AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

2008 Financial Crisis Vs. The COVID-19 Pandemic – What’s Worse?

Daily news briefings on flattening the curve, empty store shelves, cost-cutting measures in companies, jobless people on streets, disruption in global supply chains- the COVID-19 pandemic has created an economic crisis “like no other”, one that could be way worse than the 2008 financial crisis.

Here’s why-

- Despite the strong responses from governments across the globe on lockdown, strict social distancing measures, and hurried financial policies- it seems that the recession that COVID-19 pandemic will bring will have lasting effects on the global economy.

- The COVID-19 pandemic, unlike the Global Financial Crisis of 2008, is not only affecting the businesses and employment, but it will bring profound political and social changes.

In 2008, the world witnessed how the financial uncertainty spread from the downturn in real estate. It was a huge financial shock, heaped on top of the losses to households from a slump in the real estate sector that led to economic contraction. Millions of people lost their jobs, and some major industrial companies stumbled towards bankruptcy. However, due to substantial intervention of both fiscal and monetary policies, the recession did not prolong, and recovery began in the second half of 2009. It is still early to predict the course of an economic slump due to the COVID-19 outbreak, but a recession is inevitable, and it could be a sharper downturn than the 2008 financial crisis.

COVID-19 pandemic- Is this an economic catastrophe?

