AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Innovation, Investment, and Impact: A Journey with Dr Dan Swan in the Techstars Era

Techstars, established in 2006, stands as one of the most active pre-seed investors, having extended support to over 3,800 companies. The company aims to facilitate a broader flow of capital to entrepreneurs worldwide, ensuring remarkable returns for investors.

On average, an impressive 74.5% of Techstars companies secure funding within three years of participating in their programs. This is achieved through the operation of accelerator programs, venture capital funds, and encouraging connections among startups, investors, corporations, and cities.

Furthermore, 18.5% of Techstars’ portfolio companies have successfully exited five years after their program, with an even more noteworthy 31.1% achieving exits after eight years, as reported by PitchBook in June 2023.

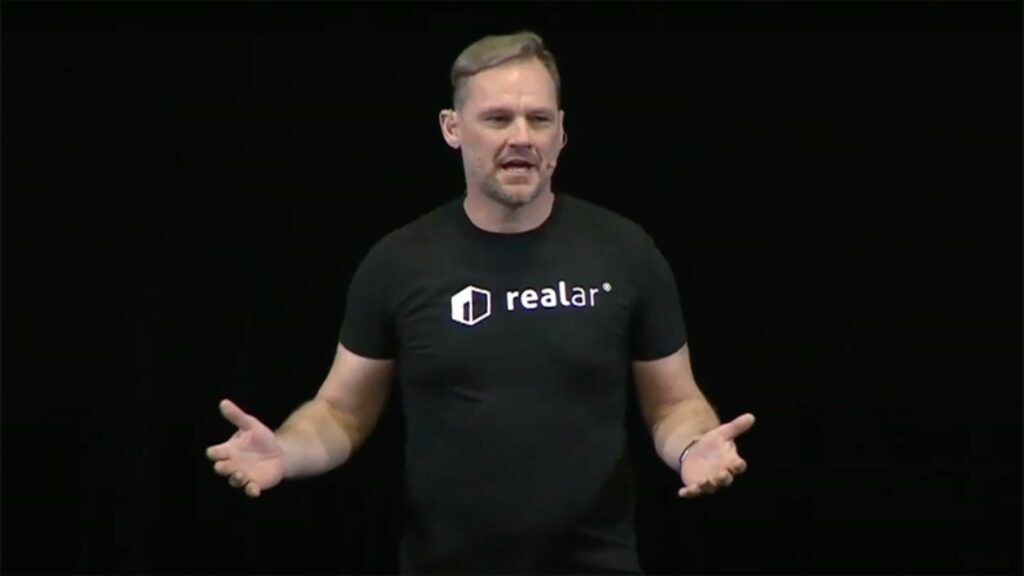

Dan Swan, an experienced innovator, entrepreneur and investor plays a key role at Techstars, contributing to the success of emerging startups. With expertise in advanced technologies, Swan is the founder of Realar, a Techstars Portfolio Company and actively mentors across the Techstars network. Recognized in 2022 as one of Australia’s top 100 innovators, as part of his strategic advisory he advocates for ESG principles. Asia Tech Daily’s editor recently conducted an insightful interview with Dr Swan, exploring his investment journey and perspectives on innovation.

To Dan, in his own words, “Innovation is about challenging the status quo and thinking creatively to solve real-world problems.” From his early days as the founder of to his current role as VC with VU Venture Partners, an advisory board member, Dr Swan’s journey showcases the intersection between emerging technology and responsible investing.

“My journey in the startup world began with an exciting acquisition journey, leading to an IPO and a subsequent sale to Oracle Inc. My first time in New York City was when we listed on the NASDAQ. My investment experience started in 2008 with Australia’s first Silicon Valley-style accelerator.”

Innovation as a Guiding Principle:

With a PhD in Innovation Studies, and recognized as one of Australia’s top 100 innovators, Dr Swan shared his perspective on innovation. For him, innovation goes beyond groundbreaking ideas; it involves execution and tangible impact. Dr Swan’s approach focuses on fostering a culture of continuous innovation and encouraging teams to prioritize customer experience, focus on data-driven execution and ship product .

Techstars Impact:

Being a Techstars Accelerator Alumni, Dan Swan reminisces about a standout moment, “As a co-founder of Realar, we were deeply committed to addressing a challenging issue of visualization in the proptech sector. Working with mentors, we refined our strategy, sharpened our pitch, and built valuable connections. Through support from Techstars we were also able to find new markets for our data and AI products. Being recognized by one of the world’s top accelerator programs and securing funding was an incredibly rewarding milestone, and an exciting point of success for me personally.”

Now as a mentor at Techstars, Dr Swan plays a pivotal role in guiding emerging entrepreneurs. The transformative impact of Techstars on startups and helping founders succeed but extending beyond individual success stories to shape the broader startup ecosystem. The network fosters community, collaboration, and shared learning, contributing to a more connected entrepreneurial community globally.

ESG Advocacy: A Responsible Innovation Approach:

Dr Swan’s commitment to Environmental, Social, and Governance (ESG) and Responsible Investing (RI) principles is also part of his investment thesis. He stressed the need for a nuanced approach, moving beyond branding to focus on genuine actions that create tangible impacts. Integrating ESG and RI principles doesn’t necessarily a product feature but part of how your company operates:

“To integrate ESG and RI principles effectively, it’s crucial to move beyond mere branding and focus on genuine actions that create tangible impacts. Businesses should prioritize transparency, accountability, and sustainable practices, while being aware of the challenges, like greenwashing and the potential clash between capital and ideals. Baking these into your company’s “values” means committing to long-term, responsible strategies that align with true environmental, social, and governance goals. Doing this in a Lean way, without heavy-lifting is now part of the challenge startups should address”.

