AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

IPO-bound Nykaa eyes for expansion in Europe and the Middle East

India-based online beauty and cosmetics retailer, Nykaa is now looking to expand its services in Europe and the Middle East as it gears up for an initial public offering later this month.

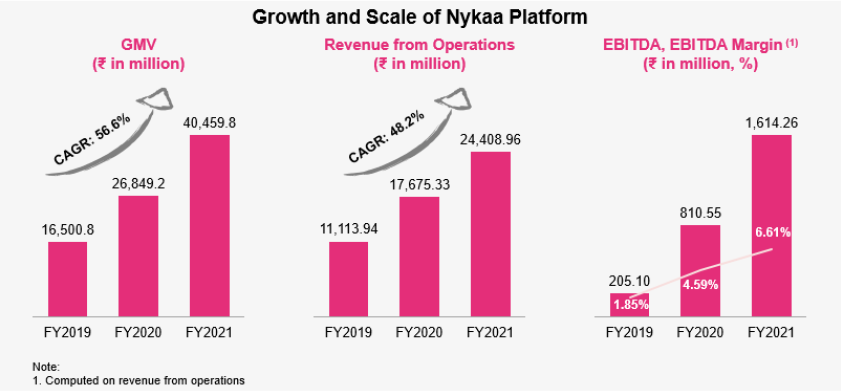

Nykaa, owned by FSN E-commerce Ventures limited has witnessed a gradual recovery in its consolidated GMV since the peak of the pandemic, according to company sources. The Mumbai-based startup is looking to list in public with a Rs 5,352 crore IPO that would give it a valuation of $7.1 billion (Rs 53,200 crores).

The firm’s IPO comes at a time when the lifestyle and beauty commerce sector has caught up in the country with new-age and well-funded firms such as Purple, Sugar, and Good Glamm among others.

Diving Deeper

Nykaa started as a multi-brand beauty products online retailer and then forayed into fashion 3 years ago. The firm further plans to expand in categories such as tech accessories, wellness, mother and baby jewelry.

Falguni Nayar, CEO and co-founder of Nykaa said that the company is actively looking at international expansion and plans to take Indian brands along with private labels to international customers.

“At the moment we are very keen to go into the Middle East, where we think there is a lot of affinity to Indian consumption, and want to export many of our Indian brands as well as our own brands. The UK is another market where we’re starting out. Europe is another area of opportunity,” said Nayar during the press briefing.

She also added, “We’ve always said that we will be a multi-brand retailer first with an extremely vibrant platform available to all our brand partners. So we will always be a retailer first, but within that there are always market gaps and ideas of brands that we can offer to the customers to make the experience better. So we will be a house of brands, also with a range of brands across beauty and fashion, that will contribute to a fair percentage of our net revenue.”

Presently Nykaa owns private brands including Kay Beauty in association with Bollywood actress Katrina Kaif , Nykaa Naturals, and has recently acquired D2C skincare brand Dot & Key.

Nykaa’s 95 percent business presently comes from online channels and the company expects to grow up to 15 percent of the total business going forward as its footfalls and stores surged post-pandemic. The company has more than 2.03 million monthly average of unique visitors and GMV of $147 million for the first quarter of Financial Year 2022.