AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

A Strategic Shift: Why Japan Is Doubling Down on Europe’s Deep Tech Advantage

€33B in Japanese capital has flowed into European startups since 2019 — and with 70% now targeting deep tech and AI, a new era of industrial collaboration is taking shape.

Across global tech, one trend is becoming increasingly clear: Japan is not just financing innovation, it’s partnering to build it. According to new research by NordicNinja and Dealroom, Japanese investors have participated in over €33 billion worth of funding rounds into European startups and scaleups since 2019, with another €3 billion projected by the end of 2025.

But beyond the financing, something deeper is taking place: a technology alliance built on strategic alignment rather than opportunistic capital deployment.

This shift signals a new phase in the Japan–Europe relationship — one built on deep tech expertise, industrial partnerships, supply-chain resilience, and climate innovation. In other words: Japan is not just investing; it is choosing Europe as a co-builder of its future industrial strengths.

Why Europe, and Why Now?

Following the EU–Japan Economic Partnership Agreement (EPA) in 2019, trade between the two regions surpassed €200 billion annually, creating both regulatory clarity and commercial momentum for cross-border collaboration.

Several global trends are further accelerating the partnership:

Structural Drivers Behind the Shift

- Aging populations and labour shortages in Japan — need for automation and AI

- De-risking supply chains — especially batteries & semiconductor dependencies

- Strong European track record in deep tech, sustainability, and frontier research

- EU regulations pushing innovation in climate tech, circularity, and clean energy

- Japan’s corporate legacy in precision engineering and manufacturing scale

The result: Japan now participates in 6% of all venture capital investments in Europe, rising steadily every year.

Where the Money Is Flowing — and Why

Japanese investment is not spread evenly — it is targeting specific geographies and sectors with long-term synergy potential.

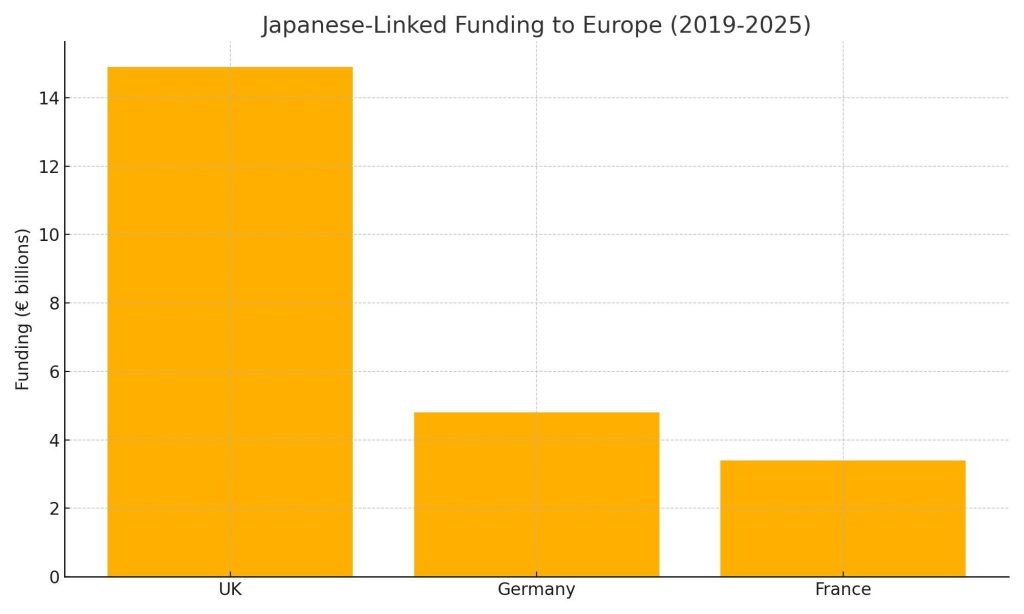

The UK dominates — helped by its AI, semiconductor, quantum, and defense-tech advancements. The Nordics “punch above their weight”, especially in climate tech and robotics, while Germany offers complementary industrial competencies in automotive, manufacturing, and energy systems.

Deep Tech at the Core of Japanese Strategy

In 2024, a record 70% of all Japanese investment into Europe went to deep tech and AI, double 2023 levels and twice the previous high in 2021. This marks the strongest year on record — and signals a sectoral shift away from consumer apps and fintech toward hard-tech infrastructure.