Collaborating with VU Venture Partners:

In his collaboration with VU Venture Partners, Dr Swan highlighted the dynamic experience of working with a multi-stage venture capital fund. The key to success, according to Dr Swan, lies in strategic initiatives that prioritize deep market analysis, strong founder relationships, and leveraging a global network for insights and opportunities.

VU Venture Partners’ multi-stage focus allows for a diverse approach to investments. Dr Swan explained that in early stages, the focus is on foundational strength and the team’s focus, while later stages prioritize scalability, traction with product-market-fit, and a growth trajectory. Each stage offers unique opportunities and challenges.

Insights into Landmark Investments:

Discussing landmark investments in companies like Beyond Meat, Facebook, and Uber, Dr Swan emphasized the importance of unpacking visionary leadership and disruptive innovation. The investment process involves meticulous due diligence, assessing market size , impact, scalability, and long-term growth prospects.

Evolution of Realar: A SaaS Success Story:

Dr Swan shares the journey of Realar from an augmented reality real estate app to a growing SaaS platform. The key to success was recognizing customer needs, developing a user-friendly experience, and integrating feedback. The transition focused on AI scalability and providing data-driven solutions, positioning Realar as a first-to-market leader.

“We focused on user experience first, integrating valuable feedback from early users, and continuously adapting our development. This unlocked product grew from an MVP app, to a SaaS platform driven by AI scalability and providing data-driven solutions to real estate professionals. In this transition, our focus on advanced AR technology and client-centric solutions positioned Realar not just as a market participant, but as a market leader in the industry.”

Tips for early stage Founders:

Dan Swan’s advice to early-stage founders centers on the foundational elements crucial for startup success:

- Craft a value proposition anchored in a clearly defined and proven problem.

- Understand the intricacies of the target market, with a deep focus on the customer.

- Cultivate an agile team, ready to adapt and pivot in response to feedback and market shifts.

- Foster a culture of innovation and resilience within the organization.

- Connect with mentors, investors, and peers in the startup ecosystem for guidance and support.

- Prioritize relationship building for sustained success, emphasizing the virtues of perseverance and adaptability.

He further adds, “A common mistake among early-stage founders is neglecting market validation. It’s crucial to thoroughly understand and test your market fit as you scale. Avoid getting too attached to the initial idea; be open to feedback and ready to pivot if necessary. Another oversight is underestimating the importance of a diverse and skilled team. Surround yourself with people who not only compliment your skills and share your vision, but that challenge you with a diversity of ideas and thinking. Finally, manage your resources wisely. Overextending financially or focusing too much on perfection in the early stages can hinder growth. This is a big problem with ESG companies right now.”

Tips for investors:

Offering advice for new early-stage investors, Dr Swan emphasizes simply thorough due diligence, being founder-first, and building a strong network. For founders, he highlighted the importance of clear value propositions when talking to investors, understanding the target market, building great teams, and connecting with a diverse range of mentors for guidance and support.

“Understand the market, the potential of the product or service, and the team’s capability to execute their vision. Diversity. Not only in your portfolio across various sectors, but also invest in diverse people, all can mitigate risks. Building a strong network in the startup community is invaluable for gaining insights and spotting emerging trends.”

“Lastly, be prepared for both successes and failures–and learn from them. Early-stage investing involves high risks, but with careful strategy and a learning mindset, it can also be highly rewarding.”

Dan’s pivotal learning moment is being willing to adapt in the face of unexpected challenges, shaping his approach to innovation and investing.

“In building a diverse portfolio, the key is to maintain a balance between innovative potential and stability. See above, diversification across sectors is fundamental, but equally important is investing in diverse teams and leadership. This approach not only mitigates risks but also brings varied perspectives and resilience to your portfolio.”

“Carefully evaluate the growth potential of emerging technologies against their go-to market readiness and risk factors. This balanced approach ensures a stable forward-thinking investment strategy, positioning your portfolio to capitalize on both current trends and future innovations.”

Balancing Roles and Future Aspirations:

Balancing roles as an entrepreneur, investor, and mentor, Dr Swan shared his approach. Integrating strategy into daily routines is about aligning short-term tasks with long-term vision with an efficient workflow. Looking ahead, Dr Swan aspires to deepen his impact in the startup ecosystem, mentoring and investing in startups driving innovation in emerging technologies.

Dan Swan’s journey from small startups to becoming a recognized innovator and investor with some of the largest tech companies in the world reflects a commitment to continuous learning and growth. His insights into responsible innovation, collaboration with VCs, and the transformative impact of Accelerators like Techstars provide valuable lessons for both investors and early-stage founders.

Also Read:

- Indonesia’s Zenius Announce Brief Halt in Operations Amidst Financial Headwinds

- Indonesia’s EV Startup Swap Energi Secures $22 Million Series A Funding

- GBA Capital Commits $10 B to Catalyze Web3 Startups in Virtual Reality, Metaverse, and NFTs

- We Founder Circle Emerges as Largest Angel Investor Network

- Riding the Boba Tea Craze: How ODD ONE OUT Conquered American Taste Buds With Its Premium Milk Tea