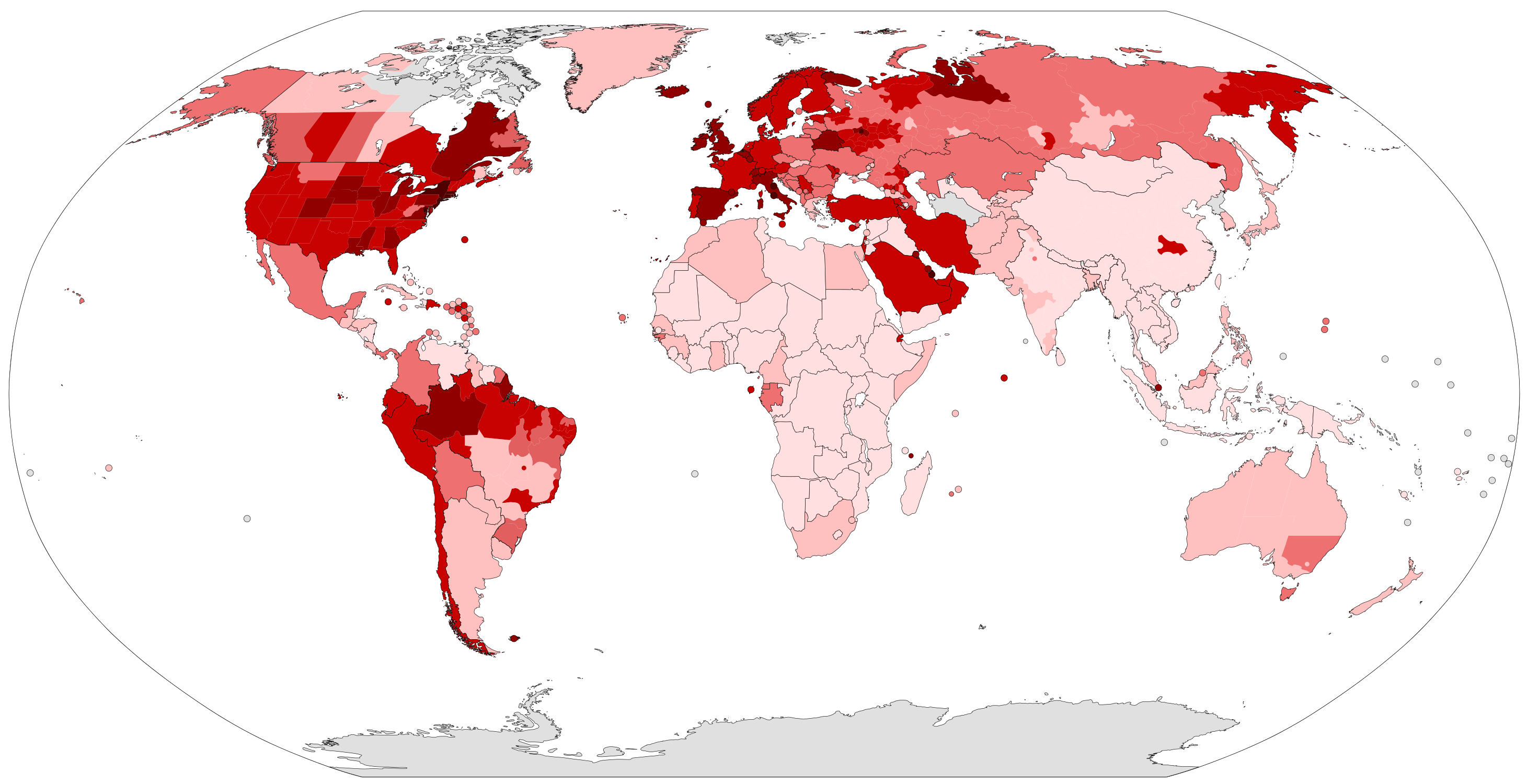

The world is facing the worst scare since the 2008 Global Financial Crisis in the form of COVID-19 pandemic. This deadly virus has claimed more than 300,000 lives and is still counting! At the time of writing this article, the number of people affected by the virus is over 4.7 million, and it seems that there is no end to this until we find a vaccine. Health care systems across the world are already overwhelmed. It is being said that coronavirus would change the way of life for years to come.

The coronavirus outbreak, which has brought the whole world under lockdown, is being compared to the 2008 recession. The economic upheaval that this virus is causing has revived the memories of the biggest financial crisis that the world faced in 2008-09. The bloodbath on global stock markets, recession chatter, central banks, and government loosening the purse strings- it seems it will be worse than the Global Financial Crisis of 2008.

What the world needs now is a globally coordinated national action to slow the spread of the virus to minimize the size and the time length of its economic fallout.

To begin with, let’s take a look at certain parallels that we can draw between the 2008 Global Financial Crisis and the COVID-19 pandemic.

Here is what we infer-

Denial, underestimation, and unpreparedness

In both scenarios, the policymakers initially downplayed the gravity of the problem. In the 2008 crisis, the analysts relied on the historical models of real estate price behavior and saw a downturn as improbable. Similarly, in the early stages of this pandemic, the Chinese government deliberately hid the seriousness of this disease and even silenced those who voiced their concerns about an imminent threat to humanity.

In Brazil, President Bolsonaro continued to deny the gravity of this virus and called it a “small cold” that could kill only the old people. Even the United States of America, considered as the world’s superpower proactively minimized the gravity of this health crisis, there was delayed response in starting testing and containment. As a result, the U.S. not only has the highest number of infected cases in the world but has led to severe economic fallout.

Social distancing has become the only way to control the spread of contagion to avoid overwhelming the health care system. In fact, social distancing has become a significant reason for the large-scale reduction of expenditure and consumer demand. In both the crisis, it is clear that the regulatory and institutional frameworks were unprepared.

Local soon became global

During the Global Financial Crisis, it was initially supposed to be a problem of the subprime mortgages segment in the U.S. real estate market. However, in a couple of months, it immersed the financial sector and global banking, causing social and economic damage, which was not witnessed since the great depression of 1929. Similarly, COVID-19 was initially seen as a ‘Chinese virus,’ and like MERS and SARS, it was believed that it would remain contained in the region. However, with China representing the 1/3rd of the global GDP, disruptions in the manufacturing industry became evident even before the virus spread outside China.

The most important question now – What will be the ultimate economic and human cost of the present crisis?

