Participating investors included:

- Shubham Mittal – July Ventures (B2B & B2B2C)

- Michelle Chang – Pegatron Venture Capital (manufacturing, hardware, EMS/ODM ecosystem)

- Raynard Lao – January Capital (digital commerce infrastructure)

- Kalyan Sivalenka – HAF.VC / Springforth (sector-agnostic early-stage investing)

- Mohd Akhtaar – HASAN.VC (ethical & impact-driven tech)

- Urska Vracun – Epic Angels Network (female-led angel network)

- Charlie Streeter – Voluntas Group

- JDI Capital Group

- Angel investors from Singapore, India, and Europe

Rather than chasing trends, the panel leaned toward grounded execution — a signal that early-stage capital in 2026 will be selective but active.

Startup Pitches: Ten Founders, Ten Distinct Approaches to Innovation

Ten startups from across Asia and beyond presented their solutions. This edition featured a strong showing in AI, sustainability, telepresence, healthtech, and consumer-tech infrastructure.

The Q4 2025 Pitching Startups

1. Autharva, Inc. (USA/India) – AI-Driven Identity Security

Automates access provisioning using Agentic AI to eliminate manual approval workflows and reduce human error.

2. BioBytes Inc. (South Korea) – AI Sarcopenia Prediction

Uses ML-driven biomarkers and a proprietary biobank cohort to predict muscle decline for early intervention.

3. Vidopix (India) – AI Video Intelligence

Transforms emotional and behavioral cues from video into quantifiable insights for brand and content optimization.

4. Torau – “GENCHI” (Japan) – Telepresence Mobility Platform

Connects users to local “avatars” for remote physical navigation and task execution, backed by multiple patents.

5. Assessli (India/Global) – Large Behavioral Model for Personalized AI

A domain-agnostic AI companion using LBMs to deliver personalization across education, HR, and healthcare.

6. Climate Seal (China) – AI Carbon Footprint Automation

Reduces months of carbon reporting into hours using an agentic AI aligned with ISO standards.

7. MilikiRumah (Singapore, Indonesia) – Rent-to-Own PropTech for Underbanked Users

Uses alternative data to build credit profiles and enable access to affordable homeownership.

8. Artograph (India) – AI-Based Memory Care & CBT Platform

Combines generative AI with therapist-designed modules for dementia, PTSD, depression, and anxiety support.

9. Minimap (South Korea) – Unified Gaming Library & Insights Platform

Aggregates PlayStation, Xbox, Switch, Steam and more into a unified dashboard with personalized recommendations.

10. SustainInsight (UAE) – AI-Powered Assurance-Grade ESG Reporting

Consolidates ESG, carbon accounting, and compliance into an audit-ready AI platform for enterprises and governments.

Across the pitches, a central pattern emerged:

founders who communicated a precise wedge, clear customer insight, and realistic go-to-market plans created the strongest investor engagement.

A New Founder-Focused Prize: Beyond the Pitch Room

Q4 introduced a new winner prize designed not as a trophy, but as a pipeline into investor conversations.

The winning startup — to be announced in the coming week — will receive:

- Curated 1:1 introductions to at least five qualified investors

- Investor matching based on sector and stage

- Guidance from the organizing team, including beSUCCESS

- Post-event media visibility across AsiaTechDaily and partner outlets

- Support navigating follow-up fundraising discussions

Instead of applause and ceremony, the prize focuses on what founders need most: real investor momentum after the event.

Closing Reflections: A Platform Taking Shape

As AsiaStartupExpo completes its first year, a clearer picture is emerging of both founder behaviour and investor expectations:

- Founders are maturing — with sharper decks, clearer business logic, and early customer insights.

- Investors remain active but disciplined — seeking clarity over grand visions.

- Cross-border capital flow is increasing — requiring structured, communication-strong teams.

- Media + community + capital is becoming a unified support system — rather than isolated components.

The Q4 edition brought these threads together with a thoughtful keynote, a disciplined pitch structure, and a prize designed to turn exposure into outcomes.

Looking Ahead

In the coming days, startups will receive investor feedback summaries, media interview opportunities, and — for one team — direct access to investors who can shape their fundraising path.

As the platform moves into 2026, the core message remains consistent: Pitches get attention. Inflection points build companies. AsiaStartupExpo aims to help founders move from the first to the second.