AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Southeast Asia Fintech Funding Rebounds in H1 2025, But Early-Stage Crunch Persists

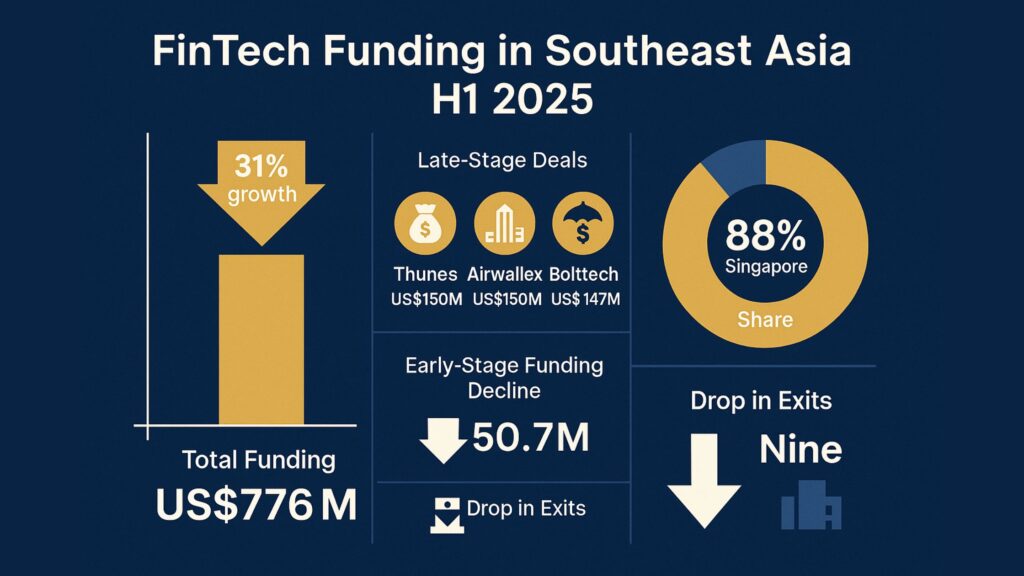

After a turbulent two-year funding slump, Southeast Asia’s fintech sector is cautiously turning a corner. According to the SEA FinTech Semi Annual Funding Report (H1 2025) by Tracxn, total fintech funding across the region climbed to US$776 million, marking a 31% increase over the previous half-year. But beneath this headline figure lies a more nuanced story: the recovery is overwhelmingly driven by late-stage funding, while seed and early-stage deals continue to decline.

The rebound in Southeast Asia’s fintech funding during H1 2025 was largely driven by a few standout mega-deals. Leading the charge was Thunes, which secured US$150 million in a Series D round to further expand its cross-border payments infrastructure. The company’s ability to streamline international transactions has positioned it as a critical enabler in the global fintech ecosystem, attracting significant investor interest.

Airwallex, another regional heavyweight, also raised US$150 million in a Series F round, reinforcing its ambition to deepen its global footprint in B2B financial services. The Australia-founded, Asia-focused fintech continues to be a strong magnet for capital as it accelerates growth across multiple international markets.

Meanwhile, Bolttech, a Singapore-based insurtech platform specializing in embedded insurance solutions, raised US$147 million in its Series C round. With demand for integrated insurance offerings rising alongside digital commerce, Bolttech’s model resonates with investors seeking scalable, infrastructure-oriented fintech plays.

Together, these three companies accounted for over half of all fintech funding in Southeast Asia during the first half of 2025. As noted in Tracxn’s SEA FinTech Semi-Annual Funding Report, the momentum underscores a shift in investor behavior toward mature startups with strong infrastructure capabilities and clear monetization strategies.

Singapore: The FinTech Powerhouse

Singapore once again asserted its dominance as the undisputed fintech hub of Southeast Asia, attracting a staggering 88% of all fintech capital in the first half of 2025, according to Tracxn’s latest report. The city-state was the headquarters for all three mega-deals, Thunes, Airwallex, and Bolttech.

