AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

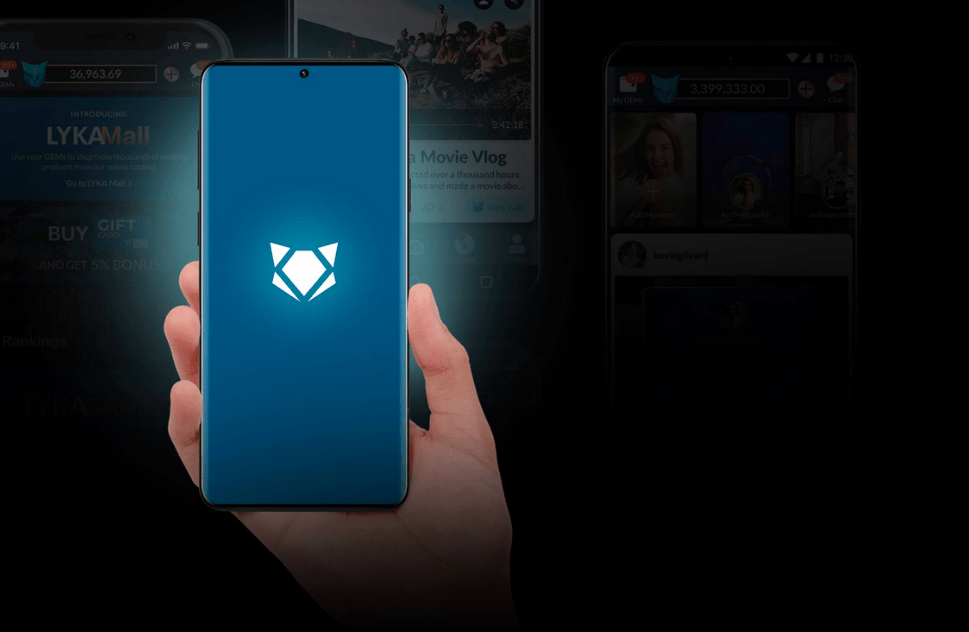

PH central bank orders social media platform Lyka to halt payments operations

The Bangko Sentral ng Pilipinas (BSP), the central bank of the Philippines, has ordered social media platform Lyka to halt its operations as an Operator of Payment System (OPS) until it secures registration from the monetary regulatory.

Lyka is a startup launched in the Philippines by a Hong Kong-based company. The firm allows its users to purchase, exchange, and use Gift cards in Electronic Mode or GEMs as payment for goods and services.

“The Monetary Board has ascertained that these activities make Lyka an OPS and is thus required to register with the BSP, which is needed before it is allowed to continue with its OPS activities,” the BSP said in a statement.

The BSP reminds entities operating a payment system to comply with the requirement under the NPSA and BSP Circular No. 1049 to register with the BSP.

Circular No. 1049 provides for the Rules and Regulations on the Registration of Operators of Payment System. Registration of an OPS allows the BSP to have oversight of the payment system it operates to ensure that it functions safely, efficiently, and reliably by itself, consistent with the central bank’s objectives of consumer protection and financial stability.

Under Circular No. 1049, OPS that are required to register, but are found to be operating without registration, shall be directed to comply with the Circular’s registration requirements.

Those that fail to comply may be ordered to stop operations until immediate action is taken to register with the BSP.

“This is without prejudice to other enforcement actions that may be taken against the OPS and its directors/officer and/or employees in accordance with the BSP’s authority over payment systems under RA No. 7653, as amended (The New Central Bank Act) and the NPSA,” the central bank added.

The BSP also advises the public to transact only with BSP-registered OPS that are listed on the BSP’s website.

An OPS may be cash-in service providers, bills payment service providers, and entities such as payment gateways, platform providers, payment facilitators, and merchant acquirers that enable sellers of goods and services to accept payments, in cash or digital form.