Now, before we can say what is worse and how, let’s also look at some differences between the two-

This pandemic is exerting a more radical and abrupt effect, unlike the Global Financial Crisis of 2008. The real economy has been put out of action completely and immediately. Factory closures have dried up the supply chains globally. There is unemployment, as people lose their income, their consumption declines, and the situation was further worsened by the fact that most of the shops were ordered to close.

Process

The coronavirus pandemic has first affected the real estate sector and the supply of production and then the demand. Whereas in the 2008 financial crisis, the effect was first seen on the demand side, which later transformed into the great recession.

As the supply chains over the world are now integrated, several components of the products are now being manufactured in various low-cost countries, which could then combine in a different country/location to make a final product. The downtime due to this pandemic caused a domino effect, with almost all production coming to a halt. This has affected all the sectors and the demand side too.

The self-quarantine and lockdowns imposed by governments are to limit the contagion. However, it has its adverse effects not only on the human psyche but on the economy too. There is a demand shock emerging everywhere and has led to massive unemployment across the globe. In the U.S. alone, over 20 million people have lost their jobs already.

If we compare to the 2008 financial crisis, the initial shock led to the bursting of the housing bubble in the U.S. and then on the demand. It eventually affected the international financial markets leading ultimately to a global recession. To avoid a sudden meltdown of the economy, actions were aimed at reviving finance to help the economy get out of the crisis. In the 2008 financial crisis, the insufficiently capitalized banks were part of the problem. However, now the financial institutions will be part of the solution. All thanks to a better regulated financial system.

Speed of the crisis

The Global Financial Crisis was brewing up even before 2008, and the economic rebound was delayed at least by two years. However, the subsequent recovery was very progressive. However, in the case of the COVID-19 crisis, hopefully, quick and coordinated policy reactions may speed up the recovery of GDP once the containment measures are lifted.

Multilateralism

On the face of it looks like, despite simultaneous reactions from major countries, it still falls short of an authentic regional or international coordination, especially between the governments. This is one of the major and worrying contrasts between the 2008 financial crisis and the COVID-19 crisis. The momentum of global leadership seems to have faded now. Most of the countries are now sailing in the same boat amidst this crisis, whereas at the time of recession of 2008-09, the G20, including international organizations, took the lead.

COVID-19 is crushing the economies globally

This pandemic has virtually brought the world economy to a standstill, with millions of people put under lockdown and global supply chains thrown into a frenzy. The virus made its first lethal impact on China- the world’s factory, which made many industries crumbling under its effect. To say the least, the aviation industry, the tourism industry, and the oil markets are dealing with historic blows.

Aviation and Tourism Industry

This pandemic has hit the aviation industry, which was already dealing with cut-throat competition, poor financial health, and price wars the hardest. COVID-19 outbreak has virtually grounded air travel globally and has threatened to bankrupt many airlines. Globally, the livelihoods of 65.5 million people are dependent on the aviation sector, including tourism. Out of this, approximately 2.7 million are airline jobs.

This pandemic will have ripple effects on the tourism industry for times to come- with travel bans, the scare among people, mandatory quarantine rules, people are canceling trips and, events being postponed indefinitely. The travel industry is facing the most immediate repercussions, and the impact of this pandemic is more severe than any other previous event.

The international airfares have dropped 30-35% since the coronavirus outbreak. Some experts fear that the overall economic impact may exceed $1 trillion. With so much uncertainty as to when will this pandemic will end, it is being estimated that revenue loss on the airline business will be colossal. Many airlines are seeking state relief to sail through this untimely turbulence.

According to the World Travel and Tourism Council, travel and tourism generate 10.4% of the global GDP and backs 319 million jobs across the globe. However, the COVID-19 pandemic and sluggish economy have dampened the travel sentiment. The downfall in the travel industry has jeopardized the jobs of many. The three biggest airlines Delta, United, and American, have already asked employees to volunteer for unpaid leaves.

It looks like it would be a long road to recovery.