Adding to its prestige, Singapore was also home to the only fintech unicorn created during H1 2025. While this surge in capital signals investor confidence in the country’s ecosystem, it also casts a spotlight on the widening funding gap across the broader Southeast Asian region.

Singapore’s continued success is largely due to its:

- Pro-business regulatory framework that encourages innovation while maintaining financial stability.

- Monetary Authority of Singapore (MAS) initiatives that support sandbox environments and progressive fintech policies.

- Global investor accessibility, including well-developed capital markets and robust legal protections.

However, this high concentration of capital raises critical questions about regional equity. The imbalance suggests that countries like Vietnam, Indonesia, and the Philippines—despite having fintech sectors—are struggling to attract proportional funding. This trend, if unaddressed, could hinder the development of a more distributed and resilient fintech ecosystem across Southeast Asia.

Seed and Early-Stage Funding Continues to Shrink

Despite headline growth driven by mega-deals, early-stage and seed investments in Southeast Asia’s fintech sector declined sharply in H1 2025, signaling a significant shift in investor risk appetite. While established firms continue to draw large checks, younger startups are finding it increasingly difficult to secure early backing.

Early-stage funding fell to US$167 million, marking a 27% drop compared to H2 2024 and a steep 65% decline year-on-year. Seed funding took an even bigger hit, dropping 50% year-on-year to just US$50.7 million.

This trend suggests that investors are gravitating toward companies with validated business models, recurring revenues, and clearer paths to profitability—often at the expense of emerging innovators.

“This may result in a thinner pipeline of disruptive fintechs in the coming years,” said a partner at a regional VC firm.

Key figures:

- US$167M in early-stage funding (down 27% H2H, 65% YoY)

- US$50.7M in seed funding (down 50% YoY)

If this cautious sentiment persists, the fintech ecosystem could experience a slowdown in innovation, with fewer breakthrough startups emerging to challenge incumbents or pioneer new financial technologies.

Exit Activity Remains Subdued

Exit momentum—often considered a key indicator of a startup ecosystem’s maturity and investor confidence—remained sluggish in H1 2025. The region saw only one IPO, with Antalpha making its public debut, underscoring the continued challenges in achieving meaningful exits through public markets.

M&A activity also slowed. There were just nine acquisitions across the Southeast Asian fintech sector, marking a decline from 11 in H2 2024 and 16 in H1 2024. The numbers reflect a broader hesitancy among acquirers, likely influenced by macroeconomic uncertainties and tighter capital conditions.

Notable exits in H1 2025 included:

- ASCENT, acquired by KFin Technologies for US$34.7 million

- Coinseeker, acquired by Titanlab for US$30 million

While these deals provided some movement, they were relatively modest in scale and insufficient to significantly boost investor sentiment.

The subdued exit environment continues to be a drag on early-stage investment confidence, as VCs and angel investors weigh the limited pathways to profitable returns in the short to medium term.

Global Context and Investor Outlook

Globally, fintech funding reached US$24 billion in H1 2025 (source: Innovate Finance), showing tentative recovery from recent lows. Southeast Asia’s fintech rebound is outpacing global averages in growth rate but remains concentrated.

Top Investors by Stage (Tracxn):

- Seed: Iterative, Selini Capital, 500 Global

- Early-Stage: Back in Black Capital, Citi Ventures, HSG

- Late-Stage: DST Global, Unbound, Vitruvian Partners

While late-stage capital is flowing again, the industry may face long-term consequences if early innovation continues to be underfunded.

Conclusion

Southeast Asia’s fintech rebound is real—but far from uniform. The region’s established players are winning big, thanks to investor caution and market maturity. But if early-stage innovators continue to be overlooked, the ecosystem’s long-term dynamism could suffer.

It’s a moment of both validation and vulnerability for SEA fintech. Stakeholders will need to balance efficiency with inclusivity to build a truly sustainable recovery.