Top Investment Priorities Identified in the Report

- AI & robotics

- Climate tech & circular economy

- Battery recycling & clean energy

- Industrial automation

- Resilience technologies (23% share and growing)

This aligns closely with Japan’s national priorities — particularly:

- Securing raw materials and supply chains

- Strengthening industrial competitiveness

- Scaling low-carbon and circular solutions

- Building sovereign technology capabilities

Phase Shift: From SoftBank-Style Mega Deals to Strategic Early-Stage Bets

Historically, Japan’s presence in European tech was associated with large, splashy investments — often led by SoftBank in high-profile growth rounds. But now, the investment pattern is changing.

What’s New

- Record number of early-stage & breakout-stage deals in 2024

- 5.9% increase in deal volume involving Japanese capital since 2022

- 140 rounds in 2024 alone — most diversified to date

- Broader sector focus: from circular batteries to autonomous driving

This signals a strategic pivot: Japan is no longer just backing global champions — it is co-developing emerging technologies early in their lifecycle.

Real Examples — Strategy in Action

Recent investment activity reveals that Japan’s interest in Europe goes far beyond capital deployment. The partnerships forming now reflect strategic intent around automation, energy resilience, frontier research, and industrial scale.

Autonomous Driving & AI

The collaboration between Wayve, Nissan and SoftBank highlights how European AI capabilities are being positioned within Japan’s mobility ecosystem. Wayve’s autonomous driving systems, developed in the UK, are now being tested for Japanese roads — demonstrating how AI innovation from Europe can translate into real-world deployments in Asia’s automotive sector.

Climate Tech & Circular Supply Chains

Battery circularity and decarbonised logistics have become prominent investment priorities. Tozero secured €11 million in seed funding from NordicNinja, Honda and JGC to advance circular battery recycling, while HIVED raised €38 million in a Series B led by NordicNinja, Yamato Holdings and Marunouchi Innovation Partners to build zero-emission delivery infrastructure. These deals reflect Japan’s broader pursuit of supply-chain security and low-carbon manufacturing.

Quantum Computing & Frontier Research

Japan has also targeted Europe’s quantum computing strengths. Partnerships such as IQM with TOYO Corporation and Quantinuum with Mitsui & Co. are extending European quantum technologies into Asia-Pacific markets. The strategy here is clear: combine European innovation with Japan’s industrial precision and scaling capabilities to accelerate commercial applications of frontier computing.

Robotics & Resilience Technologies

In robotics, the UK Atomic Energy Authority and Japan’s Fukushima Institute are co-developing systems designed for hazardous and extreme environments. These collaborations illustrate how Japan is seeking European expertise to develop solutions that address industrial safety, labor shortages and operational resilience.

Why This Matters — Beyond Capital

The narrative emerging is simple but significant: Japan doesn’t do “capital tourism.”

It builds strategic partnerships — and scales solutions.

This mindset is especially crucial in:

- Defense-tech and dual-use technologies

- Industrial autonomy and robotics

- Circular manufacturing models

- Secure data networks and quantum systems

In this emerging dynamic, Japan brings manufacturing scale and quality control, while Europe supplies frontier innovation and experimental agility.

What to Watch — Key Signals for 2025 & Beyond

| Indicator | Why It Matters |

| Early-stage Japanese deal volume | Proof that collaboration is shifting from late-stage capital to deep co-building |

| Europe’s regulatory clarity (esp. AI & climate) | Makes it a safer innovation sandbox for Japan |

| De-risking supply chains | Battery recycling & logistics tech will accelerate |

| Defense & resilience technologies | Dual-use innovation may become a major investment category |

| Industrial partnerships | Expect more Mitsubishi, Omron, Honda-type deployments |

Europe may be emerging as Japan’s R&D testbed — before scaling into Asia-Pacific and global manufacturing pipelines.

Conclusion — A New Tech Alliance Is Forming

The Japan–Europe partnership is evolving from capital deployment to strategic technology alignment. The next phase is not about investment alone — it is about shared industrial future-building.

Japan increasingly views European startups and scaleups not as financial assets, but as collaboration nodes for solving global problems: climate risk, autonomous systems, defense readiness, supply-chain circularity.

And that makes the next five years critical.

Those who understand this — the strategic partnership layer — will lead the next tech wave across Europe and Asia.

Image credits: NordicNinja and Dealroom