AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

East Ventures Backs Sxored to Tackle Lending Inefficiencies in Southeast Asia

Sxored, an Indonesia-based startup specializing in smart document processing and AI-driven credit analysis, has raised an undisclosed amount of funding led by East Ventures, a leading venture capital firm active across Southeast Asia.

The investment will support the company’s efforts to enhance its proprietary AI and machine learning models, particularly in handling unstructured and templateless documents, thereby accelerating overall product development.

The capital injection will be used to strengthen Sxored’s proprietary AI and machine learning capabilities, especially in processing unstructured documents and expanding its product features.

Sxored, launched in June 2024, delivers an AI-driven platform designed to streamline credit document reviews. By integrating smart Optical Character Recognition (OCR) with an AI copilot, it efficiently pulls data from e-statements across leading Indonesian banks, identifies signs of fraud, and produces clear borrower summaries. The system also accelerates collateral assessments by estimating property values and mapping their locations.

The company is tapping into Indonesia’s expanding lending market, which saw more than Rp170 trillion (US$10.3 billion) in loans disbursed last year. With the sector expected to grow at a compound annual rate of 11–13%, Indonesia is positioning itself as a major lending hub in Southeast Asia, covering both conventional and digital lending channels.

While Indonesia’s lending market continues to expand, financial institutions still struggle with slow decision-making, rising operational expenses, and an increasing number of document fraud cases. Sxored addresses these pain points by offering an AI-driven platform that enhances fraud detection, boosts scalability, and speeds up processes.

“Most lenders in Indonesia still verify documents the old way by manually reviewing PDFs and hoping nothing is missed. We built Sxored to eliminate that guesswork. With our system, banks, fintechs, and even VCs and auditors can underwrite faster, detect fraud more accurately, and serve more customers with less risk”, said Cyrill James Hardie, Co-Founder and Chief Executive Officer of Sxored

The startup was founded by a five-member team with previous fintech experience, including a mutual fund marketplace that was successfully acquired. Currently, Sxored operates with an eight-person team and is running ten pilot projects with financial institutions and professional service firms.

The funding will also support the development of new features such as simulated financial reporting and broader data extraction, allowing the platform to serve a wider range of financial use cases. The startup plans to refine its AI models further to handle templateless documents and expand adoption beyond traditional lenders.

Backing the startup, Wesley Tay, Principal at East Ventures, said: “We believe in Sxored’s mission to modernize lending infrastructure and improve risk management. Their AI-driven platform is well-positioned to help solve deep-rooted pain points in financial services. We look forward to supporting their growth as they scale.”

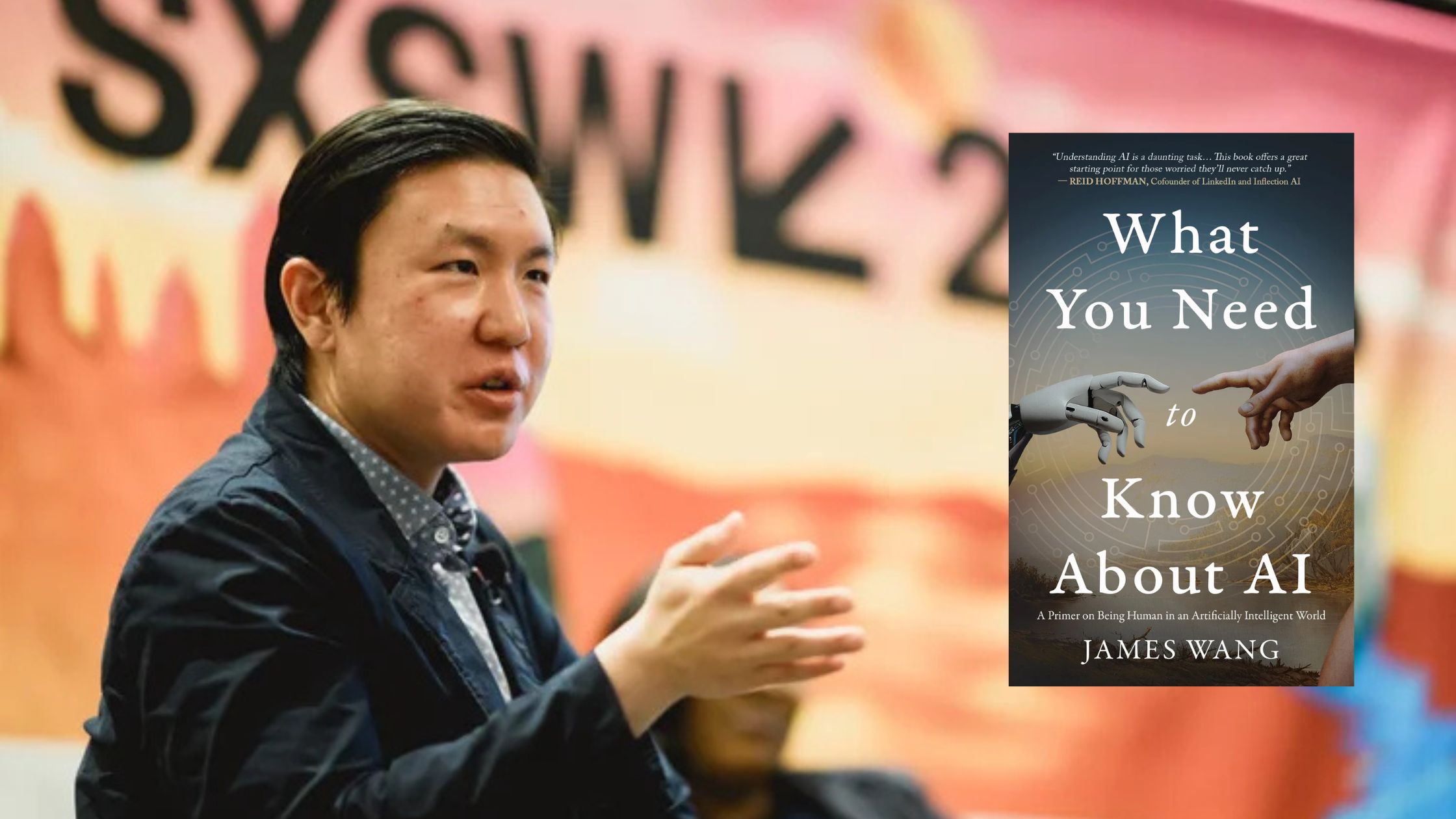

Image credits: East Ventures