Oil industry

The oil markets are also not in good shape amidst the coronavirus fear. Global oil consumption is facing the biggest ever fall in history due to the temporary ban on travel, factory shutdowns, and other measures that are being taken to contain the virus.

Global oil prices have fallen steeply. In fact, for the first time in history, the crude oil price fell below $0 a barrel. According to a forecast made by IEA in February 2020, the predicted global oil demand should have grown by 825,000 barrels per day in 2020, however, what has happened is the exact opposite. The global demands have fallen significantly, and the virus outbreak has added to the uncertainties. According to experts, the fall in oil demand could easily outstrip the losses faced during the 2008 financial crisis.

Disruption in global supply chains

According to experts, COVID-19 pandemic is a ‘Black Swan Event’-something which was unpredicted and will have a huge global impact. Even the 2008 Financial Crisis was a Black Swan Event. However, it only reduced the demand, but this deadly pandemic has affected both supply and demand.

Many governments around the world, due to the ongoing COVID-19 pandemic, have created relief programs to address the economic collapse. However, it seems that it will be too late or too little to save tens and thousands of suppliers.

The global supply chain hubs- China, the U.S., and Europe have been poorly stuck by this pandemic. China being the primary producer of many high-valued industrial products and commodities, forms the core of the global supply chain. The Chinese authorities imposed severe restrictions due to this outbreak, which has impacted the economy as a whole since many production sites were closed.

Exports from China have declined in almost all regions of the world, which had implications for both producers and consumers. Industries from automotive to apparels to electronics, all are reeling under the effects of this pandemic. According to a survey done by PwC of finance leaders in Mexico and the U.S., 31% have indicated the supply chain as one of the top concerns related to the coronavirus outbreak.

Furthermore, the factory shut down in the European Union has created a ripple effect for the supply-chain exports of other countries. This is because the European Union is the major importer of manufacturing inputs from both Asia and Africa and buys almost as much of manufacturing inputs from Latin America as the U.S. does. Adding to the chaos, the shutdowns in China and the U.S. both have triggered the reduction in imports of manufacturing inputs.

The machinery, rubber and plastics, electronic equipment, and chemical sectors are the worst affected due to this supply-chain disruption. According to experts, it is being estimated that the loss will be more than 7% of the total export value of these sectors.

This unprecedented disruption in the global supply chain has never been seen before. The companies are now acknowledging that reliance on a single country is not wise. There would be rethinking required for supply chain functioning in the future. To return to full production would need re-establishment of existing links, ensuring an open world trading system, and removing temporary barriers which are put in place now.

Relocating production closer to home or immediate attempts to onshore tasks may delay restoring production since finding alternate suppliers for specialized parts and in a travel-restricted world waiting for deliveries would not only be lengthy and costly but uncertain too. Moreover, switching away from these three main hubs will not be completely effective as it is difficult to compare their scale of production.

The impact on the global startup ecosystem

The drop in investments in the global startup ecosystem has triggered an economic contraction. After the Financial crisis of 2008-09, the global venture capital investments took almost 2-3 years to recover to the pre-contraction level. With the COVID-19 pandemic, not only there is a sudden economic crisis, but the human impact is also alarming.

More than 41% of startups globally are threatened. Since the start of this crisis, most of the startups had to terminate their full-time employees. While North America is the place with the largest share of companies decreasing their headcount followed by Europe and then Asia. A sizeable share of startups across the globe has witnessed a significant revenue drop. The B2B startups that serve the big enterprise clients are more likely to be adversely affected than the B2B startups serving the small and medium enterprises.

In 2008, Sequoia Capital, one of the best-known venture capital firms in the world, advised its companies to reduce costs and start to generate profits as soon as possible. Recently, again due to the COVID-19 crisis, the company has published similar advice to its portfolio companies that it is fast becoming more serious than the 2008 financial crisis.

All aspects of businesses, from fundraising to employees to customers and suppliers, startups are struggling to cope with the impact of the virus. Some companies are scrambling to save their business from collapse. Job cuts, suspension of operations are the key points that are being discussed in the contingency plans across startups. Finding the next round of capital has become challenging. This will quickly turn into a cash flow issue, especially for firms that had given priority to customer acquisition instead of generating profits.

COVID-19 crisis has impacted tourism platforms, transport booking services, business travel support, and home rental companies the most. One of Europe’s biggest online tourism platform-GetYourGuide that books tours and attractions have said that their bookings have been down by 50% in February 2020 and have continued to sink since then.

As countries across the globe have closed their international borders and even the domestic flight bans have been placed in a few countries, the platforms for booking flights, trains, car-shares, coaches are naturally feeling the squeeze. Omio that became a unicorn 2017 felt the impact first when bookings in China fell, and then the U.S. customers canceled European tourist spots. Amidst the strict lockdown measures, even Uber and Ola reported a significant decline in demand. However, now many countries have started easing up on their lockdown measures, and these ride-hailing platforms are coming back in business but with strict guidelines issued by the central and state authorities.

On the brighter side, startups in a few sectors are witnessing a boom in their business; for instance, video conferencing firms have been able to add hordes of users since people are working from home. Similarly, online education content, streaming, and gaming providers are all reporting a significant increase in their user base and the time spent on their platforms. The online food and grocery delivery startups have also seen a rise in their business. The medicine delivery startups have also seen a jump in their orders since people are stocking up on drugs, sanitizes, and masks. However, even these firms are facing severe challenges in their supply chains.

Even as the world is trying to ease the lockdown measures and open up markets, the sentiment among investors and entrepreneurs across the globe is that it is easily the worst crisis ever since the Great Recession and impact will be long and lasting.

So can we say what’s worse?

The economies are feeling the brunt through multiple channels. According to a top IMF official, the expected complexity and speed of the contraction of the global economy is unprecedented, maybe much worse than the financial crisis of 2008.

Until and unless we know when and how the coronavirus public health-crisis will get resolved, economists cannot even start to predict the end of the recession that is now underway. However, there is every reason to anticipate that this slump will be far deeper and even longer than the 2008 financial crisis.

Employment in China has somewhat recovered, but it is still unknown as to when it will return to the pre-COVID-19 level. Moreover, even if Chinese manufacturing does recover completely, who is going to buy those products when the rest of the world economies are sinking? For the United States, the worst-hit nation, returning to 70%-80% of their capacity, seems like a far-fetched dream as of now.

What the world is experiencing right now is worse than the influenza outbreak of 1918-20. According to experts, if 2% of the global population succumbs to this virus, the death toll would be approximately 150 million. However, given the strict social distancing measures and lockdowns that are being adopted worldwide, we are hoping that the outcome probably will not be that extreme. But until this health-crisis resolves, the economic situation is certainly grim. And even if there is an economic restart by the end of this year, the damage to businesses will have lingering effects. The problem is that we are experiencing not just a demand shock but a supply shock as well.

According to WTO economists, the trade slump will be worse than the 2008 financial crisis. The estimated expected recovery in 2021 is quite uncertain since it largely depends on the duration of the outbreak and how effective the policy responses are. The immediate requirement is to bring the pandemic under control and mitigate the economic damage. Although a rapid and vigorous rebound is possible, however, the decisions taken now by the policymakers will determine the shape of future recovery.

COVID-19 pandemic- The darkest hour for humanity

It is apparent that the present COVID-19 pandemic, like the Global Financial Crisis of 2008-09, is unveiling the dark side of globalization. It has already exhibited the deficiencies and strengths of national health systems across the globe. It has put to test the potential of the digital society as it has forced many people to work remotely, and looking at the present situation, this will be a norm for times to come. Although, China, where it all started, has managed to slow the spread of contagion but at the cost of economic recession.

The coronavirus outbreak is noticeably the darkest hour for humanity. It is a threat that may end up as the worst meltdown for the global economy than the 2008 financial crisis, especially if the outbreak prolongs.